Pricing

In addition to the restricted liquidity caused by issue size, the background to demand in the long-term sterling market means that many investors will tend to buy and hold these assets, and there is no great incentive to trade. As noted above, in the absence of a liquid market, it may be difficult to determine an efficient price for a new issue.

Both investors and bond professionals tend to use the swap market as a proxy for corporate risk pricing generally, as the swap market will see a large volume of transactions on a daily basis. This is not a perfect proxy as the long end of the swap market will itself tend to be less liquid than shorter dated swaps, and there may be a time lag between movement in swap spreads being reflected in a movement in bond spreads. Nevertheless there is probably sufficient correlation between the two to conclude that widening in one sector will tend to mean widening in the other, and volatility in the swap market will tend to mean volatility in corporate/project bond spreads. This also tends to be the case when one considers the index-linked bond market (noting that there is no equivalent RPI-swap curve and in theory there is no reason why a fixed rate swap curve should be correlated with the price of an index-linked bond).

For the purpose of our analysis we can argue that fixed rate investors may look at their return from a potential new investment on a 'swapped Libor plus' basis. We can therefore take the margin over gilt for a new issue and break it down into two component parts, namely the 'implied' swap spread and the margin over swapped Libor. In addition to this volatility in swap spreads there is also potential volatility in gilt rates which will similarly feed directly into the cost of debt.

If there is volatility in swap spreads on the day of pricing/launch, then the pricing of the swap for any competing bank deal will almost certainly move, and the margin over gilt for a bond issue could move.

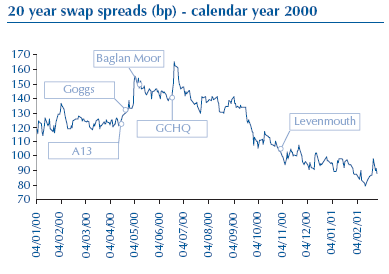

The graph below plots the 20 year swap rate as a spread over the 20 year Gilt over the course of the year 2000 (Source: Bloomberg), as well as the launch dates of the project bonds in the same period. Please note that the swap spread is derived from screen based rates and will thus present only an approximation of where actual swap spreads would have been on the day, and at the precise time, of bond launch. Nevertheless the graph is reliably illustrative of the volatility in swap spreads (and hence rates) in that 12 month period.

The bond for Exchequer Partnership was launched on 28th April at 163bp over the Treasury 2½% 2020. The 20 year swap spread on that day from the above graph was 132.99. Anecdotally, and subject to our caveats above, one could therefore put the pricing of GOGGS in the region of swapped Libor + 30bp.

The bond issue for Baglan Moor hospital was the closest in line to that for Exchequer Partnership. However, this is not comparable as it was a shorter deal, priced over a shorter (more expensive) Gilt and with a hospital trust as a counterparty, rather than the Government itself (DETR). This deal issued at 185bp over the 21/2% 2016 Gilt. Swap spreads were higher at 150.62 and anecdotally, the market perception is that this increase in swap spreads was caused by a swap competition on another PFI transaction, the MoD main building.

The closest comparable issue was that for Road Management Services (A13) plc, which launched on 13th April 2000 at 170 basis points over the same Gilt, the Treasury 2½% 2020. This deal also had a central government (DETR) covenant, although it was slightly shorter in final maturity (28 years). Using the same historical data from Bloomberg, 20 year swap spreads on that day were 125.82. Anecdotally, one could therefore put the pricing of A13 in the region of swapped Libor + 44bp.

The next PFI bond over £100 million to issue was that for Integrated Accommodation Services plc, which launched on 15th June 2000. Using our own information from the book-building of this deal, and the swap spread from the day, a deal of similar size to GOGGS could have been issued on the same day at swapped Libor + 24bp.

From our own views, and those of the market both now and at the time, the 163bp issue spread for Exchequer Partnership represented a fair price, and indicated a good performance by the lead manager.