The final bids were lower than earlier valuations had suggested

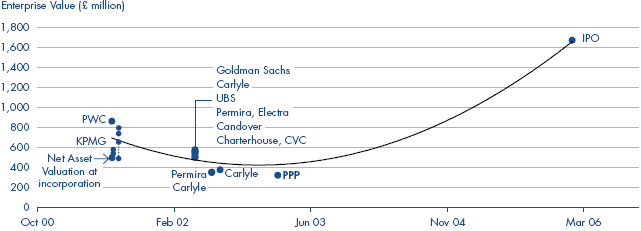

2.22 Soon after incorporation in July 2001, the value of QinetiQ had been appraised jointly by KPMG and PricewaterhouseCoopers (PwC). The report, prepared by KPMG, gave KPMG's initial judgement of the value of the business as in the range of £551-£571 million. The report also referred to PwC's initial view that a value of £862 million was more realistic. PwC do not now have the inputs and assumptions supporting that figure and are therefore unable to confirm its robustness or comparability with other valuations. In August 2001 the Department requested that PwC halt the joint valuation work and instead carry out a review of KPMG's valuation, which had by this time changed to between £467-£649 million. PwC suggested that KPMG's revised valuation was low and that there was strong evidence that it could be increased by £170-£250 million based on the market value of land and buildings owned by QinetiQ, which had not been valued by KPMG as part of their work. Following due diligence, Carlyle, in their bid dated August 2002, valued the business at £374 million (paragraph 2.24). The range of historical valuations is shown in Figure 7 overleaf.

7 | The value attributed to QinetiQ fell during the sale process |

Enterprise Value (£ million)

Source: National Audit Office analysis and the Parthenon Group report on the Formation and Privatisation of QinetiQ commissioned by the National Audit Office, July 2006 | |

2.23 The seven indicative bids received on 22 May 2002 valued QinetiQ at between £450 million and £600 million before adjustments for debt in the business. At the same time UBS Warburg, acting for the Department, valued the business within the range £495-£625 million on the same basis, which confirmed that the indicative bids were within an acceptable range. This decline from the value in 2001 was attributed to the depressed market for technology and research stocks.

2.24 Following due diligence, the final bids received from Carlyle and Permira on 15 July 2002 valued the business within the range £325-£350 million before adjustments. The decline was due to significant changes in forecasts for the Solutions and Estates business (see Figure 4), following the release of year-to-date performance, and due diligence findings relating to expected future capital expenditure requirements. Carlyle's final bid valued QinetiQ at £374million before adjustments.

2.25 Two price-sensitive commercial issues were still outstanding when Carlyle was appointed preferred bidder in September 2002: QinetiQ's pension fund deficit and the finalisation of the Long Term Partnering Agreement (LTPA) between QinetiQ and the Department. Carlyle were granted an exclusive negotiation period from 3 September 2002 to 30 November 2002 although the Department retained Permira as a reserve bidder to try to maintain an element of competitive tension. The negotiation period with Carlyle was later extended to 2 December 2002, although the deal was not finally completed until 28 February 2003 following delays in signing the LTPA. Over the three months Carlyle were preferred bidder, the value attributed to the business declined to £319 million after Carlyle negotiated reductions of £55 million: £30 million relating to the LTPA and an immediate reduction of £25 million for the deficit in the QinetiQ pension fund. Due to the decision to sell a minority stake, these reductions in the value of the business are equivalent to a £21 million reduction in the value received by the taxpayer from the sale (£11 million relating to the LTPA and £10 million relating to the pension fund deficit). The actual impact of the reductions in value on the proceeds received by the Department is shown in Figure 9 on page 25.

2.26 By appointing Carlyle as preferred bidder with price-sensitive issues outstanding, the transaction changed from a competitive to a negotiated process. If the competition had remained open while these issues were being resolved, the other shortlisted bidders could have had sufficient time to submit binding and compliant bids (paragraph 2.11). This could have resulted in improved competitive tension, potentially leading to greater proceeds from the sale. The Department disagrees with this conclusion and notes that Permira did not improve significantly their offer when asked to submit a revised bid (see paragraph 2.12). The Department took advice from UBS Warburg prior to signing the deal with Carlyle that stated that the negotiated adjustments were not such that they materially affected the basis of the competitive process insofar that other bidders would have been likely to act in the same way. The Department and UBS Warburg believe that a delay to the process could have resulted in Carlyle withdrawing from the competition and that greater proceeds could not have been achieved from the sale.