Summary

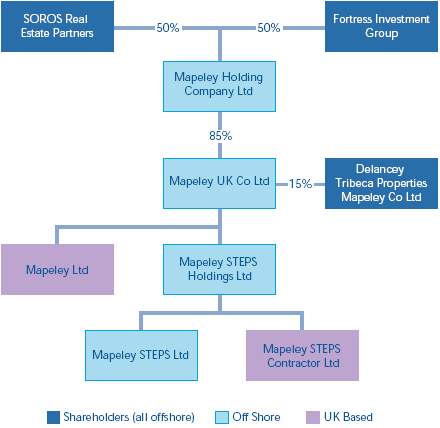

1 This report examines the value for money of a property and services outsourcing deal by the Inland Revenue, HM Customs and Excise and the Valuation Office Agency (the Departments) known as STEPS (the Strategic Transfer of the Estate to the Private Sector). In March 2001, the Departments signed the contract to transfer ownership and management of the majority of their estates to a private sector consortium of companies within the Mapeley Group, hereafter referred to as Mapeley STEPS.1 The contract commenced on 2 April 2001.

1 |

| The structure of the Mapeley Group |

|

| |

| NOTE 1 Delancey Tribeca Properties Mapeley Co Limited was formerly called Delancey East Limited. | |

|

| |

| Source: National Audit Office | |

| 2 STEPS was similar to a deal signed in December 1997 by the Department of Social Security (now the Department for Work and Pensions). That deal (called PRIME2) was expected to reduce costs by some £560 million over 20 years. Over the 20-year life of the STEPS contract, when compared with the Public Sector Comparator, the Departments expect to save £344 million (in net present values), with an estimated first year saving of some £27 million. In 1998, as part of a Comprehensive Spending Review, the Departments considered ways of increasing efficiency and effectiveness in the management of their estates and how to work more closely together across the range of their responsibilities. These factors pointed towards the joint procurement of a PRIME-type estate management deal that would produce substantial cost savings. 3 The STEPS deal will last for 20 years and comprises the following key elements: a) the transfer for £220 million of the Departments' freehold and long leasehold buildings to a subsidiary of Mapeley (Mapeley STEPS Limited). The remaining estate comprised liabilities under short-term leases, which were transferred to both Mapeley STEPS Limited and Mapeley STEPS Contractor Limited, a different subsidiary of Mapeley (see figures 2 and 3); b) in return for operating the estate and taking responsibility for rental and other costs, the Departments will pay Mapeley STEPS Contractor Limited an average annual charge of £170 million,3 equating to some £1,500 million4 over the period of the contract. c) At the end of the contract, the Departments will not own the estate, but will retain a right to occupy the buildings that they wish to remain in, with leases based on market terms obtaining at the time. 4 We examined the extent to which the STEPS deal is likely to deliver value for money. The methodology for the study is outlined at Appendix 1. In summary, we found that: a) the deal has delivered benefits and more are expected; b) the Departments got a good price; and c) good risk management will be essential. |

_______________________________________________________________________________________________________________________________________

1 For the purposes of this report, the term Mapeley STEPS will be used to describe Mapeley STEPS Limited and Mapeley STEPS Contractor Limited. Where necessary, in later parts of the report, specific legal entities within the Mapeley Group are identified.

2 C&AG's report: The PRIME Project: The transfer of the Department of Social Security estate to the private sector (HC 370, session 1998-1999); PAC Report, The PRIME Project: The transfer of the Department of Social Security estate to the private sector, Committee of Public Accounts, Forty-first report 1998-1999.

3 This charge reflects the Departments most likely requirements for accommodation and may increase or decrease as their accommodation requirements change.

4 This is the present cost at 2001 prices of the payments amounting to £3,400 million over the 20 year contract, discounted at 6 per cent real to April 2001.