The project had multiple aims. For Social Security, the project was intended to deliver savings in benefit fraud and running costs, modernise the delivery of benefits and improve accounting

1.3 The two purchasers' objectives for the project are summarised in Figure 4. Broadly, the Department of Social Security required a more efficient and secure method of paying benefits, and Post Office Counters Ltd wanted a technology platform that would provide basic automation for its existing (largely clerically handled) business and help it to develop new business.

Figure 4 |

|

| |

| Overall objectives of the BA/POCL project |

| |

Objective |

| Department of Social Security | Post Office Counters Ltd |

To provide a virtually fraud-free method of paying benefits at post offices that is automated, has lower end-to-end costs than the current paper-based process, with continuously reducing overall administration costs year on year; | • |

| |

To automate Post Office Counters Ltd 's other client transactions, its products and its support processes to improve competitiveness, increase efficiency, and to enable greater commercial opportunities for the business; |

| • | |

To enable full and speedy reconciliation of benefits payments, with accounting arrangements consistent with recognised accountancy practices; | • |

| |

To provide an improved service to the parties' customers. | • | • | |

Source: Project Statement of Service Requirement 1996 |

|

| |

1.4 The Department of Social Security are responsible for administering the social security system, paying the benefits laid down in legislation to those who are entitled to them. Spending accounts for some £90 billion, nearly one third of all government expenditure, and most of this flows to benefits claimants through the Benefits Agency, the largest of the Department's agencies, Figure 5. The Agency is tasked to:

■ deliver active, customer focused services;

■ provide secure and accurate services;

■ effectively manage money; and

■ use quality, efficient organisational processes.

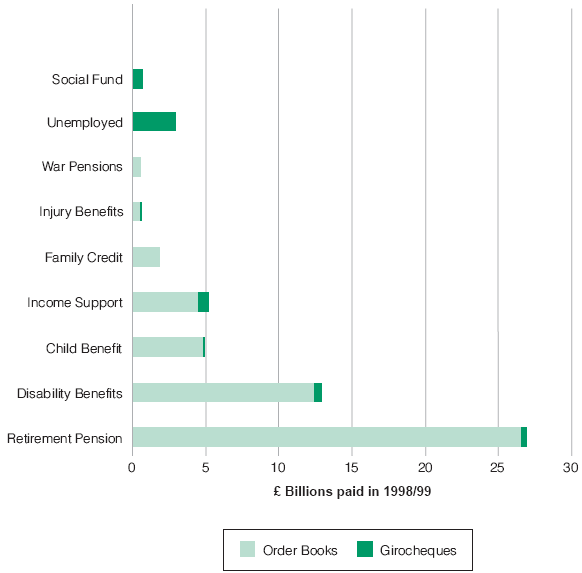

Social Security benefits paid through post offices in 1998/99 |

|

|

Figure 5 |

| |

|

| |

|

| |

Source: National Audit Office |

| |

1.5 Most of the Department's customers still receive their benefit by order books or girocheques which they cash weekly at post offices. The process is expensive to administer and prone to fraud. In 1997-98, the Department paid over £400 million to Post Office Counters Ltd and Girobank for services related to cashing benefits. In addition, they spent a further £125 million themselves administering their existing payment arrangements. Because currently the encashed order books are not all reconciled to claimants' details the Department are unable to verify that all have been cashed, as required by basic financial accounting standards, though they can identify individual encashments.

