Executive summary

|

| In this section |

|

|

| The OGC is generally seeking a 30 per cent share of future refinancing gains on early PFI deals | 2 |

|

| Over the past two years, the OGC has carried out a large programme of work to change the approach of departments and the market in new contracts | 3 |

|

| The benefits of most refinancings of new deals will be shared 50/50, but this new approach will need to be carefully managed | 4 |

|

| Recommendations | 6 |

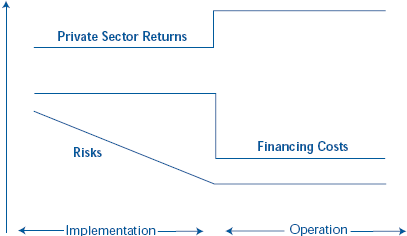

1 In June 2000 we published a report on the refinancing of the Fazakerley PFI prison contract.1 Having considered the report and taken oral evidence, the Committee of Public Accounts (PAC) published its own report.2 Both reports highlighted the potential for the shareholders of private sector companies contracted to deliver PFI projects to increase their returns significantly by refinancing the projects (Figure 1).

2 The PAC recommended that departments should share in the financing benefits from a successful PFI project and that the Office of Government Commerce (OGC) should complete its planned updating of central guidance on refinancing as a matter of priority.

1 |

| Relationship between risk and returns in a typical PFI contract |

|

| This figure shows that, once the required service has been brought into operation, the project risks are lower, as the risks associated with commencing service delivery are no longer relevant. This creates opportunities to reduce the annual financing costs, as funders are prepared to offer better terms for projects with lower risks. Improved financing terms have also been possible in early PFI projects as PFI has become an established procurement method with which the financing market is familiar. Lower annual financing costs improve the returns that can be paid to the private sector shareholders.

NOTE 1. These are the expected returns to the private sector shareholders over the life of the contract. The returns normally become payable to the shareholders once the implementation of the service has been successfully inaugurated. |

|

| Source: National Audit Office |

3 We examined how far the OGC and departments have responded to these reports. The methodology we adopted to undertake this study, based on a wide ranging survey of PFI contracts, is set out in Appendix 1. In summary we found that:

■ Early PFI deals: The OGC is now helping departments to generally secure 30 per cent of future gains in those cases where the contract does not explicitly entitle the department to a share of such gains;

■ New PFI deals - guidance: Over the past two years, the OGC has carried out a large work programme to change the approach by departments and the market to refinancing, culminating in the publication of revised guidance in July 2002; and

■ New PFI deals - implementation: The benefits of most refinancings of new deals will be shared 50/50, but the implementation of the new approach will need to be carefully managed.

___________________________________________________________________________

1 HC584 1999-2000.

2 HC995-i) 1999-2000.

- The OGC is helping departments generally to secure a 30 per cent share of future refinancing gains on early PFI deals

- Over the past two years, the OGC has carried out a large programme of work to change the approach of departments and the market in new contracts

- The benefits of most refinancings of new deals will be shared 50/50, but this new approach will need to be carefully managed

- Recommendations