SUMMARY

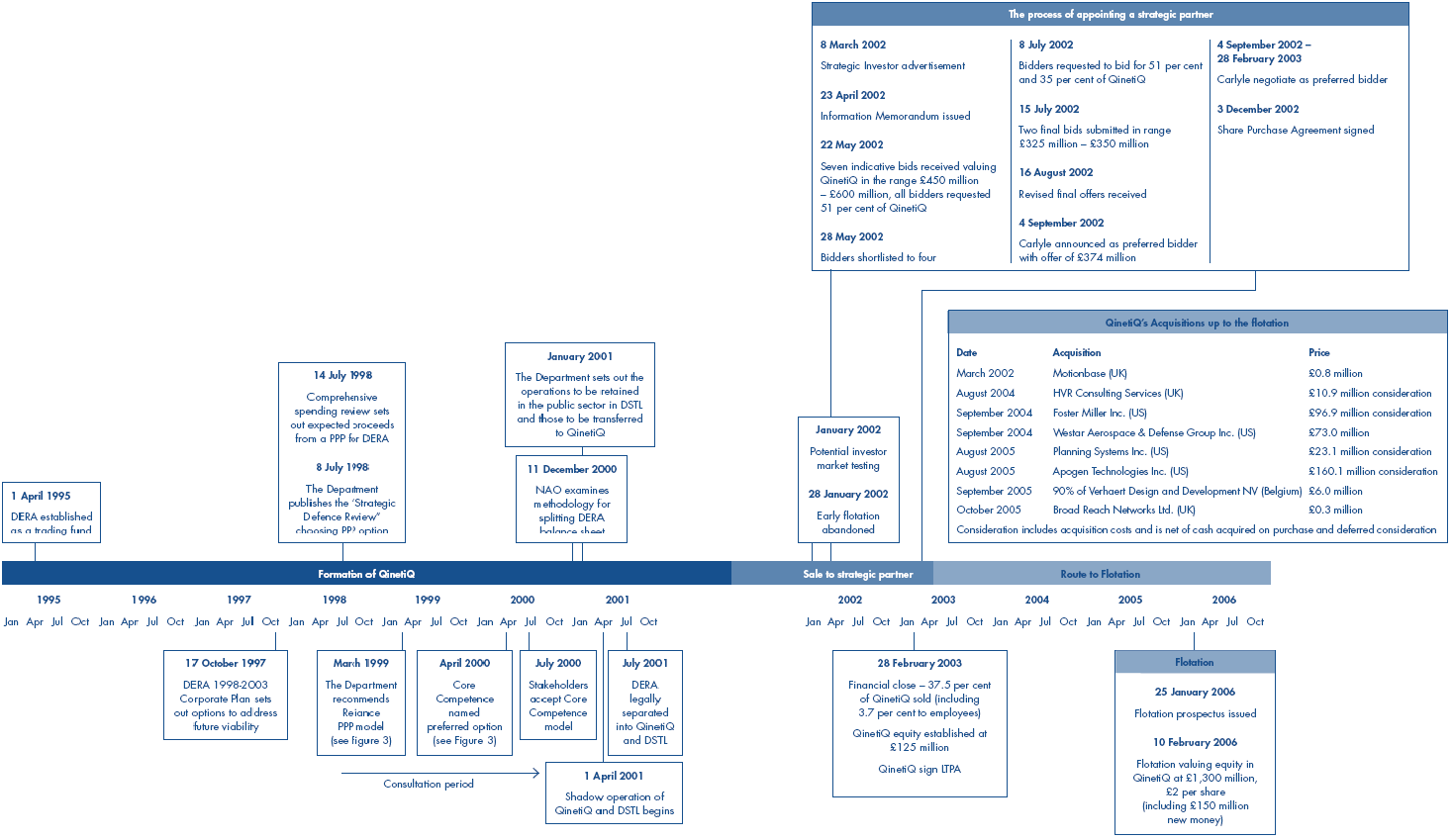

1 This report examines whether the privatisation of the defence technology business QinetiQ was a good deal for the taxpayer. The privatisation was carried out in two stages - the sale of 37.5 per cent of the business in February 2003 (33.8 per cent to the Carlyle Group and 3.7 per cent to management and employees). The aim of this was to help develop the business ahead of a flotation on the London Stock Exchange, which took place in February 2006. The privatisation has generated net proceeds of £576 million and the Ministry of Defence (the Department) still holds a 19 per cent stake in the business worth £235 million as at 31 October 2007. A complete timeline for the process is shown in Figure 1 on pages 6 and 7.

2 QinetiQ has a vital role in carrying out research and advising the Department on the development and procurement of equipment as well as managing the testing and evaluation of this equipment. It also engages in wider commercial activity and since the privatisation has expanded into the US. It was created out of the Defence Evaluation and Research Agency (DERA) in 2001 specifically to allow the majority of DERA's activities to be privatised. To protect defence interests the most sensitive aspects of DERA's business were kept in the public sector and a system - the Compliance Regime - was put in place to protect the independence of QinetiQ's advice to the Department once it had become a commercial supplier.

3 The decision to split DERA followed wide consultation on the form of the privatisation. Implementing the split was challenging and carried out to a tight timetable. The Department handled this process well. Although the Department did more than was legally required and there have been no legal challenges to date, there were complaints from some elements of the defence industry about the handling of their intellectual property.