1.6 The misuse of order books and girocheques is now estimated to cause over £100 million of fraud each year, as shown in Figure 6. The Comptroller and Auditor General has qualified his opinion on the accounts of the Department of Social Security in successive years, in part because of the level of fraudulent encashment of orderbooks and girocheques. In January 2000 the Committee of Public Accounts expressed concern at rising losses from the fraudulent encashment of order books and girocheques and looked to the Agency to tackle it with vigour. 2

|

| |||||||

Figure 6 | A comparison of the methods of benefit payment used by the Department of Social Security | |||||||

Transfers into claimants' bank accounts are by far the cheapest form of benefit payment for the Department. Since this method of payment was introduced in 1983 its use has increased so that today approaching a third of total benefit expenditure is paid this way. | ||||||||

Method of benefit payment | Average Direct cost (pence per transaction) | Share of Benefits payments in 1998/99 | Estimated fraud in 1998 £ million, and fraud rate4 | |||||

|

| £ billion, | per cent |

| ||||

OrderBook | 49 |

| 51 |

| 63 |

| 85 1.7% | |

Girocheques and payable orders | 79 |

| 6 |

| 8 |

| 22 3.7% | |

Bank Transfers1, 2 | 1 |

| 24 |

| 29 |

| None identified | |

Payment Cards3 | 67 |

| 0.03 |

| 0 |

| None identified | |

Total |

|

| 81 |

| 100 |

| 107 | |

Notes: 1. The proportion of new claimants choosing payment by bank transfer ranges from 10% for Income Support recipients to 47% for retirement pensions and 54% for Child Benefit. Some 16 million customers use order books or girocheques and 8 million are paid by bank transfer. There is a continuing trend towards greater use of bank transfers, adding about half a million customers to the total each year. Transaction costs are rounded to the nearest penny. 2 Transfers into claimants' bank accounts are cheaper to the Department, in part because they transfer the cost of providing cash to the banking system already available to 85 per cent of benefit recipients. This cost varies according to the method through which cash is dispensed, and the circumstances of the account owner. The cost of a bank transfer shown here is the direct cost to the Department, and excludes any costs to banks, and costs of extending the Agency's systems. 3 At the time it was cancelled, the payment card had been used to pay some £30 million of child benefit, to 37,000 customers in 205 out of over 18,000 post offices. The use of the card has since been stopped. 4 Fraud figures are for misuse of instruments of payment only, and exclude other types of benefit fraud. The figures cited here reflect reductions in fraud achieved by an Electronic Stop Notice System in the Greater London area since the mid-1990s, (Paragraph 1.7). Source: National Audit Office collation of Department of Social Security data. | ||||||||

1.7 In the early 1990s the Department considered alternative ways of paying benefits. The mandatory use of automated credit transfers for all benefit recipients offered the greatest potential cost savings for the Department. However, Ministers felt at that time that compulsory extension of bank transfers on its own would have limited recipients' choice of delivery location and put at risk the national network of sub-post offices and so this had been rejected by Ministers collectively in 1983 and again in 1992 to 1994. Some options for drawing cash, such as through cash-back from retail outlets, did not exist at that time. The Department also considered extending an anti-fraud computer system (the Electronic Stop Notice System) that was used by post offices within the M25 area to check bar-coded order books. This system reduces the incidence of instrument of payment fraud but marginally increases administration costs because it adds to, but does not replace, the existing paper systems.

1.8 When the contract with Pathway was signed in May 1996, the Department of Social Security's business case concluded that the programme as timetabled represented a good return on investment to public funds, mainly by reducing fraud and running costs. The main costs and benefits to them, excluding those to Post Office Counters Ltd, are shown in Figure 7.

The intended main costs and benefits of the payment card project to the Department of Social Security when the deal was signed | Figure 7 |

|

|

|

|

|

|

|

|

| |

Cost/Benefit |

| £ million1 |

| ||

Payment Service Costs |

| 1480 |

| ||

| Less: Administrative Savings |

| 1179 | ||

|

| Less: Fraud Savings |

| 1330 | |

| NET SAVING |

| 1029 |

| |

| Net Saving (Discounted at 6%) |

| 609 |

| |

Source: Department of Social Security | Note: 1. This was the estimated value of the Payment Card solution compared to continuing with the existing order book system over the life of the contract to 2005. | ||||

___________________________________________________________________

2 Third Report, Session 1999-2000: Appropriation Accounts 1997-98 Class XII, Vote 1 (Central Government Administered Social Security Benefits and Other Payments)