Customer satisfaction measures did not measure SBS performance accurately

2.28 SBS measures customer satisfaction through postal surveys of a sample of NS&I customers, some 750,000 a year, and customer satisfaction Key Performance Indicators (KPIs) are based on the results. From the start, SBS often failed to achieve the KPIs and considered the delivery of its service to NS&I customers was not being

|

7 |

|

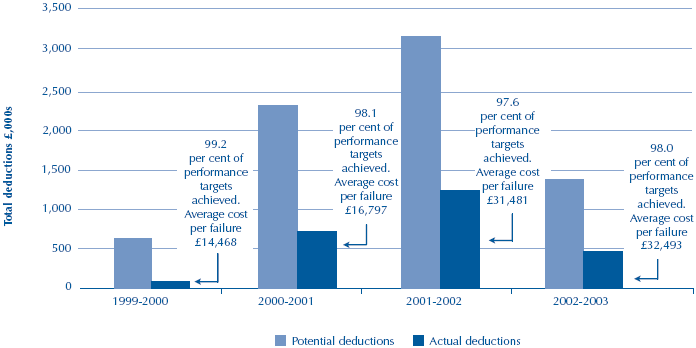

SBS has achieved 98 per cent of performance targets set |

|

|

|

|

|

|

|

Source: NS&I |

|

8 |

|

The Savings Certificate Rollover Incident |

|

|

|

|

|

|

|

In October 2001, NS&I introduced "automatic rollover" on Savings Certificates. Customers no longer had to inform NS&I if they wished to rollover their investment for a further term of the same length. Following the change, a small number of customers contacted NS&I to query or complain about the rollover procedure. In addition delays began to develop on payments and after-sales work. This reached a critical state at the end of February 2002. The average time taken to turn around customer payments increased from 2 days to 12 days and responses to general correspondence were taking over 30 days in some cases against a target of 6 days. The problems attracted national media attention and the number of customer complaints rose significantly. This posed a potential threat to NS&I's image. SBS met the costs of a jointly agreed recovery plan and NS&I paid compensation to those customers most seriously affected by the delays. Both parties learnt that it was vital to work together to ensure all potential risks are identified, mitigated and impacts monitored and addressed. It demonstrated the need for NS&I to carefully manage its relationship with SBS and remain vigilant within the partnership, to avert any residual risk. The introduction of rollover did have positive benefits for the business. The retention of matured funds in Savings Certificates more than doubled, operational costs of the product reduced and research indicated that 98 per cent of customers are satisfied with the changes. |

measured accurately. It thought that many other factors, outside SBS's control, such as the interest rates paid on products or service delivery at the Post Office, were having an impact on levels of satisfaction. Customer research indicated this view was correct and as a result NS&I and SBS agreed to suspend any deductions relating to the KPIs measuring customer satisfaction from 2001.

2.29 Following a review of customer satisfaction measurement, NS&I designed new postal and telephone surveys to provide a better measure of SBS's service to NS&I's customers. NS&I piloted the surveys in September 2002 and will use them from 2003/04 to give it greater feedback on customer service by product and by channel. SBS will continue to administer the postal surveys. NS&I is employing another company to conduct telephone surveys as the requirement is outside the original contract, and SBS lacks the resources to undertake such work.

2.30 NS&I told us that it considers customers are very satisfied with the service they receive. Research by MORI in July 2002 showed that customers' net satisfaction with NS&I's service increased by 9 per cent on the previous year to 85 per cent, which is above ratings achieved by NS&I's major competitors. SBS handles 50 million transactions a year and only 0.02 per cent result in complaints, which equates to one complaint for every 4,200 transactions. The Key Performance Indicator for Customer Complaints requires upheld customer complaints to be equivalent to less than 0.1 per cent of transactions. NS&I and SBS are working on a joint project to examine the current complaints process as it is thought that many issues could be addressed through devising and publishing a comprehensive series of "Frequently Asked Questions" for the NS&I product range.