Passenger satisfaction ratings

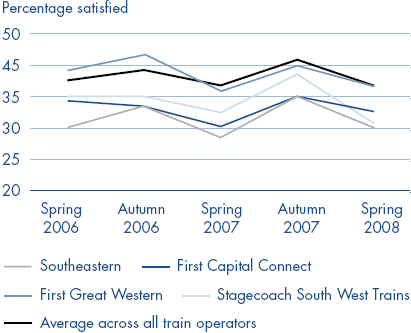

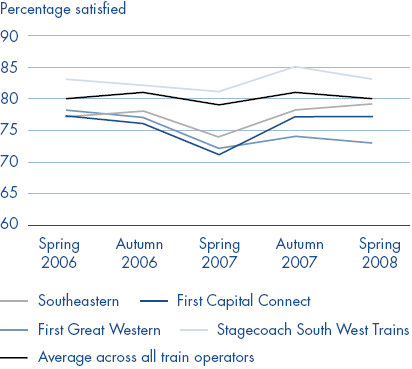

3.13 The National Passenger Survey is based on a sample of between 25,000 and 30,000 self completed questionnaires. Scores tend to fall in the spring because of train performance problems in winter and following annual price rises. Taking this into account, Figures 14 and 15 show trends on recently let franchises that are already in service, albeit at an early stage in the franchise lifetime. All four, like other London and South East commuter franchises, historically score below the national average on ticket value for money. Three of the four score below the national average for overall journey experience, with only Stagecoach South West Trains exceeding the national average on this score.

13 | Table of fares rises by TOc in January 2008 | ||

Train Company | Average Regulated Fares Rise (year on year) (per cent) | Average Unregulated Fares Rise (January) (per cent) | |

Crosscountry1 | 4.8 | 7.0 | |

East Midlands Trains | 4.8 | 7.0 | |

First capital connect | 4.8 | 4.8 | |

First Great Western | 4.8 | 6.1 | |

GNER (for NX East coast) | 4.8 | 6.6 | |

London Midland2 | 4.8 | 4.8 | |

Southeastern | 6.8 | 4.8 | |

Stagecoach | 4.8 | 4.3 | |

|

| ||

Source: ATOC |

|

| |

NOTES 1 CrossCountry: No increase in Advance Purchase fares. 2 London Midland: Some cheap day returns increase by 3.8 per cent. 3 Until 2003 regulated fares increased yearly at the rate of one percentage point below RPI. The July 2007 RPI figure was 3.8 per cent and the January increase is based on the previous July's RPI value plus one per cent. 4 Details of which fares constitute regulated fares are contained in the Glossary. 5 Overall percentage of revenues from regulated fares are shown as reported by the Association of Train Operating companies in January 2008. | |||

3.14 In Spring 2008, First Great Western (FGW), at 73 per cent, was furthest below the national average of 80 per cent for overall journey satisfaction. Passengers on some FGW routes had not received the expected level of service and the case shows both the extent of problems experienced by passengers and the corrective action taken by the Department and the train operator. (See case example at Figure 16.)

14 | National Passenger Survey trend in ticket value |

Ticket Value for Money | |

| |

Source: Passenger Focus | |

15 | National Passenger Survey trend journey satisfaction |

Overall journey

| |

Source: Passenger Focus | |

16 | case Example – First Great Western | |||||||||||

|

|

|

|

|

|

|

|

|

| |||

The FGW long distance franchise was awarded to FirstGroup plc in December 2005 and is due to run for ten years from April 2006. Why problems arose FirstGroup, then the incumbent operator for the Great Western part of the merged franchise, put in an aggressive and innovative bid. This involved trying to undertake three major changes: timetable change; rolling stock changes; and moving the train service depot from cardiff to Bristol - accepting the risk that a new depot would not be open in time. Timetable and rolling stock change The new franchise planned changes in the train timetables in December 2006, with 28 rolling stock vehicles being given up early in the period to December 2007 although introducing refurbished high speed rolling stock with additional seats increased fleet capacity by six per cent overall. Passenger Focus warned the Department in Spring 2006 that the December 2006 timetable would lead to "an inability to meet existing demand". The capacity proposals had been accepted by the SRA, and then by the Department, as being sufficient to meet the required level of service. ■ there is increased peak capacity for London - Reading services (see Appendix 5) ■ there were reductions in little used Wessex Trains services (some were reinstated). |

| Depot change The new franchise was based around moving maintenance of the Diesel Multiple unit (DMu) fleet from cardiff to Bristol, to secure financial savings and improve reliability. Delivery of the new depot was scheduled before the December 2006 timetable change, but ran late and the depot constructor went into receivership. There was a build up of rolling stock awaiting repair and in early 2007 FGW's operational fleet was too stretched to meet demand. corrective action and lessons learned The DMu depot change was a risk allocated to and assumed by FGW, which they now recognise they could have managed better with contingency planning. When the resulting problems materialised, FGW voluntarily provided additional services (June 2006) and entered into a 40 point recovery plan (March 2007), including hiring and deploying extra rolling stock units, and bore the increased depot building and constructor costs. They also worked with the Department to improve on the December 2006 timetable. Overall, FirstGroup's changes to the franchise agreement contributed a net present value of £23 million, some of which may be recovered from revenue growth. A lesson for the Department is to increase the rigour in the assessment of the deliverability of major franchise changes. Prospects for service recovery Although revenue held up, punctuality performance by Wessex Trains declined and, in respect of train cancellations, FGW has been in breach of its franchise commitments (notice issued on 26 February 2008) and now has to comply with a Remedial Plan which increases standby arrangements such as holding trains in reserve. This should improve reliability, although Passenger Focus expects capacity may come under renewed pressure after three to five years depending on passenger growth rates. FGW also agreed to provide supplementary carriages, accelerated train refurbishment and improved fare offers as a package of passenger benefits. | ||||||||||