The Treasury considers that there are advantages from market testing but benchmarking may be appropriate in certain cases

3.7 The ability of market testing to deliver its potential benefits depends on effective competition between alternative suppliers. Research by Arup has identified that there is a sufficient population of providers to form a competitive market for soft FM services and that despite consolidation, there are at least 20 substantial FM contractors. In addition, there are also sufficient small to medium sized enterprises offering a breadth of services at the local level. As set out in para 2.11, the success of market testing depends on there continuing to be strong competition when this process is used.

3.8 Based on our review of projects which have undertaken benchmarking or market testing, the arguments for and against each approach are presented in Figure 19.

3.9 Up until 2006, the Treasury had favoured benchmarking as the preferred price review mechanism because of the potential disruptions and practical difficulties which market testing may cause. The Treasury's new guidance considers that market testing is likely to yield better value for money than benchmarking based on a view that market testing offers a more flexible approach to the provision of services, emphasises the importance of transparency and competition, and can now benefit from the maturity of the soft services market.

3.10 There are advantages to an authority in having both a benchmarking and market test option in the contract since it can then choose the best process for their particular circumstances. Benchmarking is an alternative to market testing if there is not the prospect of strong competition between suppliers. It can also be completed to a quicker timescale (Figure 13) and be cheaper than a market test (Figure 19). In those situations where an authority chooses, on expected value for money grounds, to start with a benchmarking exercise the incumbent supplier may be more likely to engage positively where there is the fallback of being asked to compete in a market test.

19 | The advantages and disadvantages of benchmarking compared with market testings | ||||||||||

|

|

|

|

|

|

|

|

|

| ||

|

| ||||||||||

| Advantages | Cheaper and quicker to implement. | Competitive process. | ||||||||

|

| Maintains the spirit of partnering through negotiation with the incumbent. | More transparent process. | ||||||||

|

| Stability in provider is a catalyst for process improvement. | Flexibility for reassessing the service provision and also performance measurement system since they can be drawn up anew without recourse to variation discussions. | ||||||||

|

| Avoids potential problems with the handover to a new service provider. | Can mean the start of new relationships and new ideas if someone other than the incumbent wins. | ||||||||

|

| Avoids further TUPE transfers. | May reduce the cost if a new service provider has a cost effective innovation to offer. | ||||||||

| Disadvantages | Comparable data may not be available or be expensive to access. | Lengthy preparatory time and usually a more costly process. | ||||||||

|

| Expectations gap between the authority and the private sector over the cost of services may make agreement on the outcome difficult to achieve. | The incumbent may be in a powerful position to win the market test and so the process may not be as competitive as initially thought. | ||||||||

|

| Difficulties in finding suitable benchmarking data make it less credible as a transparent and accountable process and therefore harder to justify the value for money outcome. | Lines of communication can become complicated when the replaced incumbent had provided both hard and soft FM. | ||||||||

|

| Audit trail not always clear. Private sector may limit benchmarking information due to commercial confidentiality. | Requires a sufficient number of alternative suppliers to make it a competitive market. | ||||||||

|

| Potential for disagreement/dispute to drag on. | Tendered price may be non-negotiable. | ||||||||

|

| Can strain current relationships. | Process improvement opportunities can be lost. | ||||||||

|

| No opportunity to replace an unsatisfactory incumbent. | There is Uncertainty for the incumbent's staff and possibly TUPE issues. | ||||||||

| Source: National Audit Office, ARUP and Norfolk and Norwich University Hospital | ||||||||||

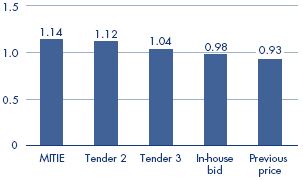

3.11 There is an option as part of a market test to consider taking the soft FM service in-house, which means removing it from the PFI contract and having implications for the risks being borne by the authority. Sussex Partnership NHS Trust decided on this option having been through a market test in which four competitive tenders were received - the incumbent's being the highest priced (Figure 20). The Authority at Queen Elizabeth Hospital, Greenwich found that the Special Purpose Vehicle (SPV) was less keen to consider an in-house bid. The SPV perceived added risks such as the liability of the Trust to any damage that may arise to the building from authority staff such as cleaners and catering staff, and doubts regarding how the performance measurement system would work to incentivise an in-house supplier of services.

20 | Sussex Partnership NHS Trust Market Testing Results |

Six FM Contractors including the incumbent (Tender 1: MITIE) were approached to tender for the Sussex Partnership NHS Trust. Two tenders subsequently withdrew. | |

The in-house bid was £156,000 less than the MITIE bid and £61,000 less than the cheapest alternative (Tender 3). Submission Value (£m p.a.)

| |

Source: Sussex Partnership NHS Trust | |

3.12 In our discussions with the Sussex Partnership NHS Trust, they were strongly of the opinion that taking the services in-house was the best alternative given affordability issues. The main contractor, Dalkia, was looking to increase the price since it was paying more to the subcontractor (MITIE) than they were receiving for the services through the PFI contract price. There had also been some service performance issues at the hospital sites. The in-house option offered the lowest price (Figure 20) which was only a slight increase over the existing price. However, the Authority had undertaken little analysis on the impact of transferring risk back in-house such as redundancy liabilities, staff retention, training issues and future wage inflation. In our opinion it was Uncertain whether the chosen option provided the best value for money outcome.