There are opportunities to refinance PFI projects and there are many ways in which this may come about

1.2 A refinancing in its broadest sense can be any change to a project's original financing arrangements. Such changes often involve taking advantage of more advantageous financing terms that can improve a project's cash flows. This is a technique that is often used in project finance and is not solely related to PFI deals. Refinancings tend to fall into two categories:

■ Those undertaken for the purpose of rectifying or avoiding actual or potential default under existing financing arrangements, commonly known as a "rescue refinancing"; and

■ Those undertaken with the intention of improving the financing terms in a successful project. This can improve the cash flows and can also increase the shareholders' returns from the project. Such improvements in returns are commonly known as "refinancing gains".

1.3 While it is not possible to give a comprehensive definition of all situations that may give rise to refinancing gains, some typical situations are shown in Figure 3.

3 |

| Changes in financial arrangements that may indicate a refinancing |

|

| There has been an increase in the number of years over which the consortium will repay its financing There has been a change in the consortium's finance provider There has been a reduction in the "margin" used to determine the amount of interest payable on the financing There has been a reduction to the consortium's borrowing costs as a result of fixing interest rates lower for the balance of the contract term than had been expected at contract letting There has been a repayment to the consortium's shareholders of some or all of their equity or subordinated debt (usually facilitated by introducing into the project new finance from other sources) Constraints on dividend payments have been removed or eased There has been a change in the financing arrangements that allows the reserve accounts to be reduced or released |

|

| Source: National Audit Office |

1.4 A number of factors create opportunities to refinance PFI projects, some of which are particularly relevant to early PFI projects:

■ Improved financing terms may be available once the required service has been implemented satisfactorily. The terms of finance are linked to project risks. Once a service is operational and the initial implementation risks have been dealt with, funders may be prepared to improve the terms of the original financing. This may include a change whereby the private sector shareholders in the project can be repaid most of their original investment. This can significantly improve the shareholders' rate of return, as they continue to earn dividends from the project but on a lower level of investment.

■ Financing terms for all PFI projects have improved because more lenders are willing to take on the risks of PFI projects. The financing terms for early PFI deals reflected the risks of funding a new form of procurement with newly developed contract terms. Subsequently, there was an increase in confidence within the financial markets that PFI projects could be a good investment or credit risk. More banks and investors entered the market and terms improved, including lower interest margins and longer loan terms.

■ Borrowing rates generally have fallen in recent years. Prevailing economic conditions and general competitiveness within the banking industry have caused base interest rates and margins for most types of commercial borrowing to fall.

■ Funders earn fees for arranging new forms of finance. Funders can earn fees both from arranging financing for a new project or from arranging or underwriting a refinancing for an existing project. They therefore have an incentive to seek refinancing opportunities, either as an arranger or as an underwriter of a refinancing. Alternatively, a funder of an existing project may choose to use a refinancing as an opportunity to withdraw funds from the project to seek new opportunities to fund other projects. This can help to facilitate the flow of deals that the market is financing.

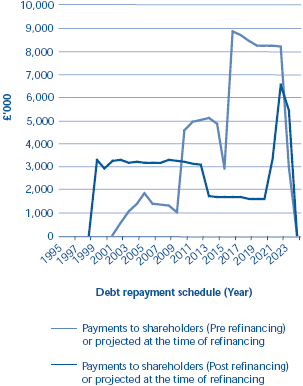

1.5 A refinancing has the effect of bringing forward distributions to shareholders (Figure 4). Because earlier distributions will be worth more to the shareholders, this has the effect of increasing their returns from the project in net present value terms. Also, as this is often accompanied by a repayment to the shareholders of some of their initial investment in the project, this can produce a significant increase in their returns relative to funds invested in the project. This was illustrated in the Fazakerley prison refinancing, where the shareholders' rate of return increased from 16 per cent to 39 per cent as a result of the refinancing.3

4 |

| How the Fazakerley prison refinancing increases - and brings forward - the returns to the shareholders of the consortium |

|

| The figures below show how the Fazakerley prison refinancing affects returns to shareholders of the FPSL consortium. The reduction in the interest rate means that annual interest charges are lower throughout the life of the loan. The extension in the repayment term of the loan means that annual debt repayment costs are lower until 2013. Thereafter, FPSL will face additional costs because the loan will not have been repaid in full by this time. As the unitary charge payable by the Prison Service remains the same as under the original contract, before any sharing of the refinancing gains, the refinancing therefore creates earlier and larger dividends for the equity investors in the consortium.

|

|

| Source: National Audit Office based on Figure 3 from the PAC report HC (995-i (1999-2000) |

___________________________________________________________________________

3 National Audit Office report on the refinancing of the Fazakerley PFI prison contract, paragraph 3.17.