Greater proceeds might have been achievable from sale to a strategic partner

4.10 After taking into account all the negotiated and agreed deductions, the sale to Carlyle gave an enterprise value for QinetiQ of £319 million. To achieve a fair value in a trade sale competition needs to be strong. The competition for the sale of a stake in QinetiQ left the Department with one credible bidder, Carlyle. When Carlyle were appointed preferred bidder two price sensitive commercial issues were still outstanding. The Department notes that it attempted to close down uncertainty for bidders by issuing 'heads of terms' for the Long Term Partnering Agreement (LTPA).

4.11 Carlyle attempted to negotiate a £50 million reduction in value in relation to the LTPA, which was eventually agreed at £30 million37 and the sale of an additional 2.5 per cent of equity. The Department received £3 million consideration for the additional equity.38 The Department has told us that it and its advisors believed the changes were necessary to allow the deal to proceed. We believe that the £30 million reduction in value was insufficiently justified (see Appendix 5). Carlyle also negotiated an immediate value reduction of £25 million39 and an indemnity capped at £45 million in relation to the pension fund deficit (see paragraph 2.29); this gave the Department the potential to benefit if the pension deficit recovered. If the deficit remained at the flotation, the pension indemnity was to be paid into the QinetiQ pension fund; the Department, as a shareholder, would therefore benefit proportionally from the increase in the value of the company. The Government Actuary's Department advised that an amount between nil and £70 million could have been justified. The present value of the total deduction was £59 million at the time of the sale to Carlyle.

16 | The Department received net proceeds of £576 million £ million | |||

|

|

|

| |

|

| £ million | ||

Direct Costs | Advisors | (28.0) |

| |

| Internal | (2.4) |

| |

Other Costs | Pension indemnity | (45.3)1 |

| |

|

|

| (76) | |

Income | Loan repayment:2 |

|

| |

| in 2002, prior to the |

|

| |

| sale to Carlyle | 57.8 |

| |

| at completion of the sale | 56.23 |

| |

| to Carlyle (see Figure 10) |

|

| |

| disposal of Chertsey property | 60.03 |

| |

| Sale of shares to Carlyle | 39.33 |

| |

| Preference share repayment | 82.44 |

| |

| Flotation | 355.95 |

| |

|

|

| 652 | |

Net Proceeds |

|

| 576 | |

Source: National Audit Office analysis | ||||

NOTES 1 The pension indemnity was agreed as part of the sale to Carlyle and was paid at flotation when QinetiQ's pension deficit failed to recover from the time of the sale to the flotation (see paragraph 2.29). 2 Represents the repayment of the £156 million loans, and associated interest (£18 million), established when QinetiQ was created (see paragraph 1.21) including the proceeds from the Chertsey disposal which were agreed to count towards the repayment of the loans. 3 Represents the proceeds of £155 million received at the sale to Carlyle (see Figure 9). 4 Represents the repayment of the Department's preference shares (see Figure 9, note 3) and interest at 9 per cent per annum. 5 Represents the proceeds from the sale of approximately 32 per cent of QinetiQ after an increase in the share capital following the issue of new shares by the company. The Department still retains a 19 per cent stake in the business. | ||||

4.12 The Department considers that its strategy to introduce a strategic partner maximised overall value and that seeking to achieve greater proceeds from the initial sale could have lowered eventual receipts. We recognise that the strategic partner model had benefits in improving the value of the business in advance of a flotation. We consider, however, that weak competition (see paragraph 2.10) and the negotiated reductions in value (see paragraph 2.26) suggest that greater proceeds might have been achievable from the sale to Carlyle. The Department and UBS Warburg disagree with this assertion. Various other indicators support our view:

17 | The Department incurred costs of £76 million (exc VAT) throughout the privatisation | ||

|

|

|

|

External consultants | Description of consultancy role | (£000) | |

Simmons & Simmons | Legal advisors throughout the privatisation | 10,747 | |

Consultancy services and accounting advice | 3,704 | ||

Arthur Andersen | Reporting accountants | 1,334 | |

UBS Warburg | Financial advice and managing the sale to the strategic partner | 2,520 | |

Rangefield | Accounting advice in the separation of DERA | 93 | |

Hogarth | Public relations advice throughout the privatisation | 87 | |

GAD | A Government Department and an actuarial consultancy operating on commercial lines giving independent professional advice within the public service | 273 | |

Willis | Insurance advisors providing specialist advice relating to division of liabilities between the Department and QinetiQ | 60 | |

DJB | Provision of specialist advice on property valuation real estate issues | 80 | |

Other | Specialist legal advice | 13 | |

Joint Global Coordinators | Coordinated the flotation | 8,770 | |

Merrill Lynch |

|

| |

Credit Suisse |

|

| |

JP Morgan Cazenove |

|

| |

ABN AMRO Rothschild | Independent advisors appointed to provide financial advice on the flotation | 335 | |

