The impact of delays

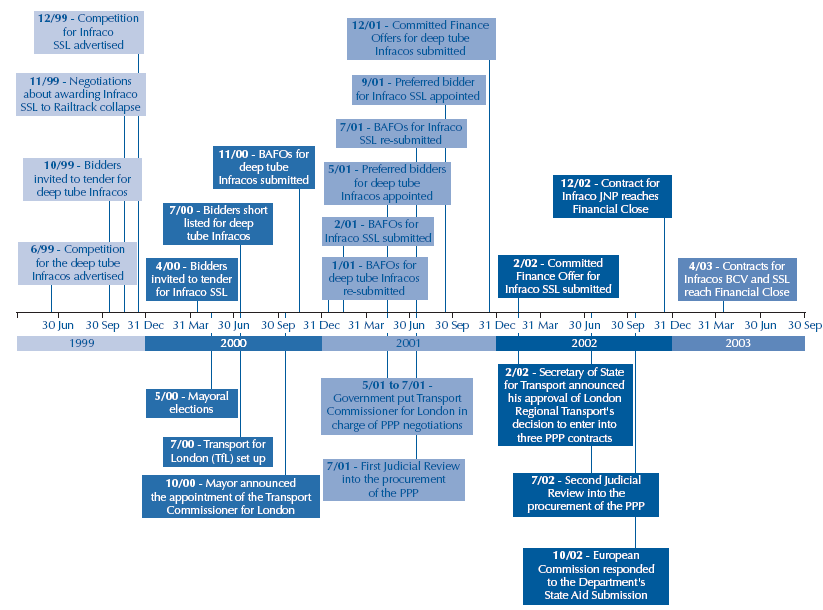

3.14 When the PPP was first considered there was a view that it could be completed within two years. The programme for the PPP, produced in March 1998, proved optimistic and, in almost every revision thereafter, the actual timing needed proved greater than the incremental increases allowed. In particular, the Mayor's opposition proved to be more deep-seated than the Department anticipated and had a more serious impact on completing the deals.

|

13a |

|

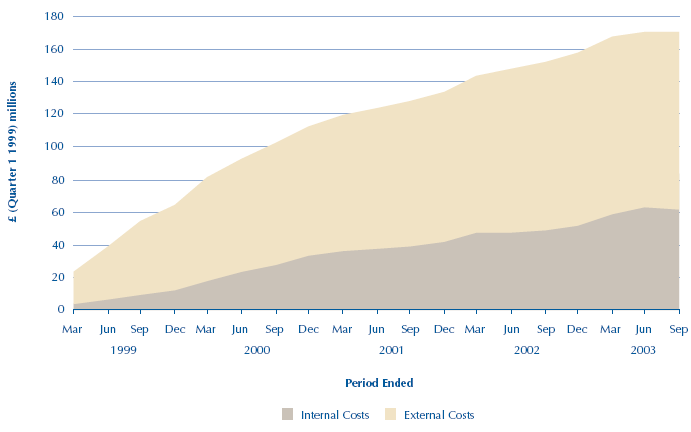

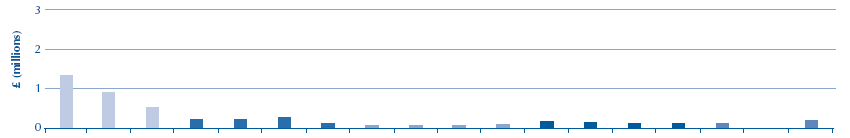

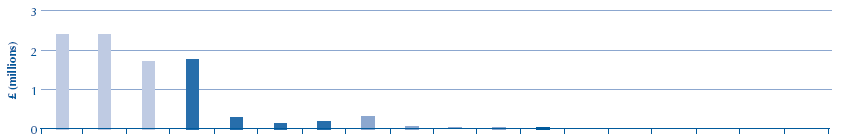

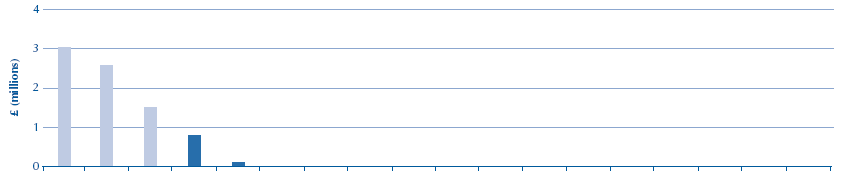

Progression of London Underground's costs over time [tables] |

|

|

|

London Underground Transition Project Expenditure.

