Even where authorities do have information, they may not recognise when a refinancing has occurred

1.39 An additional problem is that, even where authorities do have evidence about their contractors' financing arrangements, they may not recognise situations where a refinancing has occurred. In addition to the 12 refinancings listed in Figure 7 we found evidence that other refinancing gains may have arisen without authorities recognising this. These were mainly, but not exclusively, in situations where the departments did not have a contractual right to share in refinancing gains. In all these cases the project teams did not consider their project had been subject to a refinancing but often reported that the contractor had effected a "financial restructuring". An example of a financial restructuring involving a group of projects is set out in Figure 8.

1.40 We found six cases, not reported by the departments as refinancings, where contractors had improved the financing in a way which would be expected to generate refinancing gains. And in around thirty other cases contractors had effected changes, sometimes complex, to their financing where further information would be required to ascertain whether or not refinancing gains had been generated. These situations often involved increases or other changes to the borrowings. This can be associated with refinancing gains if the new borrowing allows the private sector shareholders to be repaid debt or equity they have previously invested. A number of these latter cases where further information would be required may have involved financial changes which would have been unlikely to have been defined as refinancings under the arrangements now in place. These include deals involving corporate finance and rescue refinancings of projects in distress.

8 |

| Premier Prisons financial restructuring |

|

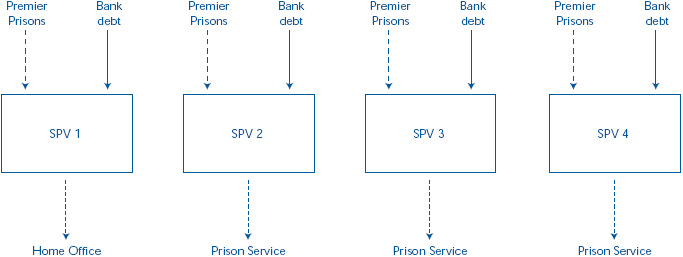

| Before the restructuring Premier Prisons had four PFI contracts, three with the Prison Service and one with the Home Office. Each project was owned by Premier Prisons through a project company known as a special purpose vehicle (SPV) and separately financed by bank debt.

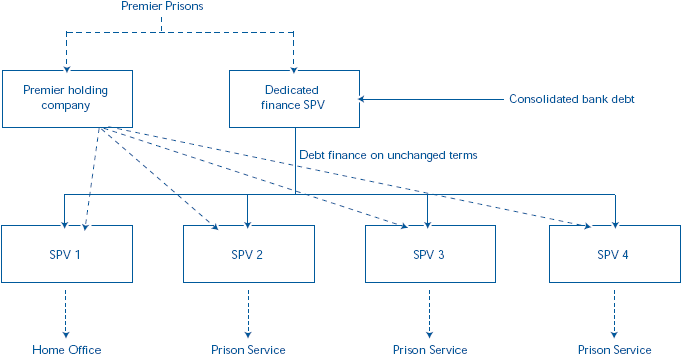

After the restructuring The debt for each project is now provided by a dedicated finance subsidiary of Premier Prisons, which is in turn financed by a consolidated bank debt facility. The terms of the debt to each of the project SPVs remain unchanged, as does the potential liability of the public sector in the case of a default of any one of the projects. Premier Prisons may now be able to refinance the terms of the bank debt to the dedicated finance SPV on a consolidated basis, which might release greater benefits than refinancing each project's debt individually. The original contracts did not contain express refinancing provisions but protected the public sector from exposure from making any increased payments. The Prison Service and Home Office took legal advice on the restructuring to protect their rights in situations such as contract terminations and to prevent cross-defaults between the projects. In line with the original contracts there is no obligation on Premier Prisons to inform the Prison Service and Home Office if a refinancing of the consolidated debt is effected and Premier Prisons will not be contractually obliged to share any refinancing gains that may arise. Premier Prisons has, however, given a guarantee that there will be no increases to the termination liabilities of the Prison Service and Home Office.

|

1.41 The six situations where there was clearer evidence that project teams had not recognised situations potentially yielding refinancing benefits included: reducing lending margins, fixing interest rates at lower rates, increasing the length of debt repayment period, repaying shareholders' debt and increasing dividends by reducing restrictions on dividend payments. In one of these six cases the authority would have been entitled to a share of refinancing gains.

1.42 Given that a fifth of projects could not give us information about their contractors' current financing there may be other incidences of situations where refinancing benefits may have arisen without the department being aware or where further information would be needed to clarify whether or not there had been refinancing gains. Authorities need to be alive to situations that may give rise to refinancing benefits and to have access to information on changes in their contractors' financing arrangements.