Introduction

1 Economic and social infrastructure forms the backbone of economic activity in the United Kingdom, and enables the delivery of public services across the country. The term infrastructure encompasses social and economic sectors such as communications, education, energy, health, transport, waste and water.

2 In the five years to April 2010 approximately £30 billion per year was invested in UK infrastructure. Future investment is forecast in the range of £40-50 billion per annum until 2030. Investment is financed in a range of ways:

• Finance can be provided by private companies, but with some form of explicit public regulation or implicit public support. Examples include the water and energy sectors, which are largely privately owned and financed.

• Finance can be provided by public resources only, or for large one-off projects such as the Olympics, with a mixture of public and private resources.

• Finance can also be provided under the Private Finance Initiative (PFI) or other forms of Public Private Partnership (PPP). Sectors of economic and social infrastructure provided in this way include, for example, new hospitals and some roads.

3 PFI projects are long-term contractual arrangements between public authorities and private sector companies with project financing raised by private companies. Project finance means that the financing is provided for a sole project, through a special company set up for the purpose. Departments generally conclude that the contract offers value for money when the benefits associated with the transfer of project risk outweigh any additional PFI financing cost.

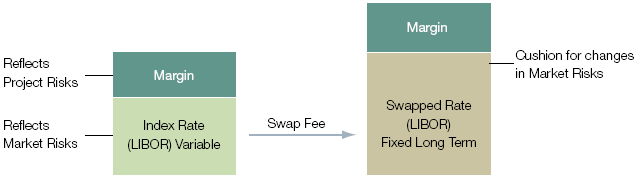

4 PFI projects typically use around 90 per cent debt finance and 10 per cent equity finance. The debt portion of this financing can be provided by bank loans and/or bonds. The banks and bond holders receive interest on their loans related to risks. Interest charged on a bank loan is usually a combination of two parts, the reference rate (usually the interbank rate) and the loan margin (Figure 1). The interbank rate refects general market risks, while the loan margin refects project specific risks. Variable rate bank loans are swapped to fixed rates to provide stable monthly payments over the project life.

Figure 1 This shows how a variable rate loan is converted to a fixed rate and the composition of loan interest costs

NOTES 1 LIBOR means the London Inter Bank Offered Rate (see Glossary) which is similar to base rate, but usually higher to reflect risk of bank failure. 2 A swap fee is payable to convert a variable rate loan to a fixed rate loan. Short-term rates can often exceed long-term rates during the life of a project. Source: National Audit Office |

5 Bond finance is where a loan is split up into many identical bonds which saving institutions can trade in public markets known as capital markets. Credit Rating Agencies analyse individual project and finance structure risks and publish a rating as a guide to investors. Before the credit crisis, the purchase of credit insurance could improve the rating of the bond, thus making the risks acceptable to non-specialised lenders such as pension funds.

6 In late 2007, market confidence in the providers of this credit insurance collapsed, leaving PFI projects in the United Kingdom without access to capital markets.

7 The bank loan market, however, continued to function. Banks can make loans while they have sufficient reserve capital (see Glossary) to allocate against them. To keep making new loans banks must free up reserve capital by selling existing loans, in whole or in part, to other banks or raise new capital. This process is known as syndication. The collapse of Lehman Brothers in September 2008 led to a halt in loan syndication, continuing throughout 2009. This limited the ability of banks to make new PFI loans.

8 The equity finance is provided by a project's contractors and financial institutions. It typically comprises a mixture of shares and shareholder loans. Equity finance is known as risk capital because, generally, the equity will be lost first if the project company fails. The shareholder loans are higher risk as their repayment in a failure is junior to the external debt, known as senior debt, which is repaid first.

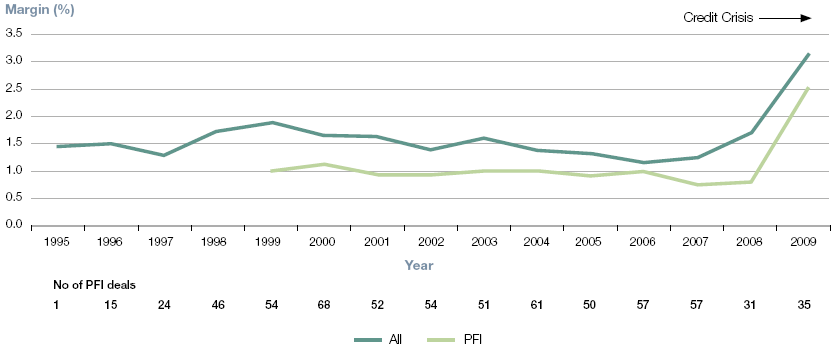

Figure 2 Average international project finance loan margins compared to PFI

NOTES 1 The margins are averages based on monthly data. 2 Numbers in bold are the number of PFI projects financed in that year. Source: National Audit Office and project finance chart based on data from the Infrastructure Project Finance Benchmarking Report 1995-2009 further description at http://infrastructureeconomics.org/2010/02/09/project-finance-benchmarking-report/ |