|

|

|

|

Source: London Underground |

|

13b |

|

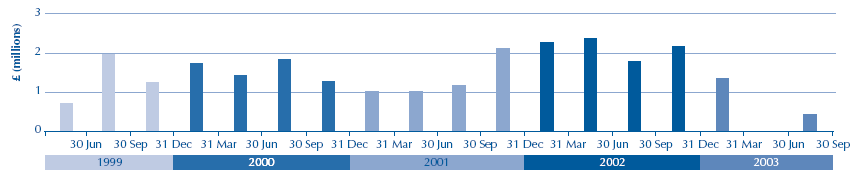

Profiles of London Underground's quarterly expenditure 13b during the procurement |

|

|

|

|

|

Freshfields (Legal advisers) |

|

|

|

Total spend £29.2m1

|

|

PricewaterhouseCoopers (Financial advisers)

|

Total spend £21.4m1

|

|

Ove Arups (Engineering advisers - Assessment of base costs and asset condition)

|

Total spend £6.0m1

|

|

PA Consulting (Business advisers - Restructuring the infrastructure business)

|

Total spend £12.5m1

|

|

Arthur Anderson (Business advisers - Restructuring operations)

|

Total spend £13.8m1 Advising London Underground about restructuring its operations was effectively complete by the end of March 2000.

|

|

Other External Advisers

|

Total spend £26.5m1 Nearly 90 per cent of this expenditure was incurred prior to the appointment of preferred bidders for the deep tube Infracos (Qtr. ending 30 June 2001).

|

|

London Underground's Internal Costs

|

NOTES 1 Totals include expenditure incurred between May 1998 and 31 March 1999. 2 All figures are expressed in Qtr. 1 1999 monetary terms 3 Positive cost adjustment at project close Source: London Underground |

3.15 Having taken the step to meet bidders' costs, London Underground acquired a financial interest in how bidders managed their affairs. Before taking this step PricewaterhouseCoopers had estimated that each of the short listed bidders would spend between £12 million - £15 million up to the appointment of preferred bidders. In late 2002, the London Underground endorsed payment of £14 million to the LINC consortium10 when it was unsuccessful in its two bids: one for the Infraco BCV contract; the other for the Infraco SSL contract. On the same basis the Board agreed to cover Tube Rail's bid development costs (£11 million) for being the unsuccessful shortlisted bidder in the JNP competition.

