The mechanisms for protecting defence interests appear to be working as intended

4.4 In seeking to develop its commercial business and use its expertise to influence the development of equipment, QinetiQ has had to manage the inherent conflicts of interest that arise from its role as the primary source of independent advice to the Department. The Department acted to prevent the most severe conflicts by its decision not to allow defence manufacturers to bid for a stake in the business. The Compliance Regime (paragraph 1.24) provides the framework by which the residual risk is managed through the creation of 'firewalls'. From June 2001 to June 2006 QinetiQ reported over 310 potential conflicts of interests, and the treatment of these is set out in Figure 15 on page 34.

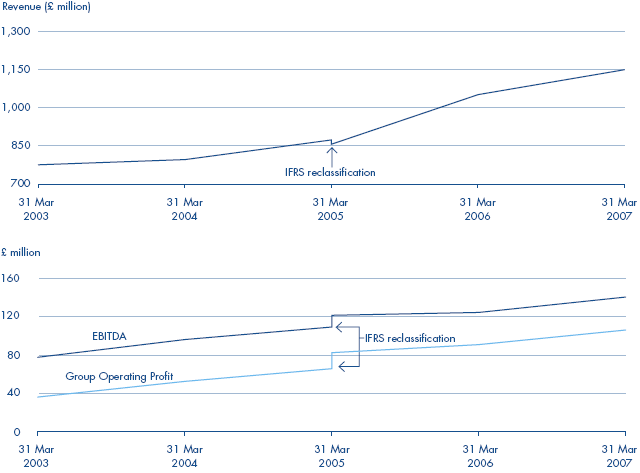

13 | QinetiQ has significantly improved its financial performance from 2003 to 2007 |

Source: QinetiQ Group Financial Accounts 2002-03 through 2006-07 and IPO prospectus | |

NOTE 1 QinetiQ was required for the first time to prepare the Group's 2005-06 annual financial statements on the basis of international financial reporting standards (IFRS). The financial information prepared in accordance with IFRS for FY 2005 is presented for comparative purposes only. | |

4.5 QinetiQ and the Department regard the Compliance Regime as a success, although there are a number of residual risks that must be managed adequately to ensure that all stakeholders' interests continue to be protected:

■ Although QinetiQ must agree all firewalls (paragraph 1.24) formally with the relevant Departmental project team, their operational integrity is not verified independently beyond the oversight provided by the Compliance Committee. The Department believes that it has high visibility of the operation of the regime and the firewalls through its frequent interaction with QinetiQ at company level. It also considers that its legal rights and the potential negative impact on the company's reputation serve as an adequate incentive on QinetiQ to avoid breaching the compliance requirements.

■ The removal of the constraints on QinetiQ's expansion into defence manufacturing after April 2008 may create logistical difficulties if it leads to an increasing number of firewalls that need to be managed. This could potentially impair the effectiveness of the firewalls.

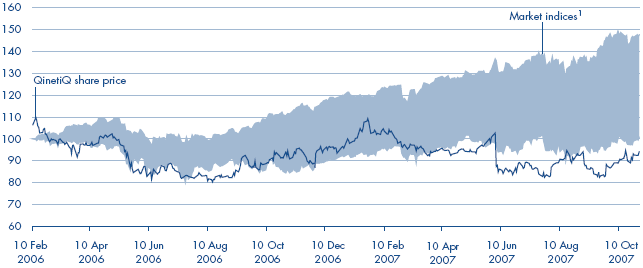

14 | The QinetiQ share price since the flotation |

Index to IPO date (10 February 2006)

Source: National Audit Office analysis | |

NOTE 1 Indices used are: SPADE, FTSE 250, FTSE Technology, FTSE Techmark and FTSE Techmark 100 | |

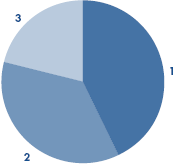

15 | Firewalls were implemented in 43 per cent of cases assessed under the Compliance Regime |

1 Constituted a real conflict of interest requiring a firewall to be established (43 per cent) 2 Did not constitute a conflict of interest in the eyes of the Department (36 per cent) 3 Request withdrawn by QinetiQ as they chose not to pursue the commercial activity (21 per cent) Source: National Audit Office analysis | |

4.6 The Department and QinetiQ decided in September 2006 that the Department's Internal Auditors should address these risks by auditing the Compliance Regime. The Department's aims are to review the effectiveness of the Compliance Regime process and its application.