Risk allocation

9 Under the PFI solution the contractor, Vickers Specialist Engines, accepted the risk of being able to provide the maximum number of generators required to provide the overall level of service required. This was equivalent to 1400 generators. However, due to affordability reasons, 1347 units were eventually commissioned.

10 Key risks transferred to the contractor under the PFI arrangement, compared to those retained by the Department were:

■ Availability and performance risk

■ Late delivery

■ Through life operating costs

■ Scheduled maintenance costs

■ Availability and delivery of spares (to distribution centres)

■ Demand in excess of minimum requirements

■ Residual value (of the asset)

This meant that the contractor took the risk of being able to provide, on demand, a fleet of up to 1347 generators within the specified timeframes.

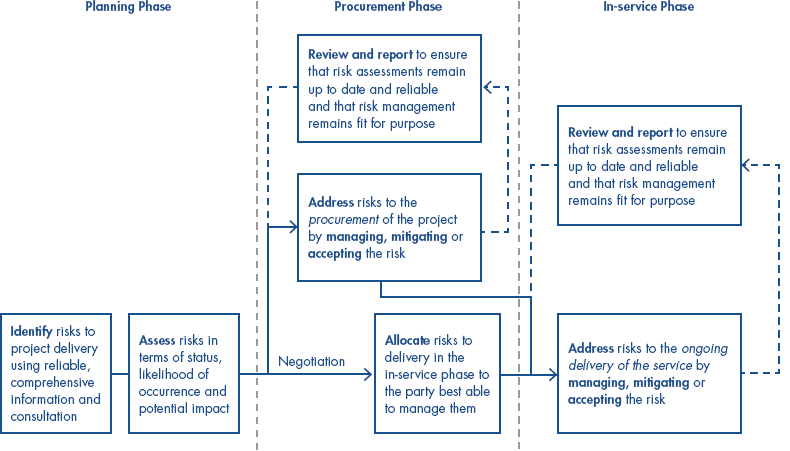

26 | Risk allocation and management are key parts of all stages of the PFI process |

|

|

Source: National Audit Office | |

11 The key risks retained by the Department were:

■ Specification of the asset - the risk of the asset not being fit for purpose was ultimately retained by the Department; after the point at which it confirmed that it was satisfied with the demonstration and testing of prototypes. The Department has subsequently had to pay £7.3m to modify the design it had accepted and further costs may be incurred in the future.

■ Specification of the level of service and usage of the asset - this was retained by the Department because it had specified the overall level of capability to be provided (i.e. the number of generators of each type). The Department is also responsible for the risk that the expected level and maximum levels of service available are a true representation of the actual need for the service. The ultimate risk of this being too much, or too little, remains with the Department. Current usage is well below the expected level.

12 In an example such as this where the margin between the public sector comparator and the PFI option is relatively low, the valuation of risks allocated to either party is an important factor in determining whether PFI offers the best value for money option. The value of the risks transferred under the PFI option was assessed by the Department as being equivalent to approximately £10 million. This risk adjustment was added to the public sector comparator. In net present value terms, using the discount rates at the time, the PFI solution was assessed as being £98.3 million, £5m less than the public sector comparator using the expected demand level. However using the current discount rate of 3.5 per cent the PFI option would have been more expensive.

27 | The net present value of the PFI project and the public sector comparator | ||

| Based on 1189 systems: | Net Present Value at 6 per cent | Net Present Value at 3.5 per cent |

| 98.3 million | 161.9 million | |

| Public Sector Comparator | 103.3 million | 157.6 million |

| Comparing PFI to the Public Sector Comparator | £5 million | £4.3 million |

|

| 4.9 per cent | 2.7 per cent |

Source: Ministry of Defence |

|

| |

13 Although the costs and financial risks of the various options are a very important consideration in ensuring value for money, other more qualitative factors should also be considered. In the case of the Field Electrical Power Supplies project, it was considered that a conventional procurement would have led to a two year delay to the in service date of the equipment. This was a contributing factor to the decision to select PFI as the procurement route.