Conclusions and recommendations

1. The Paddington Health Campus scheme, as proposed by the Campus partners in 2000, was based on an inadequate Outline Business Case, constructed without the benefit of input from doctors and nurses as to the required clinical content. Incomplete or inadequate business cases should not be approved until all material issues, including sufficient design work, have been addressed.

2. The Royal Brompton and Harefield NHS Trust and St Mary's NHS Trust had unreconciled organisational, clinical and financial interests and in the end the two Trusts took incompatible views of the way ahead. Capital schemes in the NHS should only proceed with more than one partner when there is a clearly identified single sponsor.

3. It took several years after the initial outline business case for the Campus partners to reach a clear position on the clinical content of the Campus, the land required, the planning constraints and the likely cost and affordability of the scheme. The scheme's development was also handicapped by insufficient manpower and capability. NHS Trusts taking forward building schemes should have early external assessments, for example by the Department's Private Finance Unit, of their capacity to deliver complex schemes and firm timetables against which they can measure progress.

4. The North West London Strategic Health Authority failed to manage effectively the development of the scheme by the Campus partners. The local responsibility for monitoring the scheme fell initially to the Kensington and Chelsea Health Authority and, after March 2002, the North West London Strategic Health Authority. The Strategic Health Authority should have either cancelled or fundamentally reassessed the scheme in early 2003. Instead it strongly encouraged the Campus partners to pursue additional accommodation for the scheme. New Strategic Health Authorities should establish clear criteria for monitoring each scheme's progress and take decisive action when schemes go off-track.

5. The bed capacity required by the scheme to meet patients' healthcare needs-and thus its cost and affordability-fluctuated as it was being developed, largely for reasons beyond the control of the Campus partners. Planned bed numbers ranged from 835 NHS beds to 1,200 across the five-year development of the Campus, and St Mary's NHS Trust was using different planning assumptions to the North West London Strategic Health Authority. Bed numbers, or at least an upper capacity, should be fixed as part of the Outline Business Case approval process.

6. The hospital building programme in the NHS was estimated to cost £4 billion more than the approved costs. The Department's Capital Investment Manual requires a full reappraisal if costs on a scheme are forecast to rise by more than 10%. The average rise above approved costs is 117%, more than doubling the cost. The Department should enforce the requirement for compliance with its guidance and agree with Trusts who breach these guidelines an action plan to bring projects under closer control, especially where they forecast cost-overruns above approved expenditure levels. It should develop and disseminate to NHS bodies details of the factors that will trigger intervention.

7. Forecast cost increases over all current schemes exceed the 40% maximum addition to forecast capital costs which is allowed to correct for optimism bias. The allowance does not therefore adequately reflect Trusts' over-optimism on the costs of such schemes. To introduce a proper perspective on the likely affordability of schemes, the Department and the Treasury should agree on the appropriate level of optimism bias for NHS capital schemes, based on experience to date.

8. The Department was not adequately aware of the state of the Campus scheme because it viewed scheme development as a local issue. As a result it was slow to respond to the failure of the scheme to make progress. The Department should benchmark the capacity of its Private Finance Unit against similar Units in other Government Departments and against relevant Treasury guidance, to ensure that it has the capacity to provide sufficient support to procurement teams.

9. The Campus partners believed that the Department lacked clarity in its role and objectives. The Department acted as both champion and challenger for the scheme, causing uncertainty and confusion in the Campus partners. The Department, through its Private Finance Unit, should develop flexible and transparent criteria with a greater emphasis on affordability, value for money and viability of projects. It should concentrate on the role of challenger and satisfy itself that hospital building schemes are compatible with these criteria and with other relevant NHS objectives and guidance.

10. At one stage the on-balance sheet treatment of the land deal supporting the 2004 Outline Business Case was deemed to render the scheme unaffordable. The Campus partners were therefore going to leave the scheme. While the Department said it had no requirement that the scheme or supporting land deal be off-balance sheet, the accounting treatment influenced the affordability of the supporting land deal. The Department should confirm to trusts that in evaluating affordability, value for money should drive decisions, and not balance sheet treatment.

11. The Department has not been close enough to the development of capital investment projects in the NHS. While it has a one-off programme to review all pre-contract capital investment schemes valued at over £75 million, there needs to be sustained scrutiny of large projects (over £200 million) by the Department so that NHS Trusts procure these assets within shorter timeframes and with improved value for money.

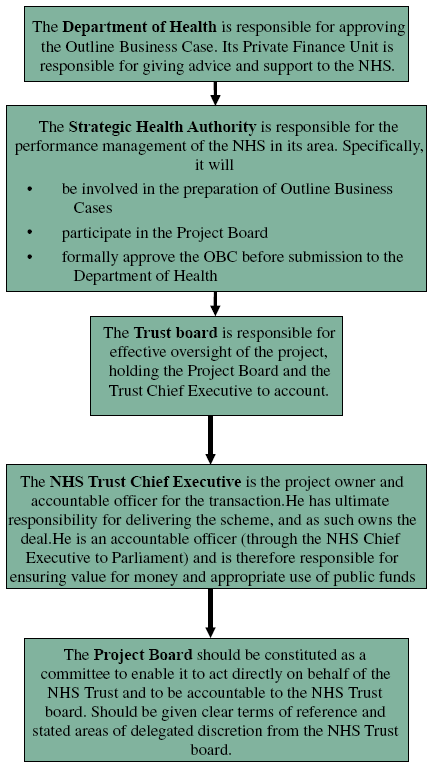

Figure 1: The principal organisations involved in the Paddington Health Campus