The Department was not involved in the design of the share incentive scheme although it assessed and approved it

2.15 A key objective of the PPP was to "implement a share scheme for all employees consistent with achieving value for money". Accordingly, all bidders were required to set out the terms of an employee share ownership scheme or other incentivisation arrangements. In their offer of July 2002, Carlyle proposed a two-tier structure allocating 10 per cent of equity to management and staff but with greater rewards available for senior management. Permira also proposed to offer staff 10 per cent of the equity but with a three-tier structure that gave higher rewards to middle management as well. Following the QinetiQ management team's assessment of the bids the then chief executive and chairman both wrote to the Department suggesting that Carlyle should revise their offer to include a three-tier structure to encompass middle managers. The chief executive also expressed the view that the 10 per cent of equity offered by Carlyle was low and wanted the incentive arrangements to offer higher returns based on exceptional performance. Informed by his previous privatisation experience, the then chief financial officer discussed this with Carlyle before final bids were submitted. Carlyle's revised final offer in August reflected the management team's suggestions, including ratchets to reward senior management for outstanding performance by increasing the amount of equity available to management and staff.

2.16 In late August 2002, as part of the 'preferred bidder' selection process, the Department approved the structure of the Carlyle incentive scheme including the maximum twenty per cent of equity available to staff. The Department accepted the scheme and did not seek specific professional advice believing that its interests were aligned with those of Carlyle, i.e. to ensure that the returns were linked to the growth in the value of the business.

2.17 On the basis of the scheme agreed, following input from the chief financial officer, the then chief executive officer proposed the specific allocation of shares to management and staff. This was on the basis that Carlyle considered he was best placed to decide the levels of incentivisation for individual staff. The Department did not seek to involve the Board or the remuneration committee in approving the allocation of shares. It has told us that it considered that it would not have been appropriate for the remuneration committee to be involved because the remuneration committee had no formal remit to advise on the proposed management incentive scheme. This was because it was a committee of QinetiQ Group, wholly owned by the Department, and, under the deal agreed with Carlyle, a new company, QinetiQ Holdings, would be formed (see paragraph 2.33). The Department considered that it is normal for the purchaser of a business to agree such a scheme, subject to the approval of other shareholders. It approved the final scheme in October 2002 based on the modelling of a limited range of outcomes. This anticipated a maximum growth in the value of the equity of five times, which indicated a maximum return to the then chief executive officer of £10 million. The Department expected the growth in value to be less than this and on this basis concluded that the returns available were at the modest end of market practice. It was aware, nevertheless, that the scheme that it had accepted could result in much larger returns to management, as in fact it did. In November 2002, after the share scheme had been approved, the non-executive directors of QinetiQ separately commissioned the company's financial advisors to model the outcomes of the employee incentive arrangements under a range of scenarios. This included modelling higher levels of growth and higher returns than those envisaged in the Department's analysis.

2.18 The Government's objective to extend share ownership to all staff was achieved and resulted in wider participation than usual in a private equity transaction. The final share incentive scheme comprised four elements, targeted at different groups of staff. The full details are set out in Appendix 4. All employees received 40 share options for free and had the opportunity to buy shares in a co-investment scheme that was largely made up of preference shares.22 The co-investment scheme reduced the shareholding of Carlyle and gave staff the opportunity to invest on the same basis as Carlyle and the Department. The top 245 managers could invest in ordinary equity, intrinsically more risky than the preference shares, that benefited from a performance ratchet and the top ten could invest in ordinary equity that benefited from an additional performance ratchet. The ratchets worked through diluting the shareholdings of the Department, Carlyle and the co-investment scheme proportionally to the size of the shareholdings if performance thresholds were met, thereby increasing the shareholdings of the top managers. The maximum of twenty per cent of equity available to QinetiQ management and staff was at the high end of market practice for private equity deals.

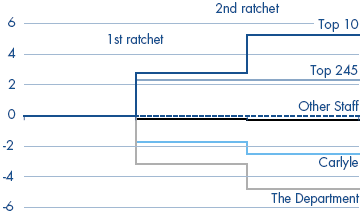

2.19 The potential return was linked to the growth in value of the equity of the company at the flotation. The performance ratchets amplified the returns of the top 245and top 10 managers, acting as an additional incentive on management to increase the value of the company. To meet the first ratchet the value of the Department's and Carlyle's equity investment needed to increase by more than three times by the flotation. The second ratchet could only be triggered if the value of the equity increased by more than four times. If the equity value of QinetiQ failed to increase by 1.2 times by the flotation the staff who had invested in ordinary equity - the top 245 and top 10 managers - would have lost their investment. Furthermore the top 245 and top 10 managers could be requested to sell their shares for the lower of the purchase price and the prevailing market value, as determined by the Board, if they left voluntarily or were dismissed from the company before a flotation. Figure 6 sets out the impact of the ratchets on the shareholdings of staff, the top managers, the Department and Carlyle; the full criteria for the operation of the ratchets are described in Appendix 4.

2.20 All the shares allocated for the senior management were eventually fully subscribed, with almost all of the managers investing the maximum permissible; not all senior managers who were originally entitled to invest subscribed for shares. The majority of staff were reluctant to invest in the co-investment scheme and even after management had made a second presentation to all staff there were still shares available. Sir John Chisholm has told us that many staff did not believe that a public sector organisation such as DERA could be transformed into a successful private company and they were concerned that the Department would squeeze margins in the business. Our contact with QinetiQ staff has indicated that the

6 | The ratchets increase the percentage shareholdings of senior management |

Movement in percentage shareholding

Source: National Audit Office analysis | |

NOTE This figure shows the change in the percentage of QinetiQ's shares held by the Department, Carlyle and QinetiQ staff when the ratchets in the share incentive scheme are triggered. | |

complexity of the investment opportunity and the short time available to make a decision in January 2003 also had an impact.

2.21 The co-investment scheme shares not taken up by staff were offered to the non-executive directors and senior management after the deal had been substantially agreed. Two non-executive directors accepted the offer and invested £100,000 in total, eventually making returns of over £800,000. It is not unusual for non-executive directors to buy shares at market value in the businesses on whose boards they sit to align their interests with those of other shareholders. In this case the shares were not freely traded. Moreover, if the business performed in line with expectations the equity would increase rapidly in value ahead of a flotation due to the highly leveraged structure of the final deal. The expectation of high returns could have resulted in perceived conflicts of interest in relation to the non-executive directors' role in the privatisation. We found no evidence, however, to suggest that the Board or the Department considered this possibility or how such a perception should have been managed. In light of the timing of the non-executive director's investment, the Department and QinetiQ consider that there were no grounds for such a perception.

_______________________________________________________________________________________

22 Preference shares have less risk than equity as the returns are paid out prior to dividends. They pay a fixed percentage return, in this case nine per cent.