The Treasury's response to lower availability of finance

10 The Treasury's role in establishing the PFI market contributed to reductions in the risk margin of private debt finance between 1999 and 2007. Over this period, the establishment of the PFI market and the availability of bank finance lowered financing costs as bank competition increased. Departments took advantage by letting around 300 contracts with relatively low financing charges. The part of the interest cost relating to project risk, the PFI loan margin, averaged around one per cent, or less. These rates were lower than intern ational project loan margins which averaged 1.7 per cent from 1994 to 2008 (Figure 2).

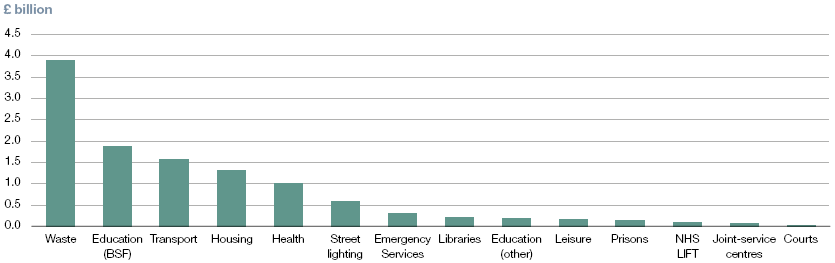

11 As the credit crisis took hold in autumn 2008, debt finance became increasingly unavailable. As a result of market conditions, largely outside the Treasury's control, first bond finance, and then bank finance, became severely restricted. But as the UK economy entered recession, the Government had a significant pipeline of infrastructure projects, with an investment value exceeding £13 billion (Figure 3).

Figure 3 The investment value of UK infrastructure projects notified in the Official Journal of the European Union as at March 2009 Capital value of pipeline by sector

NOTES 1 Building Schools for the Future (BSF) is a secondary schools investment programme. 2 Local Improvement Finance Trusts (LIFT) finance primary medical care projects. Source: HM Treasury |

12 The Treasury was concerned about the macroeconomic impact of the withdrawal of debt finance. With debt finance increasingly unavailable, individual contracts became harder to finalise. The Treasury feared that, as a result of this potential slowdown in new PFI contracts, the opportunity to stimulate the economy through new infrastructure would be lost. In addition, important benefits, for example, improved school facilities and dealing with road congestion, depended on the completion of planned PFI projects.

13 The Treasury therefore sought to maintain a flow of signed PFI contracts. The overarching Government policy in late 2008 was that the pipeline of PFI deals should reach financial close promptly, to stimulate national and local economies, and create jobs. The Treasury followed this policy whilst continuing to apply standard PFI value for money tests.

14 Bank lending was so restricted in late 2008 that, despite Treasury encouragement, no sizeable contracts could be let. In September 2008, the Treasury asked the European Investment Bank to step up its lending to infrastructure projects which the Bank did. The Treasury, however, did not set PFI lending targets for UK banks when they received government support during that winter. The Treasury initiated internal discussions about such targets but did not pursue them because the banks concerned were a sub-set of the PFI lending market and because PFI lending was only a small part of the issues facing the Treasury in relation to its banking support. In early 2009, there continued to be insufficient bank debt for larger projects because banks did not resume lending as expected.

15 The Treasury helped to reactivate the lending market for infrastructure projects by setting up its own finance unit. In March 2009, the Government rapidly set up The Infrastructure Finance Unit to address the scarcity of debt finance. The unit's role was to be available to provide government loans to infrastructure projects, on commercial terms, so shortfalls in the amount of available bank finance could be met.

16 In April 2009, The Infrastructure Finance Unit helped to finalise a large waste treatment and power generation project. The unit provided a £120 million loan to complete a £582 million financing package for a waste treatment and power generation project in Greater Manchester. The Treasury's participation in this loan, on the same terms as commercial banks, is intended to be temporary and reversible.

17 The Treasury's willingness to lend improved market confidence and subsequently around 35 government infrastructure projects have been agreed without any further public lending. The Infrastructure Finance Unit has not made any further loans. But since its establishment, around 35 projects have been agreed. There is therefore some evidence that the unit improved market confidence. In addition, the availability of government loans provided some competitive tension to the banks in a market which, since 2008, had lacked competition on loan financing terms.