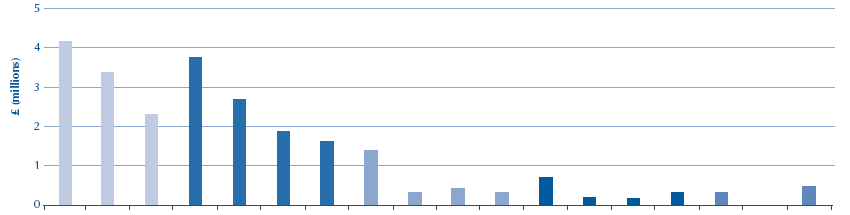

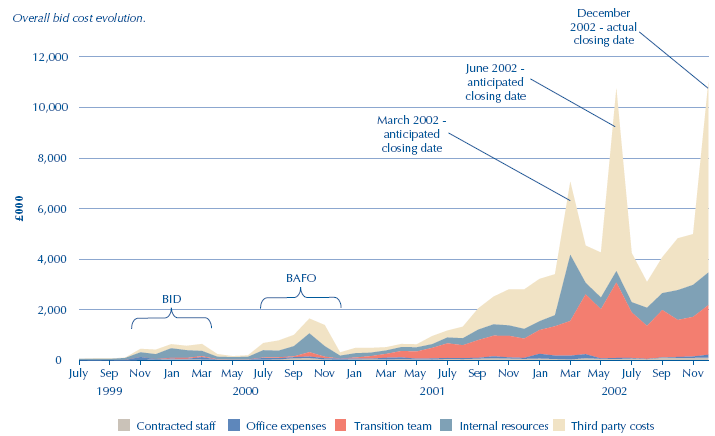

3.16 Figure 14, profiling the monthly costs incurred by Tube Lines during its bid for the JNP Infraco contract, shows that, up to its appointment as preferred bidder Tube Lines spent only a small proportion of the final total of £134 million. After being appointed preferred bidder Tube Lines' bid costs increased as it negotiated the terms of the contracts in the run up to Committed Finance Offers. Working to London Underground's proposed timetable which turned out not to be feasible Tube Lines geared up its staffing levels in anticipation of reaching the target closing dates; (the two peaks at March 2002 and June 2002 in Figure 14). Metronet also claimed bid and other related costs of some £116 million in aggregate for Infraco BCV and Infraco SSL. In the Tube Lines and Metronet cases the mechanism for recovering bid costs was through an adjustment to the relevant infrastructure service charge.

3.17 In total the transaction costs from the early preparations by London Underground through to closing all three PPP deals reached £455 million, including restructuring costs, internal costs, external costs and bidders' costs - but excluding spending incurred by Transport for London.

|

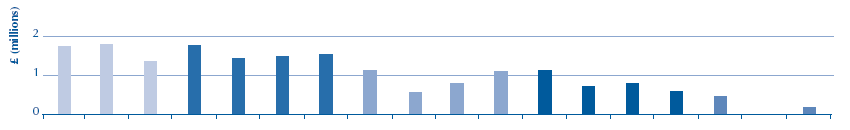

14 |

|

The evolution of Tube Lines bid costs 1999-2002 |

|

|

|

|

|

|

|

Source: Tube Lines |

3.18 In the process of validating bidders' costs London Underground identified some areas of difficulty, for example an apparently widespread practice of loading the cost of bidding with an element for funding bid costs. This was based on the cost of capital and factored in the lost opportunity of utilising this capital to make other business investment returns. Although there was agreement to reimburse bid costs under certain conditions, there was also a premium for the risk that these conditions might not have been met. In the case of the Tube Lines consortium this amounted to 21 per cent of the sum of money that Tube Lines invested as equity in the PPP. During the delays associated with the legal challenges Tube Lines also made progress with its detailed analysis and the design of its PPP proposals. It claimed these as bid costs although arguably these same costs would have been incurred post contract award had the delays not occurred, and as such there is a risk of double payment of some costs built into Tube Lines' pricing of the service charge.

3.19 In the latter stages of the procurement, the way bid costs were treated as a deferred expense in bidders' company accounts changed. The change adversely affected the commercial strength of Amey11, one of the members of the Tube Lines consortium. To provide comfort, London Underground agreed to set out in writing the position on bidders' costs in a form that was satisfactory to the financial backers of the consortium. London Underground refused to make issuance of this letter a precedent for dealing in the same way with Metronet due to the number of outstanding commercial issues.

3.20 London Underground told us that in December 2002 it considered walking away from the two Metronet deals right up to the minute when it finally obtained written confirmation on how to finalise commercial points that had been left open in May 2002. Standing firm on pre-agreeing Metronet's bid costs may well have helped London Underground to obtain the contract certainty it required at this point in order to finalise the deal on Infraco JNP that Tube Lines was then ready to close.

_____________________________________________________________________________________

10 Consortium members comprised - Linc: Bombardier, Mowlem, Fluor Daniel, Alcatel and Anglian Water and Tube Rail: Brown & Root, Alstom, Amec and Carillion.

11 In 2003 Amey was acquired by a Spanish company, Grupo Ferrovial SA.