The business was well prepared and able to demonstrate growth

3.1 From 2002 Carlyle worked with QinetiQ management to strengthen financial controls in the business. Over the period 2003-2006 a concerted effort was made to improve cash management within the company. The quality of profits28 rose from minus 34 per cent in 2003 to 155 per cent in 2006.29 Carlyle was also instrumental in strengthening the Board of QinetiQ through the addition of private sector executives, including Sir Denys Henderson who formerly chaired ICI, Astra Zeneca and the Rank Group.

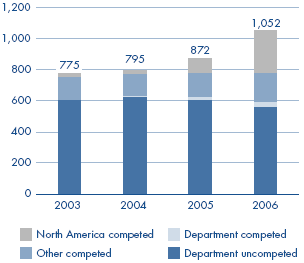

3.2 QinetiQ increased the level of revenue from outside the Department significantly from 2002. QinetiQ had been planning to move into the US defence market and had started identifying potential acquisition targets before the sale to Carlyle. It acquired eight businesses between March 2002 and October 2005, half of which were based in the US. These acquisitions were perceived successful by the market and the share of QinetiQ's revenue originating from the US increased by over 1440 per cent to £268.7 million between 2003 and 2006, as indicated in Figure 11. Over the same period the level of revenue from the UK increased by three per cent, so the overall growth in revenue was largely a result of the US acquisitions.

3.3 Despite this increased focus on revenue from other sources, QinetiQ kept the level of revenue from the Department broadly constant over the period 2002-2006. The Department was still by far the largest customer, accounting for some 57 per cent of QinetiQ's revenue in 2006. The majority of this business was awarded without competition.

11 | Growth in revenue has come largely fromUS aquisitions |

Revenue (£ million)

Source: The Parthenon Group report on the Formation and Privatisation of QinetiQ commissioned by the National Audit Office, July 2006 | |

_______________________________________________________________________________________

28 The quality of profits is the cash generated from operations divided by the profit before interest and tax and signifies how much of the profits have been generated in cash.

29 Figures are calculated from the 2003 and 2006 financial report and accounts. The 2006 figure has been computed under International Financial Reporting Standards (rather than UK GAAP) and therefore is not directly comparable.