Recommendations based on the experience of the NATS PPP

To departments establishing joint venture companies or undertaking trade sales

1 A key aspect of joint venture companies or partial trade sales is that the state retains a long-term interest in the business. There are potential tensions between levels of proceeds on one hand and capital structure and financial risks borne by the business on the other. Departments should evaluate carefully bidders' financing propositions against a full range of reasonable business sensitivities, and consider an appropriate balance between proceeds and capital structure having regard to these sensitivities. Where appropriate, they should think about building in, up-front, mechanisms for addressing financial stress. We consider that in this case there was significant risk of stress because the financial structure made only limited provision for traffic downturns.

2 The financial structure of a joint venture company or part trade sale should be consistent with the business risks to which it is exposed. Although unlimited access to risk capital is unrealistic, Departments should look to build in mechanisms to enable the business to access further capital if it is required. In this case, the structure enabled the Airline Group to secure a loan facility, but the subsequent drop in forecast revenues has made it difficult to fulfil the loan conditions.

3 In judging the risk capital needed for a PPP, departments should have regard to such historical evidence as may be available on the business risks. In this case the risk capital reflected the experience of aviation growth in the 1990s, but not the interruptions experienced in earlier decades.

4 Vendor departments should give particular consideration to the detailed conditions that banks apply to their loans to Public Private Partnerships and the extent to which access to finance has been ensured. It is reasonable that banks should hold rights to protect their loans in extreme conditions but departments should carefully analyse the terms of any financing agreement to ensure that access to finance cannot unreasonably be withheld. In this case the finance agreements contain drawdown conditions requiring projections of ability to repay the loan. There is a risk that the banks will withhold lending that NATS requires for working capital or investment if the Company's cash flow forecasts, inevitably based to a degree on subjective assumptions as are all forecasts, do not remain healthy.

5 It is right that bidders should be able to take different views on future prospects. But where the level of proceeds is highly dependent on bidders' differing forecasts of trends that cannot be controlled, such as traffic volumes in NATS' case, departments should ensure that they are comfortable with the lead bidder's forecasts. If Departments are not comfortable with forecasts they should inform their evaluation of the bids by testing each bid's financial strength against common assumptions. In this case the Department accepted the Airline Group's forecasts.

6 Companies with the relevant skills and assets that would make them good strategic partners for a state business will often have possible conflicts of interest. It is good practice when considering expressions of interest from such potential bidders not to exclude them from bidding but to invite and evaluate their proposals for dealing with conflicts of interest, as was done in this case.

7 It is important to resolve key uncertainties, such as the level of regulated prices, as early as possible in the Strategic Partner selection process, to avoid unnecessarily deterring potential bidders. In this case the regulatory uncertainty had not been resolved when potential bidders were invited to submit proposals.

8 The most important adviser in a PPP is the lead financial adviser. Investment banks often prefer to work for fixed monthly fees, irrespective of how much work they actually do, but departments should give very careful thought to the risks of such an arrangement and the scope for better incentives such as linking fees to the achievement of milestones, before appointing an adviser on that basis. In this case the Department considered a success fee, but concluded that this was inappropriate.

To the Department for Transport

9 NATS' new strategy for procurement of air traffic control systems emphasises co-operation with air traffic service providers in other countries. There are advantages to this strategy, but it brings its own risks. NATS can learn from the lessons identified in the reports of the Committee of Public Accounts and this Office on international collaborations on high technology systems, particularly in the defence sector, (see Appendix 6).

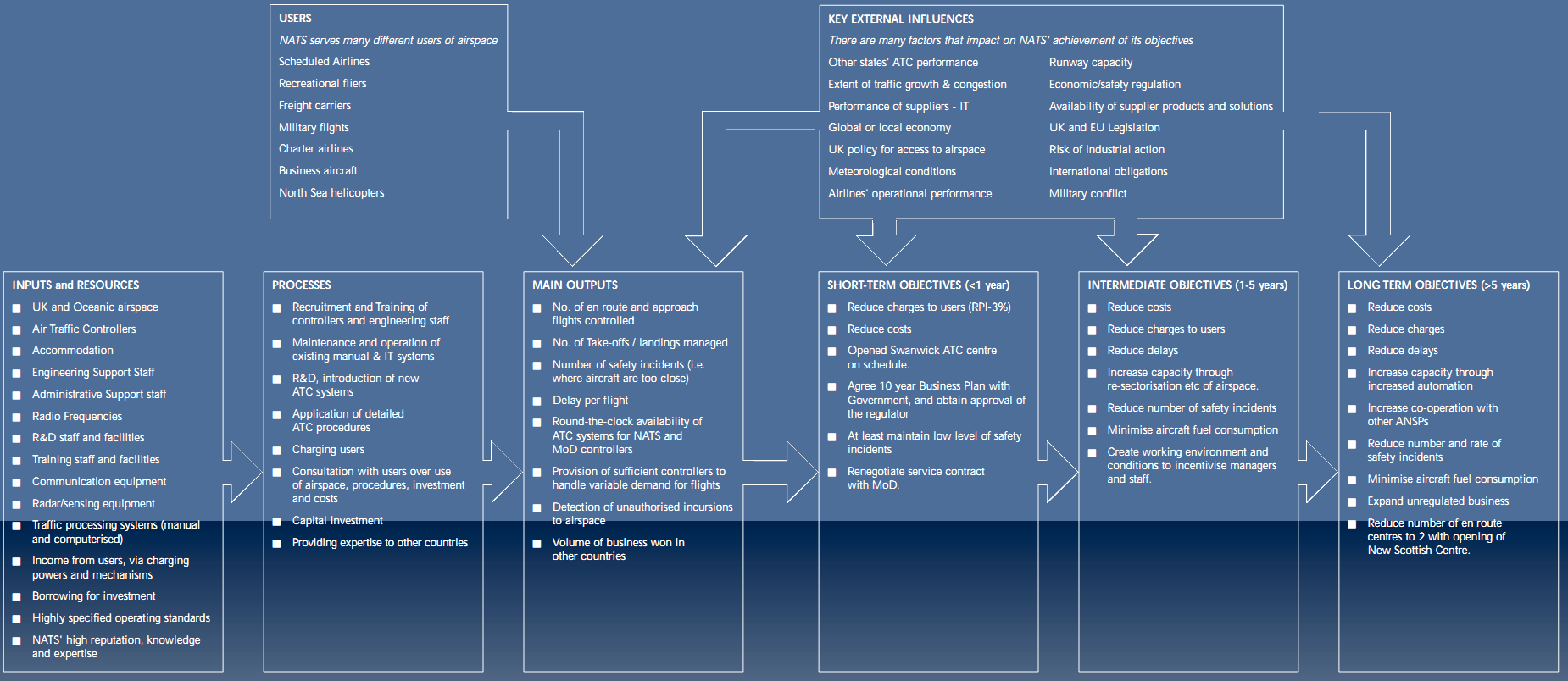

An Overview of the Business of NATS, (See also Appendix 2)