The specification and the performance baselines

2.1 The payment regime that London Underground devised for each Infraco contract was based on paying the Infraco a monthly charge, set during the procurement, that covered maintenance, renewal and upgrading of the relevant infrastructure. This infrastructure service charge (ISC) would be subject to monthly adjustments, both up or down, determined by measuring the performance of the infrastructure against a performance and asset management specification that moulded together three existing London Underground metrics and one new one. These measures are:

■ Capability - A target measure of passenger journey time for the given capability of the railway infrastructure. The capability of a line is either estimated or tested when the condition of the infrastructure has changed and this has affected the passenger journey time. For example, after a line upgrade has reduced passenger journey time, or a speed restriction has been imposed for more than three months;

5 |

| PPP bid and procurement chronology | ||

|

|

| ||

|

| Milestone | Two Deep Tube line competitions | One Sub-surface line competition |

|

| Prequalification | 22 July 1999 [2 x 4 bidders] | 22 July 1999 [4 bidders] |

|

| ITT issued to bidders | October 1999 [2 x 4 bidders] | April 2000 [3 bidders] |

|

| Response to ITT | March 2000 [2 x 3 bidders] | September 2000 |

|

| Short-listing for BAFO | July 2000 [2 x 2 bidders] | n/a |

|

| BAFO and revisions | November 2000, January and April 2001 | February 2001 and July 2001 resubmission |

|

| Preferred bidders | May 2001 | September 2001 |

|

| Application for first judicial review | 3rd April 2001 | |

|

| First Judicial Review | July 2001 | |

|

| CFO bids | December 2001 | February 2002 |

|

| 2nd Judicial Review | June to July 2002 | |

|

| Financial Close (after May 2002 initialling) | JNP - December 2002 | April 2003 |

|

|

| BCV - April 2003 |

|

|

| NOTES ITT Invitation to Tender. BAFO Best and Final Offers; and CFO Committed Finance Offers. Source: Department records | ||

■ Availability - A measure that assesses the availability of train and station infrastructure in terms of non-performance using lost customer hours per line per month; and

■ Ambience - A measure that assesses the quality of the train and station environment provided to passengers.

And a fourth measure that London Underground did not already have but which is common in PFI contracts. This was:

■ A service point regime - A regime designed to incentivise preventative maintenance in areas not covered by other measures and provide assurance on quality standards achieved, for example, in station refurbishment. The points regime calculates deductions for equipment failures and rewards timely fault rectification.

A fuller explanation of these measures, and the asset condition benchmarks that were also set, is contained in Appendix 2.

2.2 London Underground wanted the performance regime to spur the Infracos into focusing their efforts on meeting those outputs of the railway service that it considered passengers valued: journey time; safe and reliable services; and cleanliness. Judging whether the performance targets were challenging was difficult. What complicated the setting of asset maintenance and performance baselines was: the considerable uncertainty about the then condition of the assets; the level of sustainable performance at the start; and interference from the concurrent business restructuring.

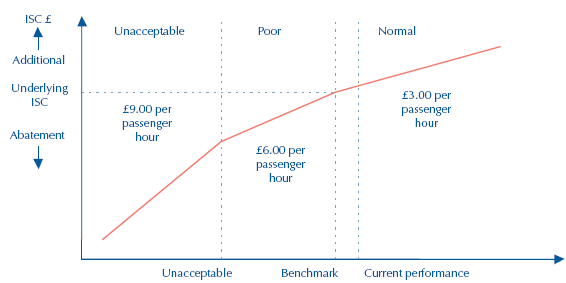

2.3 London Underground calculated the availability measure from the cumulative number of hours that passengers lost over three months when using a particular line and then divided by three. Rather than set the availability baseline at the mean, with equal bonus/abatement rates for better/worse than average performance, London Underground set the availability bonus/abatement structure boundary such that the Infraco could earn bonus payments when availability was within five per cent of the average i.e. up to five per cent more lost customer hours (see Figure 6). However, the bonus rate was set at £3 per customer hour saved when performance was better than the baseline, while the abatement rate started at £6 per customer hour lost when performance was worse than the baseline. This skewing was designed to incentivise the Infraco to improve availability performance, but was set to be price neutral if availability remained at current levels with the same degree of variability. London Underground set an increase in the abatement rate to £9 per customer hour when performance was deemed to be unacceptable. The volatility inherent in train performance meant that, without this skewing, the Infracos would have faced deductions for matching current performance and would have raised their bid prices to achieve a neutral position.

2.4 The benchmark levels for the other two measures were set above estimated current performance with financial incentives to deliver further improvement. For each line, for example, the capability payment is set to increase from certain points in time. In return, the Infraco has an obligation to shorten, by a set amount, the journey time capability of the line by upgrading it. Should the Infraco fail to deliver the improvements within the required time, London Underground would be entitled to make deductions from that Infraco's ISC.

6 |

| Infrastructure Service Charge (ISC) for Availability |

|

| The abatement increases with worsening performance.

|

|

| Source: London Underground |

2.5 In September 1999 London Underground restructured its business to mirror the proposed PPP, separating LUL as the operating company (and contract manager) from three Infraco divisions. This allowed the performance regime, particularly the ambience and availability measures, to be tested and fine tuned. London Underground compared the expected results from the theory behind the specification (see Appendix 2) against actual performance data drawn from operations, and shared the results with the bidders. Bidders were expected to factor in expectations about improving trends, for example as new investment bore fruit after a temporary dip in performance.