The impact of higher debt finance costs on public sector service payments

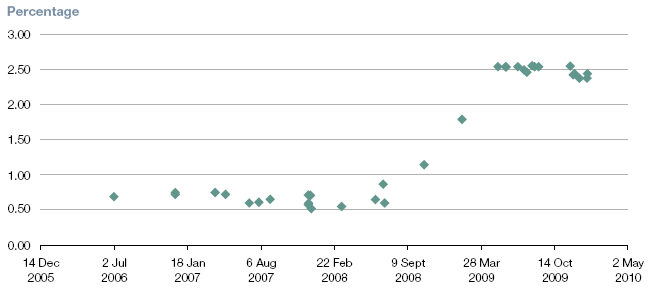

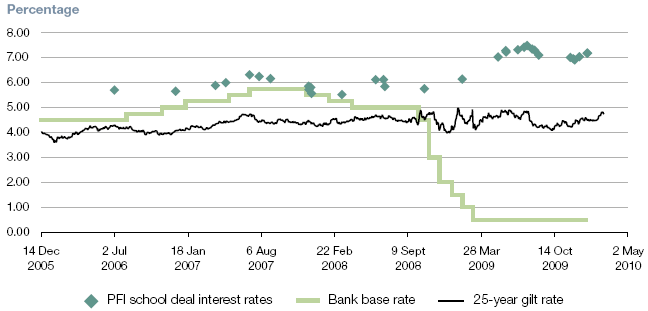

2.5 The increased cost of finance has generally been passed through by the private sector service provider to the public authority in the form of an increased monthly payment, known as the unitary charge. In Appendix Two, Figure 15 sets out the impact in real terms, compared to projects that were financed in 2007, and suggests that, on an all-in basis, the extra cost increased by around 5.6 per cent to 7.4 per cent. The financing costs of schools projects, which are fairly typical, moved up sharply at the start of 2009 (Figure 10).

Figure 10 Typical changes, after December 2008, in loan margins and total interest rates, exemplified by Building Schools for the Future (BSF) projects BSF PFI deals - bank average margins

BSF PFI deals - total interest rates

NOTES 1 The first chart shows the effect on bank margins. The second chart shows the effect on total interest costs. The charts show two main points: a There was a dramatic increase in bank margins between July 2008 and June 2009. There has been a very slight easing in the margins, moving into 2010. b The total increase in interest costs (i.e. bank margins + swap rates) is not as great as the increase in bank margins. This is due to the fall in swap rates, by about one per cent, over the same period. Source: Partnerships for Schools |

2.6 The Treasury's approval of the final financing terms for contracts, such as the Greater Manchester Waste project and the M25, demonstrates that it gave priority to agreeing contracts, and that it believed that it faced a lender's market. In such a lender's market, it was not possible to resist price increases, particularly after the Future Strategic Tanker Aircraft (FSTA) financing in March 2008, as shown in Figure 11.4 A similar trend was starting to be visible in other countries. The nearest comparator for the M25, a toll road in Germany obtained project financing in March 2009. That project's total interest cost was about 6.5 per cent, including debt margins of over 2 per cent during construction (M25 2.5 per cent) and early operating years (over 3 per cent after 10 years - M25: 3.0-3.5 per cent).

2.7 On large deals it was difficult, costly and time consuming to arrange bank finance. A very large deal, such as the M25 described in Appendix Three, also resulted in a club of 16 banks eventually taking shares of around £25 million to £65 million each.

2.8 Margin increases have not been the sole impact of any reduced competition resulting from club deals. Based on analysis of projects concluded in 2007 and 2009 (see Appendix Two), banks have also sought to reduce their project risk by lowering the proportion of debt in projects and increasing cover ratios (see Glossary). This increases the risk to investors, who have passed the corresponding cost to the public sector by increasing the unitary charge. The M25 cover ratio originally required cash, at a minimum, exceeding 1.23 times the amount needed in each period to service the debt. The banks increased this coverage requirement to 1.4 times the amount needed to cover the debt. The final M25 contract also resulted in some additional risks being borne by the Highways Agency. The Agency negotiated concessions in return.

2.9 In all types of lending, banks are seeking shorter periods for the repayment of their loans. In the case of PFI, for example, at the time of selecting the Preferred Bidder (July 2008), the planned final repayment of the M25 loans was six months before the end of the concession and it was subsequently increased by three years.

2.10 In the Greater Manchester Waste project, there are progressive step-ups in loan margins after the ninth year (see Appendix Three). The banks chose this structure to increase the likelihood of the private borrower and/or the public authority seeking a refinancing at lower margins. This is preferable to imposing an obligation to refinance the loans at a specified future date.

________________________________________________________________________________________

4 National Audit Office Delivering multi-role tanker aircraft capability, March 2010, reported in paragraph 18 that "the selection of a PFI solution was made without a sound evaluation of alternative procurement routes to justify why the PFI route offered the best value for money".