Analysis of a range of business structures

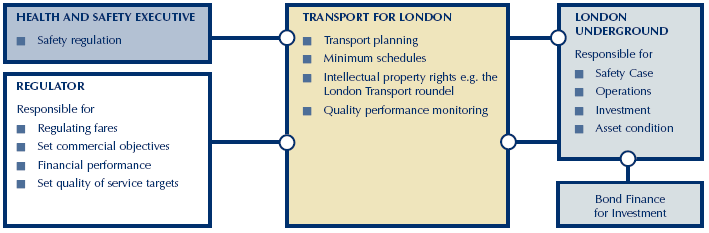

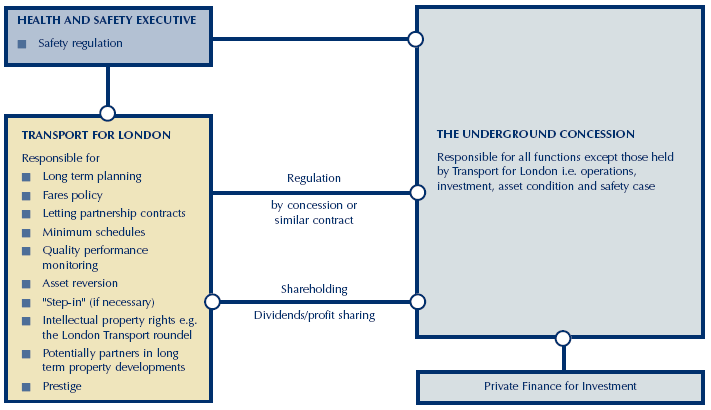

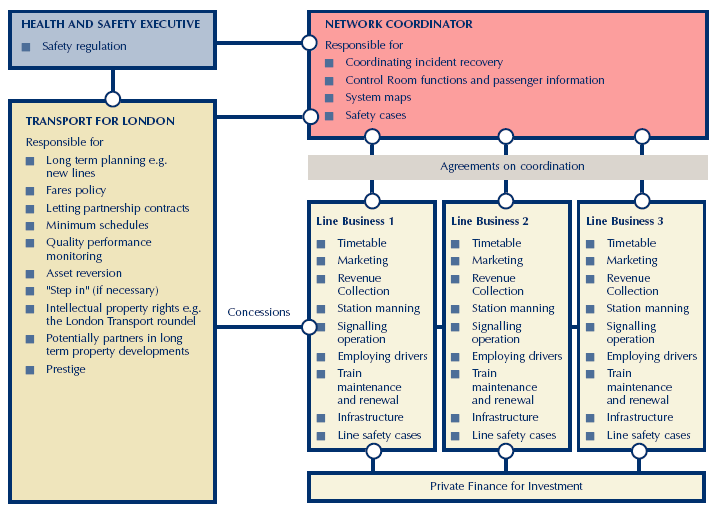

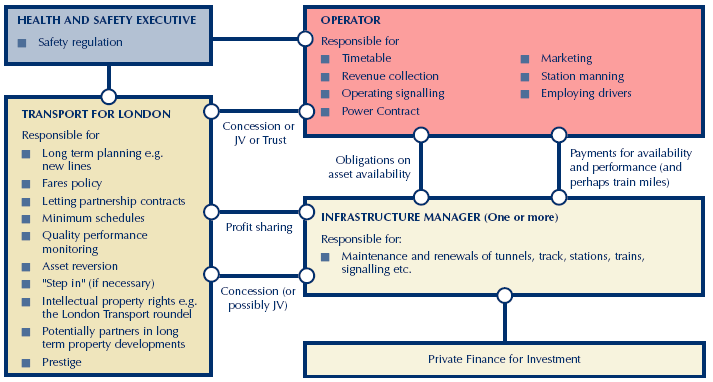

1.6 In summer 1997 an inter-departmental working group3, identified and investigated four basic business structures which could meet the Government's objectives for the PPP (Figure 3).

1.7 London Underground representatives were not included in the working group because the Department considered their presence could inhibit a frank exchange of views. Instead immediate outside advice was sought and in July 1997 following an accelerated procurement, the Department appointed Price Waterhouse as the working group's financial advisers from a short list of five bidders. Price Waterhouse was given a free rein to analyse the merits and disadvantages of the possible business structures and encouraged to consider any others, such as a non-public sector trust arrangement, that might be better suited to deliver the objectives.

1.8 In October 1997, a Price Waterhouse report recommended horizontally splitting the business into three private sector infrastructure companies (Infracos) and one or more operating companies. It ranked the variants of this option 3rd, 4th and 5th (in net present value terms) out of the eight considered variants. The report presented the argument that the recommended arrangement would better stimulate performance improvements than alternatives and could maintain the benefits of integrated operations. The report valued two options more favourably in financial terms but identified disadvantages that over-ruled the valuation findings. A single private sector concession appeared more advantageous by £300 million - but this was thought to involve greater monopoly risks. The report ranked three vertically split and entirely private concessions next, but ruled the option out because of a lack of flexibility and a requirement for a greater degree of regulation.

1.9 Although the Department did not invite London Underground onto the working group, it was asked to provide its views on possible PPPs, for which it retained separate advisers, Lazard Brothers & Co., Limited. London Underground analysed 16 variants of the same four basic business structures reviewed by the working group and circulated the results in September 1997. The analysis valued a publicly owned Tube, with stable public funding, delivering half the operational efficiency improvements assumed in the private sector business options, more favourably than all other options in financial terms. The assessed advantage was some £700 million to £900 million (in 1997 values) compared to the horizontally split options (public sector operator variants with three private Infracos - which were ranked 12th and 15th out of 16). London Underground used these findings to argue that the whole Tube should remain under public sector control with a new stable funding regime (privately or publicly sourced).

1.10 Price Waterhouse identified constraints on a partnership based on public ownership and private debt funding. The report cited prevailing public expenditure rules that would classify the debt as public sector debt. The report also stressed concerns that the capital markets would have to develop more confidence in the public ownership arrangements. Price Waterhouse suggested that the option would require the creation of a long term framework for fares (see Figure 3(a)) and realistic performance targets. This would have been necessary to give the markets comfort that London Underground's revenue base was predictable and protected from cuts in funding. Even so, Price Waterhouse doubted that London Underground would be able to raise the necessary funds without Government backing for debt repayments, something the Government was not prepared to offer.

|

3 |

|

The four basic business structures considered for the PPP |

|

|

|

a Unified business option (public sector)

|

|

|

|

b Unified business option (private sector)

c Vertically integrated business model

d Horizontally split business model

|

|

|

|

NOTE The working group decided that rolling stock should be treated as infrastructure when day-to-day operations were separated from infrastructure maintenance and renewal. As a consequence the train driver was to be an employee of the Operator, but the train was to belong to an infrastructure company. |

___________________________________________________________________________________

3 The Department, the Treasury, No 10 Policy Unit, the Department for Trade and Industry and Government Office for London.