SUMMARY

1 In July 2007, Metronet BCV and Metronet SSL, two companies set up to modernise London Underground's infrastructure, went into administration when they became unable to meet their spending obligations. Their failure resulted in London Underground Limited (London Underground) having to buy 95 per cent of Metronet's outstanding debt obligations from its private sector lenders in February 2008 rather than repaying this debt over the 30 years of the contract. The Department for Transport (DfT) made £1.7 billion of grant available to help London Underground do so.

2 The Government provided funding for the modernisation work on the basis that it would be carried out through Public Private Partnership (PPP) contracts. It accepted that stable funding was needed to remedy decades of underinvestment, but was concerned about London Underground's track record in delivering major enhancement and maintenance projects to time and budget. The Government, therefore, decided that London Underground should focus on operating passenger services, and that the private sector should be used to deliver maintenance and major infrastructure improvements.

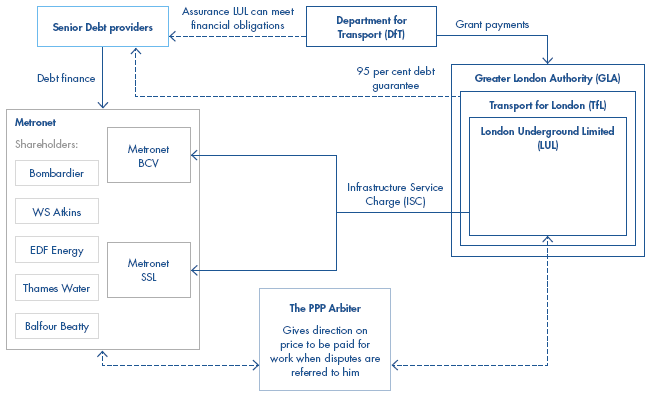

3 Metronet BCV and Metronet SSL were responsible for two-thirds of the modernisation work under their PPP contracts - Metronet BCV for the Bakerloo, Central, Victoria and Waterloo & City lines, and Metronet SSL for the District, Circle, Hammersmith and City, Metropolitan and East London lines. Both companies, collectively referred to in this report as Metronet, were ultimately owned by a consortium of Balfour Beatty plc, Bombardier Inc., WS Atkins plc, EDF SA (formerly Seeboard Group plc) and Thames Water plc (Figure 1). The other PPP contract was awarded to a company called Tube Lines.

4 The cost of work under Metronet's contracts was expected to be at least £6.9 billion over the first 7½ years of the contract in 2002 prices (£8.7 billion in cash terms). As the condition of some of London Underground's assets was unknown, Metronet could be paid for unforeseen extra work that was necessary. The PPP Arbiter was given the role of deciding, if asked, how far the public sector should be liable for extra costs which had been incurred economically and efficiently.

5 DfT, the Treasury and London Regional Transport (which owned London Underground until July 2003 when it was transferred to Transport for London (TfL)) had responsibility for the strategy and design of the PPP arrangements. London Underground negotiated and managed the contracts. DfT retained a crucial role after the PPP contracts were put in place. It gave assurances to Metronet's lenders that it would not stand by and do nothing should London Underground be unable to meet its financial obligations and provided an annual grant of around £1 billion for the modernisation.

6 In May 2008, after ten months in administration, Metronet BCV and SSL's assets and liabilities were transferred to two new wholly-owned subsidiaries of TfL. DfT and TfL saw this as an interim solution and set up a Joint Steering Committee which made recommendations to the Secretary of State and the Mayor of London on a long term solution in late December 2008. The Secretary of State and the Mayor are now preparing to take a joint decision.

1 | Roles of key players |

Source: National Audit Office | |

NOTE Simplified representation of stakeholder relationships. | |

7 The NAO has published three previous reports on the London Underground PPP arrangements: a report in 2000 on the financial analysis undertaken before the award of the contracts; and two reports in 2004 on the prices paid and the potential to deliver improvements for passengers. Key conclusions from our 2004 reports were that: there was only limited assurance that the price paid was reasonable, because of the complexity of the arrangements, and uncertainty over the eventual price; and the arrangements offered an improved prospect of delivering upgrades to the network compared to the pre-1997 investment regime.

8 This report focuses on DfT's risk management. It examines:

i the establishment and record of the Metronet businesses, highlighting key factors that contributed to their failure;

ii DfT's approach to risk management; and

iii the direct costs and consequences to the taxpayer of Metronet going into administration and progress towards a permanent solution. debt obligations, a sum that would otherwise have been repaid over the 30 year life time of the contracts.