SUMMARY

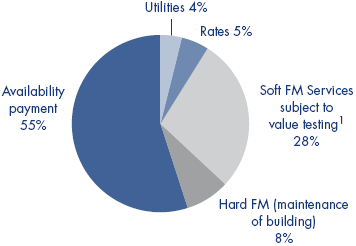

1 Around 500 Private Finance Initiative (PFI) projects out of the 6001 that have been let, are now in the operational phase. At least half of these projects have provisions in their contracts that require the value of certain services, such as catering and cleaning, to be tested at intervals, typically every five to seven years. The services that are subject to this value testing are often a significant part of the total cost of a PFI contract (Figure 1) and so the process of value testing is an important aspect in seeking to achieve value for money from a PFI contract which may run for 25 or 30 years or more. Value testing may involve comparing information about the current service provider's provision with comparable sources [benchmarking] or alternatively, inviting other suppliers to compete with the incumbent in an open competition [market testing].

2 We examined the contractual provisions for value testing within a sample of 34 PFI contracts in order to assess their expected effectiveness. We also examined the early experience of the 11 PFI projects in England that had carried out value testing at the time of our study in summer 2006. We found that in some of these initial cases the value testing had demonstrated that value for money was being achieved, but in other cases the outcome was Uncertain. Our methodology is set out in Appendix 1.

3 Although the projects examined were all those that had used value testing up to summer 2006, the number of projects is only around two per cent of all PFI projects in operation. In addition, there have, over time, been improvements in contract terms for value testing since some of the contracts we examined and there is now detailed Treasury guidance to supplement the previous guidance about value testing in the Treasury's Standardisation of PFI Contracts (SoPC). For these reasons the results of our examination of the early examples of value testing are not necessarily indicative of how the arrangements will work in future in other PFI projects. Nevertheless, we considered it important to examine these initial examples to highlight lessons drawn from the first practical experiences of applying value testing. These lessons will help the many projects that will be using benchmarking or market testing in the coming years.

1 | Example of the proportion of the total annual costs of a PFI contract which are subject to value testing |

Darent Valley Hospital Budgeted Unitary Charge 2004-05 Annual PFI Cost (£19 million p.a.) | |

| |

Source: Darent Valley Hospital and National Audit Office | |

NOTE | |

1 The value testing relates to the facilities management services such as catering, cleaning and portering ("soft FM services") which have been subject to benchmarking. These services are 28 per cent of the total annual cost of the PFI contract. | |

4 The Treasury issued new guidance in October 20062 which took account of our initial findings and additional research conducted by Partnerships UK (PUK) on behalf of the Treasury. Current best practice as set out in Treasury guidance addresses issues described in our study and gives the prospect of improved value for money in the future. Our other main findings were:

The mechanics for carrying out value testing in the early PFI contracts

i) The early PFI contracts, let before the start of contract standardisation in 1999, contain a range of provisions for benchmarking or market testing. Lawyers, Nabarro, examined on our behalf a sample of 34 contracts and found that the value testing terms were often expected to have limited effectiveness, although these have yet to be tested in practice. Some of these contracts, where value testing would be appropriate, have no contractual provisions. Where contract clauses are absent, or are expected to have limited effectiveness, it may nevertheless be possible for the parties to carry out effective and value for money value testing if they develop suitable processes.

ii) Projects will now benefit from the Treasury's 2006 guidance which is more detailed than that available in previous versions of Standardisation of PFI Contracts. We agree with the Government's view expressed in the new guidance that, because of the potential benefits of competition, transparency, and flexibility for re-assessing the service provision, market testing, if it can be applied successfully, is generally the mechanism most likely to give a better outcome on value for money grounds.

iii) Although only three market tests had been completed at the time of our study, which does not allow wide-ranging conclusions to be drawn about this process, these first three market tests were competitive processes and produced beneficial outcomes. Although not necessarily indicative of future experiences, one was won by an in-house bid and the other two by the incumbent supplier. External suppliers bid but were not successful in these competitions. To maintain the competitive benefits of market testing, suppliers must continue to be interested in bidding against incumbent suppliers. The Treasury is seeking to facilitate a market in benchmarking and market testing through publishing details of ongoing services that will be put out to competition. The Treasury intends to make this available on PUK's website.

The application of the processes

iv) In projects where ineffectual or vague contract clauses were identified, authorities and their private sector counterparts have had to work together in order to produce an effective project plan to manage the process.

v) Value testing can be a lengthy process. We found that where projects had completed the process it had taken nine to 25 months; similar to the time taken to re-let service contracts in conventional procurement. But one project examined had yet to complete the process, having taken, up to March 2007, 37 months. Agreeing how the process will be conducted can be time consuming and there have often been detailed negotiations before a final price adjustment has been agreed. In particular, projects have experienced difficulties in finding suitable benchmark data with which to compare the services. The Treasury is liaising with departments to draw up a central database of benchmarking and market testing information.

vi) By allowing prices to be renegotiated in line with market rates these processes enable the public sector to benefit if market prices fall and they also limit the Uncertainty faced by the private sector by giving them an opportunity to obtain a price rise when costs increase.

vii) The two telecommunication projects which had completed value testing had achieved value for money through price reductions of 19 per cent and 37 per cent after using benchmarking to take account of falling prices in the very competitive communications sector.