4 The decision to sell a minority stake in the business to a strategic partner, rather than float the business on the Stock Exchange soon after incorporation, was taken in early 2002 in the light of poor market conditions and the absence of a commercial track record. Nevertheless, the competition for a strategic partner began in March 2002 even though the market was poor and the commercial terms of the important Long Term Partnering Agreement (the LTPA) had not yet been agreed.1 The Department considered that a delay to the privatisation process could have had an adverse impact on long term value by undermining staff morale, damaging customer relationships and restricting QinetiQ's commercial freedom at a key stage in its development. In recognition that QinetiQ was hard to value and that the timing of the sale would have an effect on proceeds, the Department decided to sell only a minority of shares, in line with relevant recommendations from the Public Accounts Committee and National Audit Office.

5 Achieving a good price in a sale relies on there being strong competition. Twelve investors were selected to participate in the competition and four were shortlisted. The difficult timing and complexity of QinetiQ's business increased the market's perception of risk and contributed to there being only two compliant bids, in July 2002, both from private equity firms. The Carlyle Group were appointed 'preferred bidder' in September 2002, before the detailed terms of the LTPA had been agreed. The sale to Carlyle was signed in December 2002 and completed in February 2003, when the LTPA was signed.

6 After Carlyle were appointed preferred bidder they negotiated a reduction in the value of the business of £55 million, £25 million relating to the pension fund deficit (see paragraph 2.29) and £30 million relating to the value of the LTPA (see paragraph 2.27). Our analysis shows estimated cash proceeds in the final bid falling by £32 million to £155 million in the final deal. This was a result of a number of changes including the sale of 2.5 per cent more of the shares than initially agreed (see paragraph 2.32). Decisions on restructuring and funding of the services included in the LTPA had been going on since 1998. Due to the uncertainties stemming from the lack of agreed terms for the LTPA, we consider that the sale to Carlyle may have yielded less money than the Department could have received if the LTPA had been signed prior to the sale. The Department told us it was concerned that delaying the sale would have an adverse impact on the value received from the privatisation. To help reduce uncertainty in the bidding process the Department included draft terms for the contract within the sale documentation.

7 As is normal for private equity firms, Carlyle used share incentives to align management's interests with their own, that is, to realise the maximum possible increase in the value of the equity in the short to medium term. The Department considered that its interests in terms of incentivising management to increase the value of the business were aligned with Carlyle's. Although it did not want management to make very large returns purely as a result of the privatisation it accepted that management could make significant amounts of money if this was linked to the growth in the value of the business. The Department did not, therefore, seek to influence the structure of the share incentive scheme. Carlyle amended their proposed management incentive structure before being appointed preferred bidder to reflect advice from QinetiQ management. The Department subsequently approved the scheme after Carlyle were selected as preferred bidder. Its approval was based on a review of a limited range of potential outcomes, which it believed were realistic at the time (see paragraph 2.17). Up to 20per cent of the equity was made available to management and employees, subject to performance targets being met (see Appendix 4). Unusually for such deals, but in line with the Department's objectives, share incentives were made available to all QinetiQ staff, including a small allocation of free shares. Not all staff took the opportunity to invest their own money in the business.

8 The structure of the deal resulted in QinetiQ having a relatively low equity value of £125 million and high levels of debt. The equity value increased to £1.3 billion2 between the 2003 sale and the 2006 stock market flotation. This was strongly influenced by the improved business performance achieved by QinetiQ management following expansion into the US defence market and into the civil market in the UK and elsewhere. This contributed to a 36 per cent increase in revenue and a 261 per cent increase in operating profit between 2003 and 2006.3 The increase in the equity value was also influenced by an upturn in the value of defence and technology stocks.

|

1 |

Timeline of the privatisation of QinetiQ |

|||

|

|

|

|

|

|

|

|

Key |

|

|

|

|

|

- Defence Evaluation and Research Agency - Public Private Partnership - House of Commons Defence Select Committee - Defence Science and Technology Laboratory |

|

||

|

|

||||

|

Source: National Audit Office analysis |

||||

9 The value of the shares of the top 10 managers was £107 million at the time of the flotation, from an initial investment of £537,250. The Department considers that the management incentive scheme met the objective of maximising value. The returns achieved by management reflected a greater increase in the value of the business than it had expected, which also generated higher than expected returns for the taxpayer. Although we accept that limiting returns to management can diminish the attraction of such deals to potential investors, we consider that the returns in this case exceeded what was necessary to incentivise management to deliver this growth in the value of the business.

10 The 2006 flotation was well executed and benefited from favourable market conditions, with the Department realising £300 million of additional proceeds, net of costs. The decision to sell only a minority of shares to Carlyle enabled the Department to benefit from the majority of the growth in value. The absence of a dedicated offer to the public, which had been present in most previous privatisations, had an adverse effect on the media perception of the privatisation. This decision was taken because the shares were only considered suitable for sophisticated investors and the costs of marketing the issue to the public would not have been outweighed by the benefit of extra demand because of the limited size of the offer. The public were able to buy limited shares through brokers.

_______________________________________________________________________________________

1 The Long Term Partnering Agreement is a 25 year contract to operate and maintain the test and evaluation ranges.

2 Including £150 million of new money raised by the company.

3 International Reporting Standards were introduced in 2005 which affected the presentation of financial results. The impact of this is shown in Figure 13.