The option taken forward

1.17 The working group discarded two of the three options, one because of lack of market interest in a partial flotation, the other because existing rules prohibited a public sector owned London Underground from raising debt in the capital markets. The Government was unwilling to make a special exception to these rules because of concerns that the selected option should provide for the structural changes necessary to engender cost efficiencies and utilise new management skills.

|

4 |

|

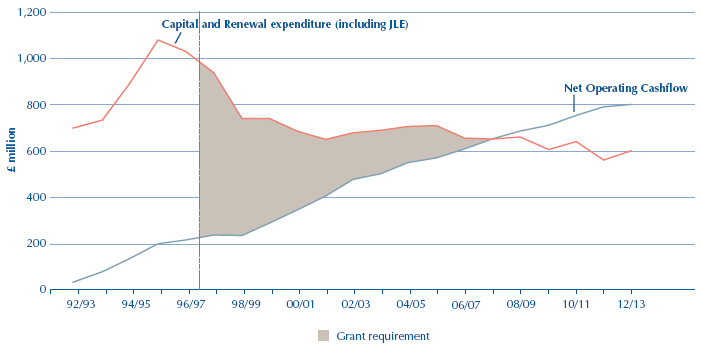

London Underground's improving cashflow (1997 estimate) |

|

|

|

|

|

|

|

Source: Price Waterhouse study (1997) |

1.18 The working group considered regulatory options and rejected extending the role of the national rail regulatory regime to the Tube. With the public sector operating the trains, the group considered that the PPPs should have a contractual rather than a regulatory framework. It saw, however, the need for an independent third party with powers to adjudicate on whether the Infraco contracts operated as intended and that the Infracos responded economically and efficiently to the investment incentives built into the PPP payment regime. This resulted in the establishment of such a party, the Arbiter, whose duties include the following:

■ To determine the economic and efficient price, when asked, to ensure that the Infracos receive an agreed return, depending on performance;

■ to give directions on whether changing requirements are new or old obligations; and

■ to adjudicate on whether adverse conditions have exceeded the threshold in the contract thereby permitting price revision.