Introduction

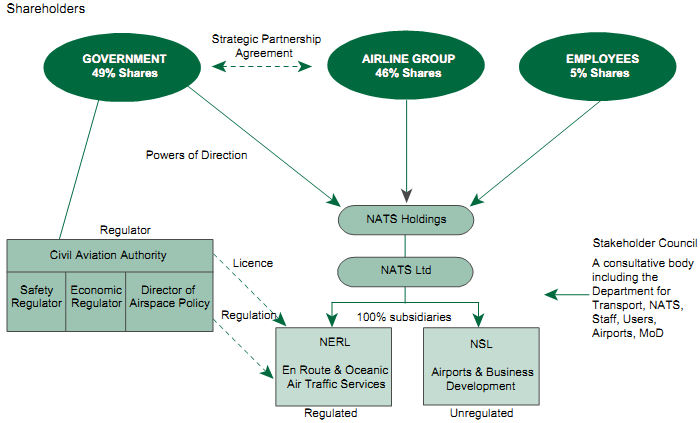

National Air Traffic Services (NATS) is the company which provides air traffic control for aircraft flying over the United Kingdom, and with its Irish counterpart, the North East Atlantic. In July 2001 the Transport Department concluded a Public Private Partnership (PPP) with the Airline Group, a consortium of seven UK-based airlines, giving the Group operational control and a 46% share of NATS (Figure 1). Proceeds were nearly £800 million, of which £65 million came from the Airline Group and the rest from bank loans that are repayable by NATS itself. As a privatised body, NATS' prices are subject to economic regulation by the Civil Aviation Authority. The structure of the PPP has affected its ability to develop its business and finance its £1 billion investment programme over the next ten years. Events following September 11th 2001 have highlighted these risks.1

Figure 1: The PPP structure

On the basis of a Report by the Comptroller and Auditor General,2 the Committee took evidence from the Department for Transport and NATS on four main issues: the choice of a PPP as the best option for the Company; the testing that was done on the Airline Group's financial proposals; the implications of the financial structure that is now in place; and the prospects for the Company.

The Department preferred the option of establishing NATS as a profit-seeking, but regulated company, rather than a not-for-profit model such as that used for the privatised national air traffic control business in Canada. The Canadian model was dismissed too readily. The regulatory arrangements, copied from the regulated utilities, have been shown to take insufficient account of the very different business risks which NATS faces.

The Department failed adequately to test the robustness of the Airline Group's proposed financial structure for NATS. The set of scenarios examined was more optimistic than historical experience warranted, and imprudently assumed that the Regulator would always be both willing and able to intervene quickly to protect NATS from any sudden business downturn.

The Department and Treasury took £758 million out of NATS in sale proceeds, leaving the Company burdened with over twice as much debt as it carried before the PPP. The Company's financial difficulties cannot be wholly attributed to the after-effects of September 11th: the Economic Regulator expressed concern at the indebtedness of NATS before those events.

One of the Department's main reasons for preferring the profit-seeking but regulated company model for NATS rather than the Canadian not-for-profit model was to give NATS freedom to invest outside public sector financial controls. In the event, the chosen regulatory structure, combined with the high withdrawal of cash from the business, barred NATS from access to external finance for over a year, just when it was embarking on a ten year £1 billion investment plan.

_____________________________________________________________________________________________________

1 C&AG's Report, The Public Private Partnership for NATS (HC 1096, Session 2001-02) paras 1, 4

2 ibid, 24 July 2002