Completeness of price information

2.26 Although London Underground routinely inspected and maintained its infrastructure assets, its knowledge about the residual life of some, particularly those difficult to access, was not complete. Even after Ove Arup had collated the available asset condition information, London Underground knew that its bidders would not have sufficient starting information to judge reasonably the residual life and associated maintenance requirements for varying percentages of the fixed assets (see Figure 7 showing variation by asset class). London Underground had identified this problem at the outset:

|

"The condition of some assets (e.g. cast iron structures) will be difficult to determine, however good the due diligence process. The private sector may apply a heavy discount to cope with the uncertainty or the public sector might have to bear or share the residual risk." Source: London Underground 'Evaluation of Options' |

2.27 The uncertainty associated with the condition of some assets also elevated the importance of the proposed periodic reviews. London Underground accepted that the contracts would include provisions on the basis that, at periodic review, contingent sums for unforeseen risks would be adjusted. In modelling this risk there was, over the bidding period, a noticeable convergence between the public sector comparator (although this was kept confidential) and the bids. It was not clear to us to what extent the public sector accepted and took on board risks identified by the private sector. London Underground told us that it made an independent judgement of the impact of these risks.

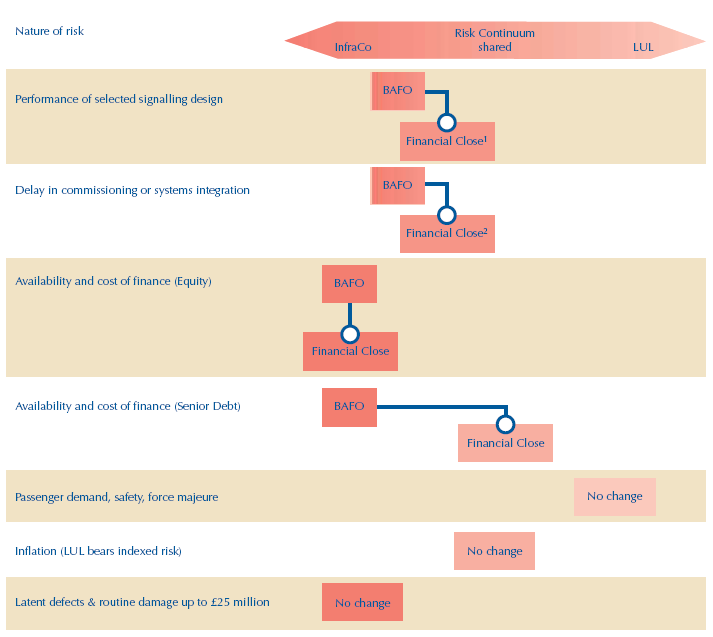

2.28 Bidders were concerned about the 7½ year periodic reviews because they considered that LUL could re-scope the extent of the work for which Infracos were responsible, and could amend the Infrastructure Service Charge. They were worried that this could create disproportionate risk. These fears and the commercial imperative for bidders to clarify all the risks they were assuming led to London Underground accepting more risk sharing than it had originally hoped to negotiate when sending out its desired form of contract at the BAFO stage (illustrated in Figure 10) in order to keep bidders' provisions down.

|

10 |

|

Risk clarification examples (illustrative only) |

|

|

|

|

|

|

|

NOTES 1 Although the underlying commercial risk share on signalling design did not change, bidders insisted on it being much more precisely defined, reducing their uncertainty. 2 Infracos are allowed certain extensions of time for delays not attributable to them. Bidders argued that this no fault principle should apply generally, and LUL dropped certain exclusions it had sought. If such extensions were used in full, which would be unlikely, Transport for London estimated their value at £117 million. |

2.29 London Underground had to strike a balance between holding a desired line on risk transfer and conceding higher levels of contingency in bidder pricing, and had to make sure that each bidder had sufficient funds in reserve to fund contingency (see Figure 11) to avoid triggering a request for an extraordinary review by the Arbiter in normal circumstances. For the Infracos, that are judged economic and efficient, their exposure to non performance deductions and/or increased costs is capped. Appendix 2 provides additional information on performance and payment arrangements.