Total Consultants1 |

| 28,016 | |

Cost of Department's staff |

| 2,366 | |

Pension indemnity |

| 45,300 | |

Total |

| 75,682 | |

Source: National Audit Office analysis |

| ||

NOTE 1 Consultant costs exclude VAT. | |||

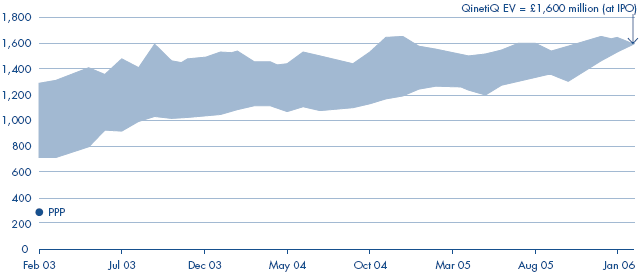

■ The value of QinetiQ in relation to market indices. Figure 18 shows the enterprise value of QinetiQ at flotation and the sale to Carlyle (PPP) with reference to several relevant market indices.40 The indices are all based to the value of QinetiQ at flotation in order to show the expected value at PPP if the value of QinetiQ had tracked the technology and defence market. Based on this, QinetiQ was either undervalued at PPP, has significantly out performed the market or a combination of the two. The Department does not accept that market indices have any relevance to an unlisted company as QinetiQ then was. It also considers that the absence of a commercial track record at the time of the PPP would have reduced the value of the business relative to comparable listed businesses.

■ The Parthenon Group analysis that valued QinetiQ, at the time of the sale, within the range £341-£513 million with a mid point of £427 million. The sale arrived at a enterprise value of £319 million. The Department considers that theoretical valuations are of limited relevance and that the price negotiated in the sale to Carlyle is the only true measure of QinetiQ's value at that time.

■ The fact that the net assets of QinetiQ were sold for £89 million less than their fair book value. Book value is not a good guide to market value but is often taken to be the minimum value of a business that is not a going concern. The Department does not accept this comparison and notes that some of QinetiQ's assets had book values that did not accurately reflect their market value.

18 | Value of QinetiQ at PPP and flotation with reference to several key indices1 |

Indexed to IPO Valuation (10 February 2006) (£ million)

Source: Parthenon report on the Formation and Privatisation of QinetiQ commissioned by the National Audit Office, July 2006 Indexed | |

NOTE 1 Indices used are: SPADE, S&P-AD, FTSE 250, S&P 500 system software, NASDAQ, DJUS tech, S&P tech hardware, S&P Aero & Defence, FTSE A&D, FTSE Techmark 100. | |

4.13 We have calculated the Department's notional internal rate of return41 from the creation of QinetiQ to 31 October 2007 and found it to be 14 per cent. This assumes that the significant investment the Department has made in DERA over the years is equal to the opening book value of the shares and loans in the business in July 2001, £502 million. It also takes into account the costs incurred by the Department throughout the process, including the substantial costs incurred in splitting DERA into two organisations, but does not attempt to quantify non financial benefits. The Department does not accept that the book value of QinetiQ at incorporation is a robust measure of the value of the business at that time and considers that it is not possible to derive an accurate estimate of the return it has achieved over the whole privatisation.

4.14 Carlyle achieved an internal rate of return of 112 per cent from their investment in QinetiQ. Over the same period the Department has made a similar return of 99 per cent. The Department's return ignores the receipts from the 2003 sale and includes the value of the Department's retained stake as at 8 February 2007, the date Carlyle sold their remaining shares. The Department's internal rate of return is less than Carlyle's because it incurred significant costs as a consequence of the PPP process.42

_______________________________________________________________________________________

37 Equivalent to an £11 million reduction in the value received by the taxpayer (see paragraph 2.25).

38 This amount of equity was worth £27 million at the flotation.

39 Equivalent to a £10 million reduction in the value received by the taxpayer (see paragraph 2.25).

40 Although the indices are based on the equity value of comparable companies we have compared this to the enterprise value (i.e. debt plus equity) due to the highly leveraged nature of the returns. Indices used are: SPADE, S&P AD, FTSE 250, S&P 500 system software, NASDAQ, DJUS tech software, DJUS tech, S&P tech hardware, S&P Aero & Defence, FTSE A&D, FTSE Techmark 100.

41 The internal rate of return is the discount rate at which the present value of all cash flows will be zero, it is used to rank investment opportunities, the higher the IRR the more profitable the investment. For our analysis we have included the value of the retained shares of the Department as at 31 October 2007.

42 It is not possible to calculate the Department's final internal rate of return until it has sold its remaining shareholding in the business.