In the final deal, proceeds fell to £155 million

2.31 Proceeds fell between the final bid and the close of the deal. Negotiated deductions of £55 million relating to the LTPA and pension fund deficit (see paragraphs 2.27 and 2.29) reduced the value of the business (see Figure 9). The impact of these reductions on cash proceeds was offset by three factors:

■ the capital structure of the business changed leading to extra proceeds of £7 million and a £7 million reduction in value of its retained equity stake;

■ the Department sold an extra 2.5 per cent of the equity to Carlyle increasing proceeds and reducing the value of its retained stake by £3 million; and

■ there was £13 million less external debt in the business at completion of the deal than in the NAO's analysis of information set out in Carlyle's bid.

At completion of the deal, NAO analysis shows therefore that the final cash proceeds reduced by £32 million to £155 million. £60 million of proceeds, relating to the sale of a surplus property located in Chertsey, were deferred until the property sale was completed. This amount was subsequently repaid in full.

9 | National Audit Office analysis of changes to proceeds after Carlyle were appointed preferred bidder | ||||

|

|

|

|

|

|

| Final bid £m | Final deal £m | Difference £m | Explanation | |

Enterprise Value1 | 374 | 319 | 552 | Negotiated reductions (LTPA and pension fund deficit)2 | |

Less value of retained stake3 | (88) | (78) | (10) | The amount of debt and equity in the new QinetiQ Holdings company changed and 2.5 per cent more shares were sold (paragraph 2.32) | |

Cash proceeds (on the assumption of no external debt in the business) | 286 | 241 | 45 |

| |

Less net external debt/provisions4 (In final bid based on NAO analysis, actual given for final deal) | (99) | (86) | (13) | NAO analysis shows less external debt at completion than estimated at the time of the bid | |

Cash proceeds | 187 | 155 | 32 |

| |

(In final bid based on NAO analysis, actual given for final deal) |

|

|

|

| |

Source: National Audit Office analysis | |||||

NOTES 1 Enterprise Value is the total value of the business, irrespective of the levels of debt and equity, as offered by Carlyle (see paragraphs 2.12 and 2.24). 2 Reductions of £30 million relating to the LTPA and £25 million for the pension fund deficit, equivalent to a £21 million reduction in value for the taxpayer - see paragraph 2.25. 3 Carlyle initially proposed a capital structure for the new company, QinetiQ Holdings Limited, based on equity of £135 million which was changed in negotiations to equity of £125 million. The major part of this was to be preference shares offering a 9 per cent return. The Department agreed to sell Carlyle an extra 2.5 per cent of equity. The value of the residual stake in the final bid was, therefore, 65 per cent of £135 million (£88 million, £79.2 million as preference shares) compared to 62.5 per cent of £125 million (£78 million, £70.2 million as preference shares) in the final deal. 4 External net debt/provisions is the amount of QinetiQ Group net borrowing from commercial lenders and other agreed liabilities. It varies with the needs of the business and the figure given for the final bid is based on National Audit Office analysis of information in Carlyle's bid document based on the 30 June 2002 balance sheet. | |||||

2.32 The Department told us that it agreed to sell Carlyle an additional 2.5 per cent of equity on top of the 35 per cent specified in their bid as part of a package of adjustments following the negotiations surrounding the Long Term Partnering Agreement (see paragraph 2.27). The Department also told us that the sale of an additional 2.5 per cent of equity gave Carlyle a greater incentive to protect their investment through close stewardship, although it recognised earlier in the process that there would be future financial benefits from restricting the amount sold to the strategic partner (see paragraph 2.2).

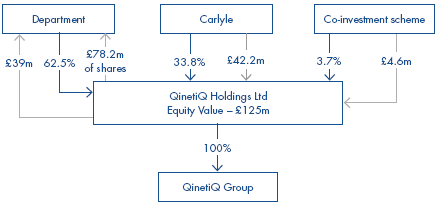

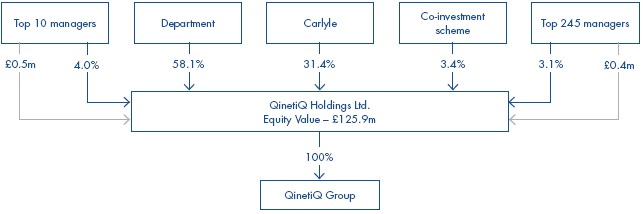

2.33 In February 2003 QinetiQ Holdings Ltd was formed as the acquisition vehicle to complete the transaction. It was established with an equity value of £125 million.27 QinetiQ Holdings Ltd acquired 100 per cent of the shares in QinetiQ Group from the Department for £117 million. The £117 million was made up of £78.2 million of shares in QinetiQ Holdings Ltd (62.5 per cent of the equity) and £39 million in cash. Although the Department had agreed to sell 37.5 per cent of QinetiQ, 3.7 per cent was to be set aside for QinetiQ staff under the co-investment scheme. Carlyle paid QinetiQ Holdings Ltd £42.2 million to acquire 33.8 per cent and QinetiQ employees paid a further £4.6 million for 3.7 per cent. The top 10 and top 245 managers subscribed for new shares in QinetiQ Holdings Ltd worth £0.5 million and £0.4 million respectively; these shares diluted the shareholdings of the Department, Carlyle and the co-investment scheme proportionally. The structure of QinetiQ Holdings Ltd at the completion of the deal is set out in Figure 10.

2.34 The Department had told bidders that they would not become entitled to be reimbursed for any costs associated with preparing their offer. Both Carlyle and Permira bid on the basis that costs would be reimbursed by QinetiQ Holdings Ltd and the Department told us that it approved this treatment of the bid costs when it accepted Carlyle's offer. The Department considers that if it had prevented the reimbursement of these costs, bidders would have asked for a proportionate reduction in the value ascribed to QinetiQ. Reimbursement of costs by the business being bought is common practice in a private equity deal where 100 per cent of the company is purchased. It would therefore have been reasonable to refund Carlyle's costs only if the Department's costs were also fully reimbursed. At the completion of the deal QinetiQ Holdings Ltd reimbursed fully Carlyle's bid costs of £16 million. The Department believes that Carlyle had an incentive to minimise their costs as they were a shareholder in QinetiQ Holdings Ltd and it did not seek to separately verify or validate the reimbursed costs.

10 | Percentage Shareholdings in QinetiQ Holdings Ltd at completion of the deal |

Step 1. The Department receives a mix of ordinary shares and preference shares valued at £78.2 million as part of the compensation when QinetiQ Holdings Ltd acquires QinetiQ Group (£39 million in cash, £56 million in loan repayments and £60 million deferred proceeds were also received). Carlyle invests £42.2 million in a mixture of ordinary shares and preference shares to purchase 33.8 per cent of QinetiQ Holdings Ltd. Employees invest £4.6 million to purchase 3.7 per cent of ordinary and preference shares in QinetiQ Holdings Ltd under the co-investment scheme. | |

| |

Step 2. Senior management invest in new ordinary shares in QinetiQ Holdings Ltd which reduces the percentage shareholdings of the Department, Carlyle and the co-investment scheme. Source: National Audit Office analysis | |

_______________________________________________________________________________________

27 The equity value of QinetiQ Holdings Ltd was not directly linked to the price paid for QinetiQ Group.