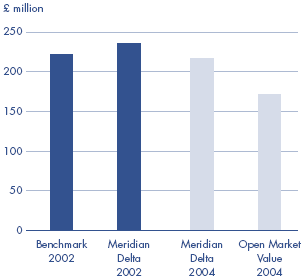

The estimated value of the deal has changed since it was signed

3.25 Since May 2002 the estimated net present value of the deal's returns to English Partnerships has reduced by £19.1 million (8 per cent) for the following reasons:

■ A £10.8 million contribution towards the cost of an increase in the amount of affordable housing incorporated in the deal during the planning process;

■ By £3.4 million due to changes in estimated market property values, and therefore the Government's share in future profits; and

■ The remaining £4.9 million is accounted for by factors such as the changes in the phasing of the development.

These changes, which result from normal planning discussions and market fluctuations, will also have affected the value of any benchmark comparators to a greater or lesser extent.

|

18 |

Comparison between the Meridian Delta scheme and the benchmark |

|

On a like for like basis the Meridian Delta scheme has higher returns to English Partnerships than the benchmark.

Source: Jones Lang LaSalle |

|

|

NOTES 1 All benchmarks show the net present values of cash flows to English Partnerships. Future values are discounted at 6 per cent real in line with then-extant Treasury guidance.13 2 The Open Market Value at April 2004 is the estimated current value of the land English Partnerships is contributing to the Meridian Delta Limited scheme. 3 The Benchmark represents the option English Partnerships had in 2002 to undertake a phased programme of site sales over 15-20 years. In 2004 it was sensible to ensure that the scheme returns still exceeded the open market value of the land. |

|

3.26 A key part of the planning permission is the Section 10614 Agreement. In the case of the Peninsula development, the conditions are extensive, ranging from improved transport and local employment policies, to contributions to schools, healthcare facilities and amenity spaces. The total cost of Section 106 Agreement contributions, to the parties, over the life of the scheme is a minimum of £86.9 million.15 In addition, an important component of this Section 106 Agreement relates to social housing, where 38 per cent of dwellings are to be constructed as Affordable Housing units, together with Intermediate Housing that must be sold at discounted prices. English Partnerships also have certain covenant obligations in connection with the Section 106 Agreement, largely if MDL is in default. Under certain circumstances16 English Partnerships' exposure is covered by indemnities provided by Bovis Lend Lease Holdings and Quintain Estates under a Collateral Agreement and Guarantee. Berwin Leighton Paisner, English Partnerships' adviser, examined the Section 106 Agreement and found that the level of indemnity17 provided exceeds English Partnerships' likely exposure during the development.

__________________________________________________________________________________

13 The current edition of the Green Book, Appraisal and Evaluation in Central Government came into effect in full on 1 April 2003. It introduced a revised discount rate. Project appraisals, such as this project, that had reached the Invitation to Tender (ITT), or Invitation to Negotiate (ITN), stages by 1 April 2003 are allowed to continue using the original rate.

14 Section 106 of The Town and Country Planning Act 1990. Section 106 Agreements prescribe improvements to the area's social and physical infrastructure that must be carried out as part of the wider development.

15 A further £12.2 million of highway related improvements is covered by a Section 278 Agreement which operates in a similar manner to Section 106.

16 Where these covenants are not Grampians (a type of negative covenant) or Bonded in respect of transportation improvements.

17 The guarantee under the Covenant Guarantee is £20 million per each 5-year period.