After an agreement was signed with the Airline Group, the value of its bid reduced

1.19 Before the deal could be concluded, the Airline Group had to secure the financial backing for their offer, by a Government deadline of 31st May. On 23rd May the Airline Group informed the Department that they would not be able to secure the support of their lending banks, unless the Government were prepared to accept a reduction in the value of their offer. They said the problem arose mainly from:

8 |

| Key events in the process of selecting the Strategic Partner | ||

|

| Date | Event | Planned date at June 20001 |

|

| 2000 |

|

|

|

| March-May | Department's lead advisers, CSFB, market the opportunity to a range of investors. They report [May 4th] that they expect 3-5 credible consortia to emerge and be capable of reaching indicative bid stages |

|

|

| 16th June | Stage 1: Department invites potential bidders to express interest | June 2000 |

|

| 14th July | Deadline for bidders to express interest and to supply accompanying information and undertakings. Seven entities respond, plus two companies with an interest in joining a bidding consortium | July 2000 |

|

| 28th July | Stage 2: Department and advisers request proposals from bidders, "to ensure that only the most appropriate and committed candidates progress to Stage 3." Proposals need not be legally binding | August 2000 |

|

| August | Bidders review draft PPP documentation |

|

|

| Mid September | Bidders receive presentations from NATS management, and ask questions |

|

|

| 29th September | Deadline for bidders to submit Stage 2 offers. Four consortia submit bids | September 2000 |

|

| October | Government and Advisers evaluate Stage 2 offers |

|

|

| 3rd November | Stage 3: Department and advisers request legally binding proposals from the Airline Group, Nimbus (SERCO) and Novares (Lockheed Martin) | October 2000 |

|

| 6th November | Bidders start due diligence, with access to data rooms and to NATS sites and key staff, as well as to the Department and its advisers |

|

|

| 2001 |

|

|

|

| 26th January | Date at which the data room was intended to close, and due diligence would end. |

|

|

| 31st January | Deadline for submission of Stage 3 offers. Offers received from Airline Group, Nimbus and Novares. | January 2001 |

|

| 19th February | Department decides to invite a further round of bidding from Nimbus and the Airline Group, to resolve issues with the conditionality of these bids. Novares' bid is assessed as poorer than these two, and is held in reserve. |

|

|

| 16th March | Revised Stage 3: Offers received from Nimbus and the Airline Group. |

|

|

| 27th March | Government announces legally binding PPP agreement signed with the Airline Group, conditional on EC merger regulation approval and execution of financing documentation. | March 2001 |

|

| 23rd May | Airline Group inform the Department that due to several factors, including a downturn in traffic projections and an underestimate by AG of staff costs, the original offer could not be financed. |

|

|

| June - July | Negotiations involving advisers and senior officials of the Department and the Airline Group. |

|

|

| 23rd July | Evaluation group recommend to Ministers to proceed with revised offer from the Airline Group. |

|

|

| 26th July | PPP agreement completed between the Department and the Airline Group | March 2001 |

|

| NOTE 1. Planned dates taken from the Department's invitation to register expressions of interest, June 2000. | ||

|

| |||

9 |

| Groups expressing interest in the PPP | ||

|

| Seven groups expressed interest in bidding to be the strategic partner, including suppliers of air traffic control systems, a private sector air traffic service provider, and a consortium of UK based airlines. Two other groups expressed interest in participating in other bids. | ||

|

| Name | Business | Outcome of their bid |

|

| A consortium of UK-based airlines which comprises British Airways, Virgin Atlantic, British Midland, Airtours, Monarch, Britannia and Easyjet, with technical assistance being provided by BT and several European air traffic service providers, principally the Irish Aviation Authority. | Winner. Signed conditional contract as selected strategic partner in March 2001; contract completed in July 2001 | |

|

| Nimbus | A company set up by Serco and PPM Ventures with technical assistance from ARINC and Cranfield University. Serco is NATS' main competitor for the provision of air traffic control services at UK airports. | Effectively became under-bidder in March 2001 when Airline Group signed conditional contract. |

|

| Novares | A company set up by Lockheed Martin (a major supplier of air traffic control systems), Apax Partners and New Zealand's Airways International Ltd, with technical assistance from AEA Technology and DERA. | Stage 3 bid placed in reserve. Company then withdrew. |

|

| Raytheon Systems Ltd | Major supplier of air traffic control systems | Submitted proposals in Stage 2 but not selected to make binding bids (Stage 3) |

|

| Boeing | Major aircraft manufacturer. | Invited to submit Stage 2 proposals, but decided not to do so. |

|

| BAE Systems/AMS | BAE SYSTEMS is a major aerospace systems company, and Alenia Marconi Systems (AMS) is a major supplier of air traffic control systems. | Invited to submit Stage 2 proposals, but decided not to do so. |

|

| Airsafe | A consortium led by Thomson CSF, a major supplier of Air Traffic Control systems. | Withdrew in August 2000 before making Stage 2 proposals, after inadvertent receipt of unauthorised information. |

NOTE The table excludes Lloyds Register and GE Group, who expressed interest but did not intend to bid in their own right, and did not join any of the consortia who submitted indicative bids at Stage 2 of the process. | ||||

Source: National Audit Office | ||||

■ oversights in the Airline Group's due diligence process, which had underestimated the staff numbers and costs in NATS, and

■ revisions to the Group's air traffic projections.

