2 Testing the Airline Group's Financial Proposals

8. The strong competition between the two final bidders for NATS, the Airline Group and Nimbus, drove up the sale proceeds to the limit of what these bidders considered the business could sustain, based on their assumptions about growth in traffic and the need for further investment. As a result of the PPP, the level of debt within NATS rose from £330 million to £733 million. Debt would rise further over the next twenty years as the Company would draw on an additional £715 million of loans to invest in new air traffic control capacity (Figure 2).10

9. The Civil Aviation Authority and NATS expressed concerns to the Department that the increased indebtedness of NATS was unlikely to be sustainable. Whilst recognising the Regulator's perspective, the Department and its advisers assessed NATS' indebtedness under the Airline Group's proposals by testing whether the business would have sufficient cash flow to meet its debt obligations, in a range of scenarios. Of the nine scenarios mandated by the Department, only one dealt with an adverse trend in traffic, in terms of the risk that annual growth in traffic would be 3.5% compared to 6.7% in the baseline. Of the ten further scenarios done by the Airline Group and shared with the Department, only one considered lower than expected traffic; in terms of a downturn during the sixth year of the PPP, on the limited scale that was experienced during the Gulf War.11

Figure 2: How the PPP was financed

| To finance the PPP deal NATS' indebtedness rose from £330 million to £733 million |

| Sources of funds Cash from the seven Airline Group shareholders | £ million | ||

| 50 | |||

| Strategic Partner Loan from British Airways | 15 | ||

| Cash in NATS at completion | 3.5 | ||

| Bank loans for the acquisition, repayable by NATS Less loan hedging costs Total available funds | 733 | ||

| -7 | |||

| 794.5 | |||

| Uses of the above funds | |||

| Purchase of equity stake from government | 65 | ||

| Repayment of NATS' existing National Loans Fund debts | 330 | ||

| Purchase of stake in NATS from government | 370 | ||

| Less loan hedging costs | -7 | ||

| Government's immediate cash proceeds | 758 | ||

| Banking costs | 33 | ||

| Cash left in NATS | 3.5 | ||

| Total funds used | 794.5 | ||

| Source: C&AG's Report, page 37 | |||

10. The Department considered that that the testing performed had been extensive and thorough, but did not claim that every possible scenario was tested. In the circumstances before September 11th, the world appeared a less risky place than it would today. The expectations for future traffic growth were different. Every year since 1983 there had been a strong consistent picture of upward growth in NATS' market, except for the relatively minor downturn during the Gulf War. The new Chief Executive of NATS came into the job on completion of the PPP

and had looked at the testing that had been done. He had considered before September 11th 2001 that the financing was going to be tight, but looked feasible. 12

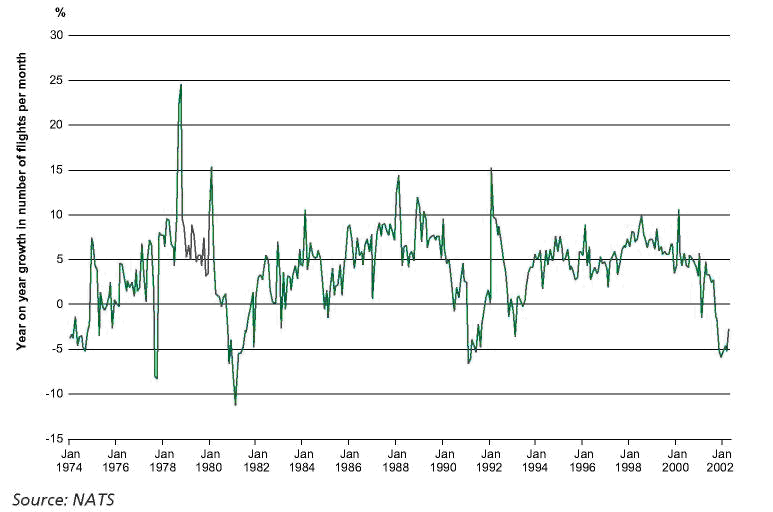

11. The Department, the Airline Group and their advisers did not test the PPP's finances against a repetition of the oil crisis scenarios of the 1970s and early 1980s (Figure 3). The Department regarded the two traffic scenarios that had been tested, based on the Gulf War and on sustained low growth, as severe but more relevant. In both of these scenarios NATS did not run out of money.13

Figure 3: The volatility of UK air traffic levels, 1974-2002

Traffic volumes are largely out of NATS' control, and can be highly volatile, leading to sudden changes in revenue

12. The National Audit Office tested the PPP finances against a repetition of the Oil Crises and found that the PPP deal would not have been robust in those circumstances. The Department did not challenge this conclusion when agreeing the National Audit Office report, only questioning whether events so long ago were a good guide to what might happen in the future. The Report, which the Department agreed to in the normal way, presented the conclusions arising from this analysis. The Accounting Officer nevertheless questioned the conclusion during our hearing. In a subsequent note, the Department retracted some of the doubts that it had raised about the National Audit Office's reconstruction of traffic data. Its main continuing disagreement was that the National Audit Office test had not assumed that the Economic Regulator would allow NATS' prices to increase if there were to be a major and sustained downturn in traffic.14

13. Contrary to the Department's assumption when testing the Airline Group's proposals, however, obtaining and implementing price increases for NATS is problematic and uncertain, and far from automatic. To increase its charges above the limits set by the price cap, NATS must formally apply to the Civil Aviation Authority. The review process must follow formal procedures of consultation and consideration. Practically this means delays of several months, and another constraint is that charges are normally set in Europe only once a year. If NATS and the Regulator cannot agree on an increase before prices are set in late November for the following calendar year, the Company will probably have to wait a further year.15

14. Following September 11th 2001, NATS applied to the Regulator in February 2002 for a price increase to take effect from January 2003. The Regulator announced its initial determination in May 2002 and in December 2002 agreed to an increase in prices, but only subject to NATS achieving a more appropriate debt structure than that established through the PPP. The Regulator's decision has been opposed by some of NATS' customers, including Ryanair.16

_____________________________________________________________________________________________________

10 C&AG's Report, para 3.19

11 ibid, para 3.20, 3.23-3.24

14 Ev 26-27

16 Ev 1, 26-27; C&AG's Report, para 3.32; decision by the Civil Aviation Authority under the Transport Act 2000, 20 December 2002; Ev 24-26