Developing a competitive marketplace

2.13 Competition between bidders is an important factor in achieving value for money. Developing a competitive supply market in the waste sector has been challenging. Up until 2006:

■ the waste contractor market in the UK as a whole had been dominated by a small number of firms3, whose activities had been centred on waste collection and landfill;

■ contractors and lenders needed to assess a range of new risks, including the possibilities of using different technologies; and

■ there were very few suppliers equipped to develop plans for waste treatment infrastructure of the size required or to bid simultaneously for a number of projects.

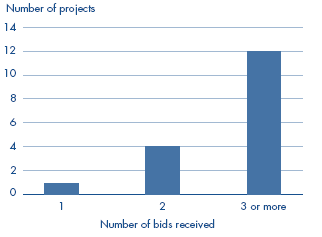

2.14 There has nevertheless been competition for waste PFI contracts. Twelve of the 17 projects developed since the Department was formed in 2001 received three or more bids (Figure 14). Initially there were only a small number of projects coming to the market. The Department has worked with the Department of Business, Enterprise & Regulatory Reform and UK Trade and Industry to encourage firms to bid for these contracts. Since the Department started to increase the number of projects, there has been a corresponding increase in the number of firms interested in bidding.

2.15 Although there have been sufficient bidders to generate competition for the contracts, the range of successful bidders has been relatively restricted. Two firms, SITA and Veolia, have won ten out of the 18 PFI waste contracts let to date, including six of the nine projects signed in 2006-07 and 2007-08 (Figure 15). Veolia won three of the four contracts let in 2007-08. Veolia's bids proposed to finance the projects out of Veolia's existing financial resources, rather than seeking specific new project related finance. Amongst the factors in appointing Veolia was the prospect of faster deal closure than alternative bids relying on project finance.

13 | The number of authorities involved in individual PFI projects is increasing | |||||

|

|

|

|

|

|

|

Status at the time of our audit | Entered into PFI contract | PFI project in procurement | Developed project plans (Outline Business Case submitted) | Initial expression of interest | No PFI solution currently proposed | |

Number of Projects | 18 | 9 | 9 | 10 | n/a | |

Waste Disposal Authorities involved | 22 | 13 | 15 | 18 | 51 | |

Authorities per project | 1.2 | 1.4 | 1.7 | 1.8 | N/a | |

Source: PFI pipeline and Defra municipal waste management statistics | ||||||

NOTE The number of authorities is one greater than the number of waste disposal authorities in England (122 as opposed to 121) because one authority that has already let a contract is also part of another potential project at an early stage of development | ||||||

14 | Projects and bidders since 2001 |

Source: Defra | |

2.16 In exceptional cases where competition is absent, local authorities and the Department adopt alternative procedures to provide assurance on value for money. Case Example 1 overleaf shows how one local authority dealt with a lack of competition for its project after a number of bidders withdrew from the competition.

2.17 The Department's recent strategy, implemented by WIDP, has sought to strengthen competition for these projects by:

■ educating the business community about the waste sector to widen the range of potential bidders; and

■ focussing on contracts for waste processing and disposal that exclude other aspects of waste management, such as waste collection and recycling.

15 | Successful bidders for PFI contracts since 1997 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Project Signed | SITA | Veolia | Biffa

| Donarbon | Focsa | Shanks | Viridor | Global Renewables | Waste Recycling Group | Total

| |

1997-98 | - | - | 1 | - | - | - | - | - | - | 1 | |

1998-99 | 11 | - | - | - | 1 | - | - | - | - | 2 | |

1999-00 | 1 | - | - | - | - | - | - | - | - | 1 | |

2000-01 | 11 | - | - | - | - | - | - | - | - | 1 | |

2001-02 | - | - | - | - | - | - | - | - | - | - | |

2002-03 | - | 1 | - | - | - | 1 | - | - | - | 2 | |

2003-04 | - | - | 1 | - | - | - | 1 | - | - | 2 | |

2004-05 | - | - | - | - | - | - | - | - | - | - | |

2005-06 | - | - | - | - | - | - | - | - | - | - | |

2006-07 | 2 | 1 | - | - | - | - | - | 1 | 1 | 5 | |

2007-08 | - | 3 | - | 1 | - | - | - | - | - | 4 | |

Total | 5 | 5 | 2 | 1 | 1 | 1 | 1 | 1 | 1 | 18 | |

Source: Defra portfolio of projects | |||||||||||

NOTE 1 In these cases SITA acquired the contracts through merger with or acquisition of the original contractor. | |||||||||||

CASE EXAMPLE 1 | |

Northumberland county council: dealing with a single tender In 2004 five bidders pre-qualified and submitted outline solutions for this project. Of these, one experienced financial difficulties and one was deselected by the Authority. Two more bidders subsequently withdrew, citing commercial reasons. A single tender was received from SITA, the incumbent waste service provider. The Authority undertook a full evaluation of SITA's bid. From this the Authority considered it worthwhile to proceed with the procurement process. In seeking approval the Authority also detailed the measures it would take to determine value for money in the absence of direct competition. The main measures were: ■ transparent negotiation, including benchmarking against other PFI projects where possible; and ■ the use of advisers to review SITA's proposal. The Department agreed that the procurement process could continue on this basis, but that the project would be subject to a detailed review prior to progressing to appointment of preferred bidder status. | The focus of the negotiations with SITA was improving project affordability. The mechanical biological treatment based proposal was eliminated. The focus was placed on energy from waste and increasing the projected landfill diversion rate. This strategy achieved the desired objectives and resulted in a significant reduction in price between SITA's tender submission and its appointment as preferred bidder. Further price reductions were achieved prior to contract signature. Throughout the process, the Authority, together with the bidder SITA, the Department, the Treasury and Partnerships UK, used the methods the Authority had proposed to secure value for money in the absence of direct competition. In addition there was a three-month review, conducted by the Treasury. Overall the procurement took 32 months to complete, which although longer than originally planned, was in line with the experience of waste PFI projects at this time - see figure 10.

|

2.18 These approaches have started to make an impact. General construction companies and overseas companies have made bids for recent projects. For example, the Australian firm Global Renewables in partnership with Lend Lease Corporation has won a PFI contract with Lancashire County Council and Cambridgeshire County Council has entered into a contract with Donarbon Waste Management Ltd, a local firm. More new entrants are currently engaged on projects at an advanced stage of negotiation and have been appointed as preferred bidders: in Greater Manchester a consortium of Viridor and John Laing and in Wakefield VT Group plc, through VT Environmental Engineering and its recently acquired Estech Europe subsidiaries.

____________________________________________________________

3 OGC (2006) OGC Kelly Report to the Financial Secretary to the Treasury.