How the performance deductions are calculated

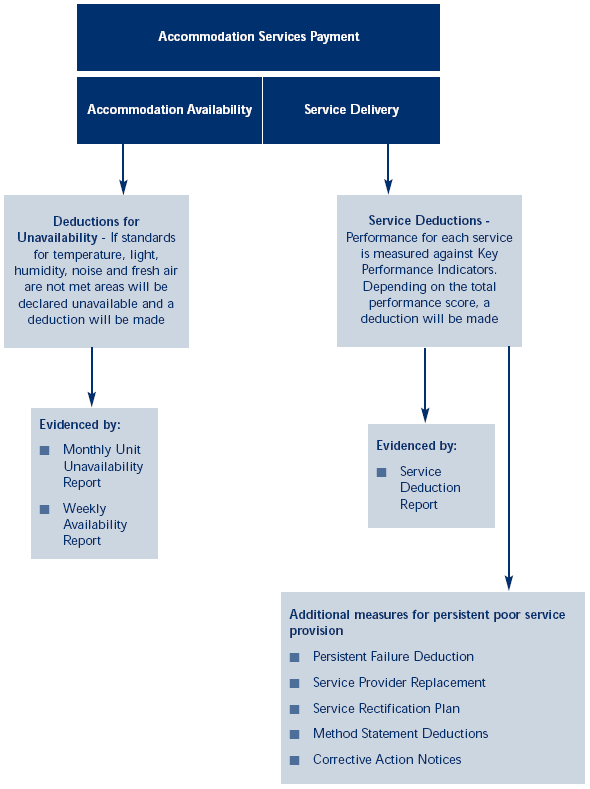

3 Performance deductions fall into two categories as demonstrated in Figure 16. Firstly, a performance deduction will be made when accommodation is actually unavailable. Each area of the building is weighted according to its importance (critical, normal or low) and unavailability is penalised according to weighting. Accommodation will be declared unavailable when contractually specified standards of temperature, humidity, noise, light and fresh air are not met. If none of the accommodation is available, the Home Office will not pay anything to the contractor.

4 Secondly, performance deductions are made when contractually agreed service levels are not met. Individual services are grouped into 'bundled services' and weighted according to proportion of the total service cost. Performance delivery for elements of each service is measured against key performance criteria and scored. Individual scores for each element feed into a service score for each bundled service and an overall score which is used to calculate a performance deduction percentage figure.

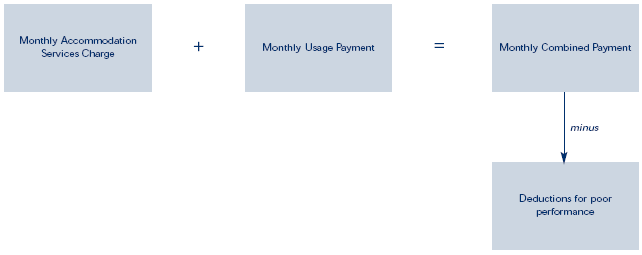

15 |

| Calculation of the Monthly 15 y Combined Payment |

|

|

|

|

| Source: Home Office |

16 |

| Mechanism for making performance deductions to the Accommodation Services Payment |

|

|

|

|

| Source: Home Office |

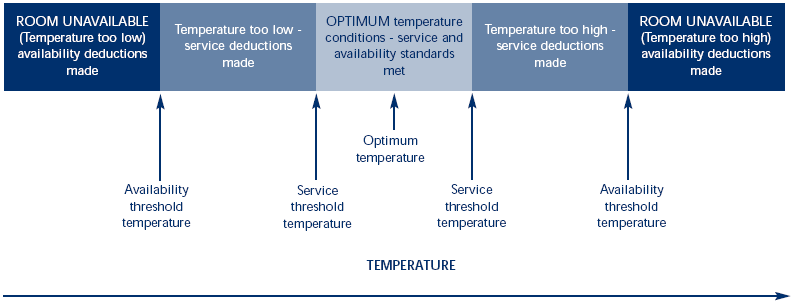

5 Poor performance in some services could result in either a service deduction or an availability deduction but it is not possible for the contractor to be penalised twice. For example, Figure 17 opposite shows that if the temperature of a particular room was too high or too low, it would be scored against the Key Performance Indicator for temperature and an appropriate deduction would be made. However, if temperature rose above a specified threshold, the room would be declared unfit for purpose and would be unavailable. In that circumstance, a higher penalty would be levied as an availability deduction.

6 The contract also contains additional measures to discourage on-going poor performance. These are:

■ Service Rectification Plan - if there is persistent poor service in a category, the Home Office can require the contractor to produce an improvement plan;

■ Service Provider Replacement - consistently poor scores in the same bundled service allows the Home Office to oblige AGP to replace the relevant service provider;

■ Persistent Failure Deduction - successive months of poor performance will result in increased deductions for the same performance shortfall;

17 |

| Circumstances in which either a service vice deduction or availability deduction is made |

|

|

|

|

| Source: Home Office |

■ Method Statement Deduction - deduction from the combined payment will be incurred if the contractor varies the specified method of service delivery for a period that is longer than has been agreed;

■ Corrective Action Notices - the Home Office can step-in and carry out services itself if, after being served notice, the contractor fails to perform. The contractor will then have to pay costs and expenses which exceed the proportion of the combined payment relating to this service.

While, taken on their own, these additional measures are not necessarily novel to PFI, the Home Office considers that in having all these tools available, it has a robust mechanism for incentivising performance.

7 AGP will be responsible for performance measurement in accordance with monitoring methodologies in the contract that set out how each Key Performance Indicator will be measured, how often it will be measured and how this will be reported to the Home Office. Figure 16 shows the evidence that has to be provided. The Home Office can inspect any monitoring carried out by the contractor and can ask to examine audit material. If the Home Office finds that the contractor has not been fulfilling its performance measurement obligations, it can monitor performance itself, at the contractor's cost.