Pricing of the bond was competitive

1.39 As explained in Box 2 the rate of interest earned by an investor in a bond may be considered to be made up of two elements:

■ the interest rate which would be payable on what is known as "the comparable gilt", namely the Government bond which is comparable in tenor to the bond in question. That interest rate is determined by conditions within the gilt market and therefore the funding competition could not have had an impact on this cost.

■ what is known as the bond spread or margin. For the most part it reflects the additional compensation by way of interest which investors in the bond require for taking on the credit risk of the project as compared with a "risk free" gilt. The bond spread is largely determined therefore by the credit rating of the project but can be influenced by technical factors such as the ease of selling the bond in the secondary market and by competitive pressures arising from effective marketing of the bond to potential investors.

1.40 The importance of the bond spread to the Treasury can be measured. We modelled how changes in the spread altered the unitary payment (Figure 6 on page 16). Every change of 1 basis point (that is, a change of one hundredth of a percentage point) in the bond spread changed the unitary payment by about 0.1%. In practice, bonds of comparable risk may be issued at different spreads. In the case of the Treasury building, if the bond spread increased by 10 basis points the unitary payment would increase by 1% (approximately £140,000 a year in March 1999 prices). It was therefore important that the bond was marketed well. Appendix 3 gives a more detailed explanation of our methodology for calculating the impact of the bond spread on the unitary payment.

BOX 2: Different components of the finance competition and how they could impact on the final cost of the project. | |

Component of financing | Description and impact on price |

Usually the largest proportion of the total funding, typically in PFI deals between 80-90% but sometimes even higher. There are two sources of senior debt: bank financing and bond financing. | |

| Bank financing. The bank will lend money directly to the project company. The cost of this funding is usually measured as a margin over LIBOR. The bank will also determine the cover ratios (see below) required for the project which have a direct impact on the unitary payment. |

| Bond financing. Funding is raised via selling a bond to one or more investors. Interest will normally be paid throughout the life of the bond with the principal capital sum being paid on maturity. The interest rate or coupon rate payable is made up of two elements: 1) the reference gilt rate, and 2) The bond spread or margin. Both are determined by the market but the bond spread can also be influenced by efficient selling of the bond. |

Financing ranked below senior debt in terms of repayment. It is, therefore, more expensive and will usually account for a smaller proportion of total funding, 5-10%. Mezzanine financing is often used when senior debt providers will not provide all of the funding required as they wish other parties to take on some of the risks of the project. Potential providers of mezzanine debt will compete on the interest rate amongst other things. | |

Monoline insurance fees | Monoline insurance refers to insuring, or wrapping, a bond so that it attains the highest investment grade credit rating (AAA). The impact of "wrapping" the bond is that the risk to the bond investors is reduced and therefore the risk premium element of the bond spread will be smaller. |

| Two parts of the monoline fee impact on price: |

| 1 The actual fee, measured as a percentage of the bond value. |

| 2 Payment structure, i.e. if the fee is payable up-front or paid over the lifetime of the bond. |

Cover ratios | Cover ratios measure the financial robustness of a project, i.e. whether the project can pay the interest and principal on it's debt and whether sufficient reserves have been accumulated to cushion any reductions in revenues. The debt providers insist that the project company maintains certain cover ratios and usually have the right to step in and manage the contract if these ratios are broken. |

| Cover ratios have a direct impact on price. For example, there might be a cover ratio that measures the ability of the project to meet it's annual debt service repayments. If this ratio is set to 1.3 the project, annually, must generate revenue that is 1.3 times greater than the debt repayments. Setting this ratio to, for instance 1.2, will allow the project company to charge a lower unitary payment as the required revenue to meet the cover ratio is lower. |

Bond arrangement fee | Charged by the bond arranger to place the bond with investors. If the bond is underwritten the bond arranger will also buy any of the bond that has not been sold to investors at the end of the placement period at a previously agreed price. The arrangement fee is quoted in terms of basis points of the total bond size. |

Redeposit rate | Once the bond has been sold to investors the project company has a large sum of cash before it is actually required in the project. These proceeds will be put on deposit and the interest rate paid is called the redeposit rate. |

| Banks will compete with each other to hold the bond proceeds and may offer different interest rates. It is in the interests of the project company, and therefore the department, to receive a high rate of interest as this income will, to some extent, offset the interest payments falling due on the bond and thus lead to a reduction in the unitary payment. |

6 |

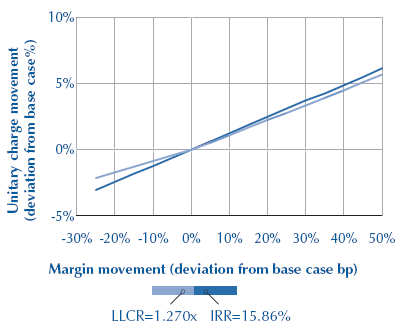

| Impact of the bond spread on the unitary payment |

The diagram shows how the unitary payment changes as the bond margin moves. The two lines in the graph represent two key project indicators (loan life cover ratio and internal rate of return) that were held constant while the bond margin was flexed. The base case scenario (where the two lines meet) is the actual negotiated deal. A more detailed explanation of the methodology for deriving this graph is at appendix 3.

Source: Operis |

1.41 It is difficult to compare the prices of similar PFI project bonds issued at different times as they are not widely traded in the financial markets after they have been issued and their issue price reflects supply and demand on the day that they are brought to the capital market. However, one method for estimating the risk premium that investors attached to purchasing the Treasury building bond is to use the fixed interest swap market12 as a proxy for risk pricing. This method is not a perfect proxy and there are several caveats to using it to price bonds but it is one of a number of methods used by bond professionals to estimate the issue spread. Appendix 4 explains our methodology for comparing bond prices.

1.42 The Exchequer Partnership bond was launched on 28 April with a spread of 163 basis points. Independent pricing sources indicate that the swap spread on that day was 133 basis points. Subject to the limitations of this method described in Appendix 4, it is therefore possible to suggest that the Treasury building bond was priced at LIBOR13 + 30 basis points. The closest comparable bond was launched on 13 April for the A13 PFI deal. On this day and on the same basis as above, the relevant swap spread was 126 basis points and the bond spread was 170 basis points. Using the same assumptions as for the Treasury building bond, this gives a higher implied cost of LIBOR + 44 basis points.

1.43 Our analysis indicates that the issue spread for the Exchequer Partnership bond represented a fair price and that the lead bond arranger, Warburg Dillon Read, performed well in marketing and placing the bond. The initial bond coupon, adding the bond spread to the underlying gilt rate, was 3.58%.

______________________________________________________________________________________

12 The interest rate swap market is, among other things, used to change the basis on which interest is paid on an asset or liability. Most commonly a floating rate is turned into a fixed rate or vice versa. The fixed rate part of the swap will be related to the Gilt rate. The swap market developed to allow borrowers who were not considered credit worthy enough to access fixed rate bonds to fix their rates of interest.

13 London Interbank Offered Rate - the interest rate at which banks will lend to each other.