2 The role of the Department of Health

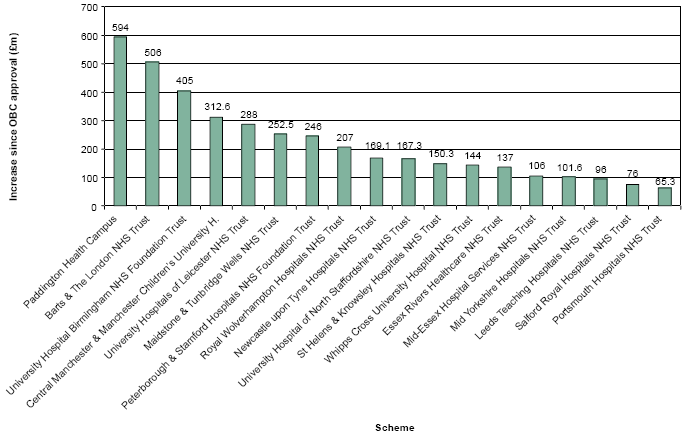

12. By the end of 2005 the Department had approved in principle the development of capital investment schemes with an estimated capital value of £13 billion. Local NHS Trusts would contract with private sector suppliers, who would build hospitals. The value of the capital programme represented a substantial increase over the original approved schemes. For the 17 schemes over £75 million that the Department reported on in November 2005 and the cancelled Paddington scheme, the estimated valuation in November 2005 was some £4 billion above the approved scheme valuations (Figure 3). Overall the schemes increased by an average of 117% over the original approved values.13

Figure 3: Increase in estimated capital construction costs since Outline Business Case approval stage

Source: Memorandum received from the Department of Health containing Replies to a Written Questionnaire from the Health Select Committee, HC 736, Session 2005-06, 5 May 2006, and Comptroller and Auditor General's Report

13. The Department is currently reviewing all 38 unsigned PFI schemes over £75 million to determine how the commissioning of major capital schemes through PFI can be reconciled with long-term affordability and policies on choice, Payment by Results and the movement of care away from acute hospitals to the primary care sector. As a result it expects the scale of the PFI programme to fall from £13 billion to £7-9 billion. The review is still to be completed and the Department believes that costs are not likely to rise in the meantime to an extent that would outweigh the benefits of such a review.14

14. Over the period in which the Paddington Health Campus scheme was being developed, the Department introduced a number of national policies with local implications. These included new guidance on bed numbers, consumerism standards, new Treatment Centres, Payment by Results and choice at the point of GP referral. Local NHS organisations had to make their own estimates of the impact of such new policies. The Department accepted that local NHS organisations, in making their own assumptions in planning capacity, had no track record on which to base their assumptions. 15

15. The Department played two key roles in the development of the Paddington Health Campus scheme. It supported the vision of the scheme as a means of meeting the clinical and estate needs of the local NHS organisations but it also challenged the affordability and deliverability of the scheme. As both 'champion' and 'challenger' the Department, and elements within it, gave mixed messages to the Campus partners, so much so that the partners were uncertain whether the Department did in fact want the Campus scheme to succeed.16

16. When the Department approved the inadequate Outline Business Case for the Paddington Health Campus scheme in 2000 it did so with a number of qualifications. The Campus partners told us this was a high level business case, but the Department agreed it was not close enough to the development of the scheme to perform an effective critical challenge. In October 2003 it was the Treasury, rather than the Department, which requested a review of the scheme and withdrew the approval of the 2000 Outline Business Case.17

17. The Department approved the Outline Business Case in 2000 despite the existence of a strong condition from the Royal Brompton and Harefield NHS Trust that it would not proceed with the scheme if it was required to merge with St Mary's NHS Trust. The Department believed that such a merger might make delivery of the campus easier, but did not propose or require one as a condition of the scheme proceeding, as it believed such a requirement would have stopped the scheme.18

18. The 2000 Outline Business Case was developed under the Department's Capital Investment Manual. That Manual required a review if the estimated cost rose by more than 10%; that outline planning permission be secured prior to advertising in the Official Journal of the European Union; and that risk management be adequate to ensure that the preferred option in an Outline Business Case was affordable and represented the optimum solution. None of these conditions were met by the Campus partners or the scheme. The Department accepts that it should implement its own guidance, and told us that schemes coming forward now are subject to central scrutiny which was not the case in 2000.19

19. In approving capital investment, for which the taxpayer ultimately pays, the Department has stressed the need for affordable schemes. In the case of the Paddington scheme, at the time the December 2004 Outline Business Case was submitted the land deal supporting the scheme was on-balance sheet. The NHS Trusts could not afford the scheme with the land deal on-balance sheet and the Department did not have the resources at that time to fund such a deal, which resulted in the Campus scheme partners resolving to exit the scheme.20

_____________________________________________________________

13 Q37, capital costs data underlying Figure 3 of C&AG's Report

14 Qq 18, 36-37, C&AG's Report, para 2.30 and Note to Q75

15 Qq 59-62, 132, C&AG's Report, para 2.32

18 Qq 159-161 and C&AG's Report 2.13

19 C&AG's Report, para 27a, 2.6, 2.14 and Q5