Part 1 Introduction

1.1 This report is about an extension to the Inland Revenue's contract with Accenture to develop and operate the NIRS 2 computer system. The extension, which was approved in April 2000, covers development work not envisaged when the original contract was signed. It will increase the overall value of the contract by between £70 million and £144 million, depending on the amount of work ordered. The current estimates are for substantially less than £144 million.

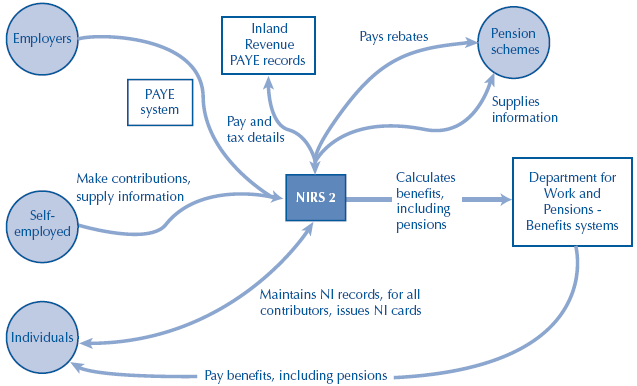

1.2 NIRS 2 - the National Insurance Recording System - is a large and complex computer system designed to support the administration of the national insurance scheme. It holds details of some 65 million individual national insurance contribution records. This information is fundamental to the accurate calculation of contributory social security benefits, such as retirement pension. It also underpins payments to pension schemes in respect of contributors with contracted out personal pensions. In 1999-2000, the Inland Revenue collected over £50 billion in national insurance contributions and the Department of Social Security (now the Department for Work and Pensions) paid out £46 billion in contributory benefits, based on records held on the system. Figure 2 provides a summary of the main functions of the system.

1.3 The NIRS 2 system was developed under the Private Finance Initiative to replace the existing National Insurance Recording System (NIRS 1). The development project was the responsibility of the Contributions Agency, then part of the Department of Social Security. In 1995, following a competition, the Agency awarded the NIRS 2 contract to Accenture - then Andersen Consulting. The contract was valued at £45 million for operational services with provision for software enhancements until the contract expired in 2004 increasing that to £76 million. It covered the replacement of NIRS 1, transfer of data to the new system, development of the system to implement legislative changes arising from the Pensions Act 1995, regular enhancements to the system, and the operation of the new service until 2004. We reported to Parliament on the competition in our 1997 report The Contract to Develop and Operate the Replacement National Insurance Recording System.3

2 |

| NIRS 2 main functions and interfaces |

|

|

|

|

| Source: Based on Inland Revenue description of NIRS key functions |

1.4 The NIRS 2 system was originally intended to be delivered by February 1998 but implementation was delayed and the system was accepted into service, with caveats, in August that year. There have also been operational difficulties which have led to delays in processing and payments, resulting in poor customer service. The Committee of Public Accounts have reported on the system on three occasions and have taken a close interest in progress in addressing the delays in implementation.4 By April 2000, the original system had been fully implemented, except for some features judged to be of a lower priority than later enhancements.

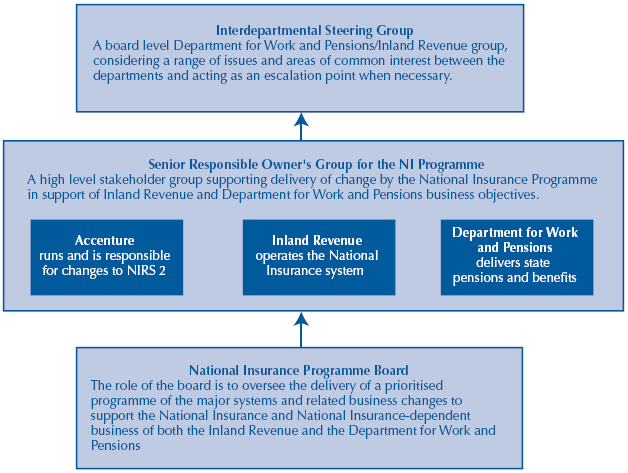

1.5 The Inland Revenue took over responsibility for NIRS 2 in April 1999 on the transfer of the Contributions Agency. The Inland Revenue are now responsible for collecting national insurance contributions and maintaining records but the social security benefit payment functions supported by NIRS 2 are the responsibility of the Department for Work and Pensions. While the Inland Revenue have overall responsibility for managing the NIRS 2 contract, they have set up joint working arrangements which bring together the main parties committed to the effective operation of the system. Figure 3 outlines the main organisational responsibilities and joint working arrangements relating to NIRS 2.

1.6 In 1998, the Government proposed significant changes to pensions and national insurance legislation. The Inland Revenue, on assuming responsibility for the contract in April 1999, worked with the Department of Social Security and Accenture to establish how best to support the legislative changes. After evaluating various options, the Inland Revenue decided that an extension to the NIRS2 contract was the appropriate vehicle to deliver the development work needed to support the changes within the prescribed timetable.

1.7 A contract addendum signed in April 2000 provides a framework within which the Inland Revenue can order the additional work from Accenture. The extension allows for a minimum capacity to cover known changes that needed to be made, and a maximum capacity to ensure any further legislative changes can be accommodated. If the minimum capacity is required for the 5 years to 2004 the estimated value of the extension is £70 million, while the value of the maximum capacity is £144 million. The current estimates are for substantially below this upper limit.

3 |

| Organisational responsibilities for NIRS 2 |

|

|

|

|

| Source: Inland Revenue statement of NIRS 2 roles and responsibilities (amended) |

1.8 We examined:

■ the extent to which the original NIRS 2 contract provided flexibility to accommodate changes in government programmes (Part 2);

■ why the Inland Revenue decided to extend the NIRS 2 contract and the steps they have taken to minimise the risk of further difficulties arising (Part 3).

This report focuses on the contract extension; our most recent report on progress with the implementation and operation of the NIRS 2 system was included in the Comptroller and Auditor General's Report on the National Insurance Fund Account 1999-2000.5

1.9 We based our conclusions on the following evidence:

■ the Inland Revenue's estimates of the amount of software development work arising from legislative changes;

■ papers relating to the original NIRS 2 contract and contract extension;

■ the Inland Revenue's comparisons of the cost of extending the contract with Accenture against the cost of engaging another supplier;

■ correspondence and notes of meetings between the Inland Revenue and Accenture about the negotiation of the contract extension;

■ interviews with the Inland Revenue's contract management team, National Insurance business manager and key staff involved in the contract negotiation, former Department of Social Security staff and Accenture's contract management team;

■ performance under the terms of the contract from the date of re-negotiation; and

■ a comparison of the contract documentation with the principles set out in the Treasury Taskforce guide to Private Finance Initiative contracts, The standardisation of PFI contracts and the Committee of Public Accounts Report, Improving the Delivery of Government IT Projects6 and the Cabinet Office review of major information technology projects (the McCartney report).7

_______________________________________________________________________________

4 The contract to develop and update the replacement national insurance recording system (46th Report, Session 1997-98 (HC 472))

Delays to the new national insurance recording system (22nd Report, Session 1998-99 (HC 182))

National Insurance Fund 1998-99 (31st Report, Session 1999-00 (HC 350))

6 Improving the Delivery of Government IT Projects (1st Report, Session 1999-2000 (HC 65))

7 Successful IT: Modernising Government in Action, Cabinet Office Central IT Unit 2000.