Overall these changes reduced the amount of debt that the Airline Group believed NATS could carry by £135 million, an amount that was reduced in subsequent negotiation.

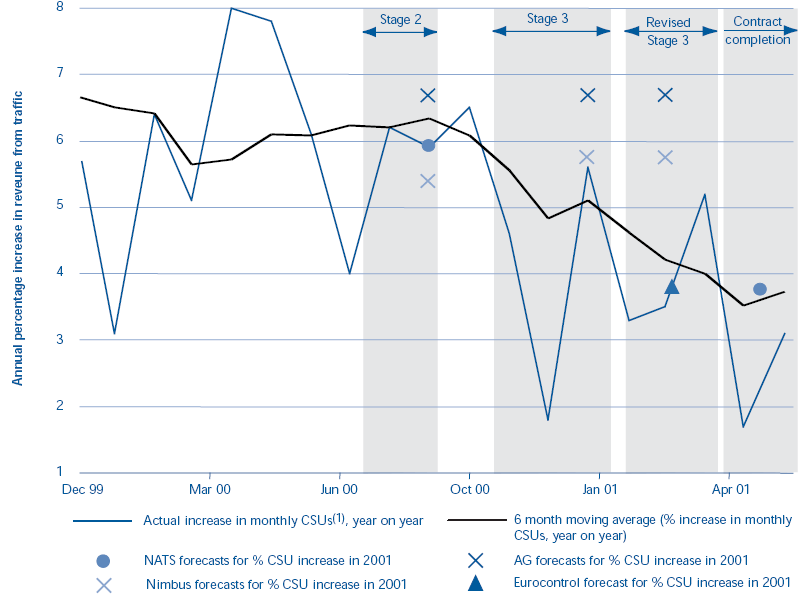

1.20 The value of NATS is heavily dependent on forecasts of the number and size of aircraft using its services since this affects its en route revenues. The bidders drew on NATS' own traffic forecasts, but came to their own views. The Airline Group's forecast of future traffic growth had consistently been the highest of the bidders. Figure 10 overleaf shows that its forecast for 2001 remained unchanged at 6.7 per cent, despite indications by the end of 2000 that traffic growth might be reducing. This decline was due primarily to the slowing US economy and secondly, from February 2001, the effects on the tourist market of foot and mouth disease. In March 2001, the European air traffic management authority, Eurocontrol, revised its 2001 forecast for the UK down from 5.9% to 3.8% growth. The information from Eurocontrol was supplied to the Department, who were also receiving weekly traffic reports from NATS. The Department continued to use NATS' September 2000 traffic forecast as the benchmark in the selection of the strategic partner. Increasing evidence that the US economic slowdown was having a persistent effect on UK traffic levels caused NATS, in conjunction with the Airline Group, to revise its forecasts in May 2001. In terms of whether an earlier revision should have been made, NATS considered that the bidders were also getting monthly reports of traffic levels and should have been able to draw their own conclusions as to whether a downturn was occurring.

1.21 As shown in Figure 11 overleaf, the deal eventually agreed between the Department and the Airline Group in July 2001 resulted in a reduction of £87m in initial proceeds for the Government compared with the Group's March offer. The Government also issued a loan note to NATS for £35 million, repayable over the next 30 years. The value of this loan note was estimated by CSFB to be worth £21m in 2001 terms. These repayments in effect represent deferred sale proceeds for the taxpayer. The value of NATS implied in the Airline Group's offer decreased from £934 million in March 2001 to £873 million in July.

10 |

| UK traffic forecasts |

|

| This diagram shows the level of revenue increase in 2001 as forecast by the 3 main bidders, and by NATS and Eurocontrol, compared with the trend in actual levels of revenue increase. The diagram shows that bidders did not take into account the downward trend in the rate of revenue increase. Neither did NATS until the contract completion stage.

NOTE 1. CSU - Chargeable Service Unit. The basic unit of air traffic on which NATS and providers in other European states apply their charges. One CSU is equivalent to a 50 tonne aircraft flying 100 km. Source: NATS, DTLR, Eurocontrol |

11 |

| Reductions in the value of the Airline Group bid | ||||

|

| Proceeds to government fell mainly because the banks determined that NATS would not support as much debt as originally offered, and because by July there was no surplus cash for the government to extract from the business. | ||||

|

|

| Airline Group bid March 2001, £ million | Airline Group bid July 2001, £ million | ||

|

| Equity from the Airline Group |

| 50 |

| 50 |

|

| Additional loan from the Airline Group |

|

|

| 15 |

|

| Bank Debt for the acquisition of NATS |

| 796 |

| 733 |

|

| Cash in NATS at completion |

| 25 |

| 3.5 |

|

| Total Available Funds for the acquisition | 871 |

| 801.5 |

|

|

| Less: Banking costs |

| (26) |

| (33) |

|

| Less: Hedging costs |

| (0) |

| (7) |

|

| Less: Cash to be left in NATS |

| (0) |

| (3.5) |

|

| Initial cash proceeds to Government | 845 |

| 758 |

|

|

| Source: The Department's bid evaluations | ||||