Refinement

The analysis just performed gives a good first idea of the effect on the Unitary Charge that would have resulted from bond margins differing from the ones shown in the base case when considering just the most significant four ratios.

At most of the bond margins explored in the preceding graphs, what actually determined the pricing was the requirement that the equity IRR exceeded 15.86%. Neither the 1.270x LLCR nor the 1.220x CLCR requirement actually bit. What this means is that, given these constraints, the project could stand a little more debt and a little less equity, and the result would deliver a slightly lower Unitary Charge.

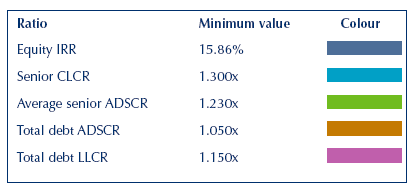

In reality the Bidder would have needed to satisfy all of the eight constraints set out by the Databook, not just a certain subset of them. We combine the IRR constraint with the others which we omitted from the previous piece of analysis in order to determine their effect on the pricing strategy of the Bidder. We have used the previous method to calculate the Unitary Charge increase required to hold the following ratios constant at the values required:

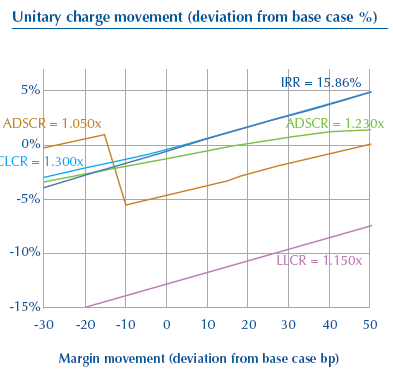

As before, the Unitary Charge will be governed by whichever line is uppermost on the graph, and as before, it is for the most part the iso-IRR that dictates the price, with the iso CLCR for senior debt eclipsing it slightly if the bond margin is reduced.

As noted in the introduction, of the eight measures identified in the Databook as being ones considered by the Bidder in setting the Unitary Charge, all but one measure in different ways the ability of the project to service its borrowings. Just one related to the return enjoyed by the shareholder investment in the equity of the project company. The idea state of affairs is that the Unitary Charge is dictated by both the debt and the equity measures. If at a given price th equity is amply rewarded, but the debt is inadequately covered, then the project may be said to be borrowing to much. If the debt is well covered, but the return earned b the equity is too low for the shareholders to find attractive then the project should seek to borrow more.

The closeness of the iso-CLCR and iso-IRR traces in the graph above shows that measures relating to both debt and equity contribute about equally to the determination of the Unitary Charge. To this extent, the Bidder may be said to have chosen the mix of debt and equity perfectly for this project. Towards the left of the graph, the two lines diverge slightly. If the gap between them was large, it would argue for changing the mix of debt and equity in the financing. That would be understandable; the ideal mix between debt and equity may be expected to change if the cost of one of the two is altered. But even at the left extremity of the graph, the gap between the lines is not large enough to make any such change significant or worthwhile.