2 | Price adjustments arising from value testing the seven PFI building projects1 | ||||||||

|

|

|

|

|

|

|

|

|

|

| Final price change after negotiations | Price change arising from the initial outcome of the value test proposed to the authority | |||||||

| In the range -2 to +6% | In the range -1 to +19% | |||||||

| (with the exception of Debden Park High School which was 14%) | (with the exception of Debden Park High School which was 26%) | |||||||

| The price change for each project also took account of any reductions to service requirements which the authorities had requested as part of the final negotiations. | To arrive at a like-for-like comparison, the price change for each project was based on the services subject to value testing which the authority had been procuring immediately prior to the value testing but before any changes to service requirements made at the time of the value testing. | |||||||

| Source: National Audit Office |

| |||||||

| NOTES |

| |||||||

| 1 The price changes shown above exclude the effect of further salary increases which NHS Trusts in five of the seven projects will be obliged to take on arising from the NHS Agenda for Change2. Other than the NHS Trust at Queen Elizabeth Hospital, Greenwich, where the impact on the final price adjustment was to increase it from +6 per cent to +37 per cent, the impact of the Agenda for Change salary increases was still being discussed by the other four NHS Trusts at the time of our study. | ||||||||

| 2 Agenda for Change is the new NHS grading and pay system for NHS staff other than doctors, dentists and some managers which became effective in September 2005. Staff working for PFI contractors are affected by this either because, in some cases, the staff remain NHS employees or because they are private sector employees covered by similar salary arrangements as a result of the Joint Statement on Workforce Matters published in October 2005 by the Department of Health, NHS Employers, the CBI, the Business Services Association and Trade Unions. It would also affect in-house services. | ||||||||

viii) In the seven building projects we examined, five of which were hospitals, where value testing had been completed the final price adjustments were mainly -2 to +6 per cent (Figure 2) although in one school project the final price increase was 14 per cent. The authorities had been involved in negotiations to arrive at these price changes after the value tests initially suggested that, in most cases, upward price changes would be required, with the changes mainly in the range -1 to +19 per cent (Figure 2).

ix) These price changes were separate from the contractual arrangements allowing the private sector an annual price increase for general inflation. The price changes initially proposed reflect various market factors, including salary costs that had risen more than had been expected since contract letting and that some initial contracts may have been priced competitively at below normal market rates. These projects were the first PFI building projects to use value testing processes and the price changes reflect cost changes in the market for facilities management services up to 2006. The resulting price changes are not, therefore, indicative of the price changes that may arise in future uses of value testing in PFI building projects.

x) The negotiations, initiated by the authorities, were a significant factor in arriving at the final price changes. As part of the negotiations, in three of the seven projects, the authorities made minor reductions to their service specification in order to keep the price affordable.

These authorities considered that the service levels were previously over-specified and do not expect the reductions in specifications to compromise the service delivered to the public although it is too early to judge the outcome conclusively.

xi) The price changes which have arisen from these value testing exercises should not be viewed in isolation but are part of the overall cost of procuring facilities services to the standards specified in the PFI contracts over an extended period. The Treasury requires project teams to make a value for money decision on whether to include or exclude these services from the contract before embarking on a PFI procurement. We are not, however, aware of any systematic overall comparison to date between the cost and quality experiences of facilities services procured under the PFI with conventional outsourcing. There are difficulties in making these comparisons as the conventional examples may not be comparable to the PFI deals in terms of the required services or standard of performance. There is also limited experience to date of the price changes arising from using the value testing arrangements in PFI contracts.

xii) We considered the value for money of the completed value tests by reference to the resulting changes to the price and service specification, and the effectiveness of the value testing (Figure 3).

3 | National Audit Office assessment of the value for money of the nine completed value tests1 | |||||||||||

|

|

|

|

|

|

|

|

|

| |||

| Type of Project | number of Projects | Value for money has been achieved | The value for money outcome is Uncertain2 | ||||||||

| Telecommunications | 2 | 2 | – | ||||||||

| Buildings | 7 | 3 | 4 | ||||||||

| Total | 9 | 5 | 4 | ||||||||

| Source: National Audit Office | |||||||||||

NOTES | ||||||||||||

1 The outcomes of two projects of the 11 projects examined by the NAO were Uncertain at the time of our examination as one had not completed their price adjustment negotiations following value testing and one had not yet quantified the outcome from value testing. Further information on the NAO assessments of the 11 projects examined is set out in Figure 15 and Figure 16. | ||||||||||||

2 Uncertainty was due to various factors including whether the best price had been secured where there had been price increases, weaknesses in the comparator data and authorities identifying that they would make changes to their value testing processes in future to achieve better outcomes. | ||||||||||||

Lessons learned as a result of the early applications of benchmarking and market testing

xiii) The projects that have completed benchmarking and market testing have learned important lessons such as: the need for realistic timescales, the benefit of the early engagement of the private sector, the need for an effectively designed project plan, access to good comparable benchmarking information and the effective role that advisors can play in the process. These lessons have been incorporated into the Treasury's 2007 Standardisation of PFI Contracts version 4 (SoPC4) and Operational Taskforce Note 1, Benchmarking and Market Testing guidance.

__________________________________________________________________________________________________

1 As of April 2007 the list of PFI projects published by HM Treasury has been updated and reduced from over 750 signed PFI deals to 600. This reflects the large data validation exercise HM Treasury has carried out as: some projects had concluded or been terminated; some projects had changed their contractual structures that meant they were no longer classed as PFI; some projects had been contractually merged; and departments have stopped collecting data on some very small projects in order to reduce reporting burdens.

2 Operational Taskforce Note 1: Benchmarking and market testing guidance, HM Treasury, October 2006.