The Inland Revenue assessed the value for money of a contract extension with Accenture against industry comparators

3.5 The Inland Revenue commissioned PA Consulting to develop a financial evaluation model which they used to compare Accenture's proposals with the estimated £44 million cost of breaking the NIRS 2 contract and using alternative suppliers. The model compared Accenture's unit costs with: (i) average costs in the industry; (ii) the costs charged by EDS, the Inland Revenue's strategic supplier on other work, representing the typical charge from an outsourcing company; and (iii) Accenture framework rates. The estimates for alternative suppliers included an element reflecting the differential cost for a new supplier to operate the existing system including previous enhancements. The Inland Revenue estimated this at £31 million.

|

5 |

|

Alternative options considered for delivering key legislative changes |

|||

|

|

|

The joint design team considered other developments, which mainly involved changes to the processing of annual returns from employers, and determined that they could be implemented without amending NIRS. |

|||

|

|

|

Development |

Solution |

Alternatives considered |

Rationale |

|

|

|

Restructuring of National Insurance contribution thresholds and limits |

Full implementation on NIRS |

Clerical Defer changes |

Affects core NIRS functions. Clerical option not viable as 48 million records affected. Deferral difficult as employers had started amending rates and thresholds on payroll systems. |

|

|

|

Enabling SERPS pensions to be shared on divorce |

Implementation on Benefits Agency system with some modification to NIRS |

Defer scheme Clerical Full implementation on NIRS |

Could be implemented using Pension Valuation on Divorce System at similar cost. |

|

|

|

Revised rules for calculating Incapacity Benefit |

Full implementation on NIRS |

Alternative IT Clerical Deferral |

Change manageable on NIRS. Alternative IT system likely to be more expensive. Clerical option available as fall-back. Deferral would jeopardise £25 million of savings. |

|

|

|

Reform of bereavement benefits |

Full implementation on NIRS |

Clerical Deferral |

No alternative to NIRS which delivered predecessor benefit. Deferral would risk legal claims from bereaved claimants under Human Rights Act. |

|

|

|

Introduction of stakeholder pensions |

Full implementation on NIRS Deferral |

Registration of schemes and scheme members could be delivered by EDS on separate system at similar cost, reducing risk to NIRS. |

|

|

|

|

Introduction of State Second Pension |

Full implementation on NIRS |

Alternative IT Deferral |

Timetable not yet fixed so could be implemented on NIRS at lower risk. |

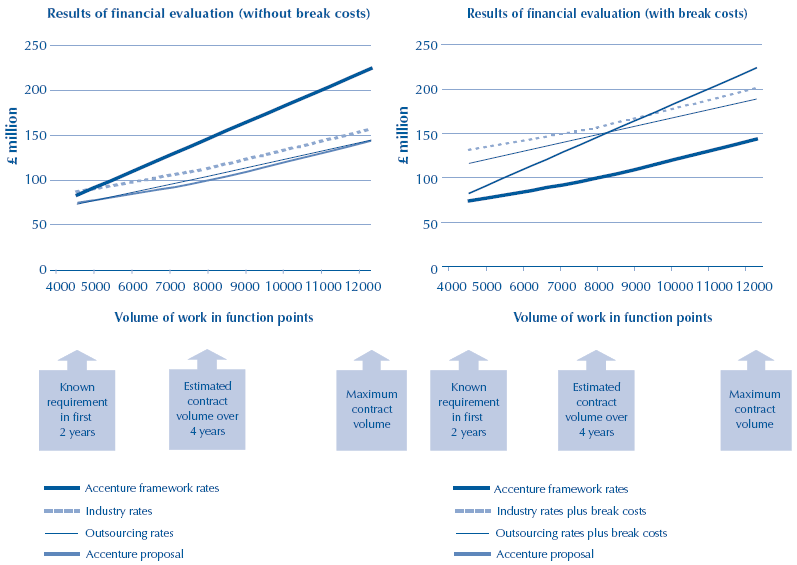

3.6 The cost comparisons (Figure 7) showed that Accenture's unit costs compared closely with alternative suppliers, but breaking the contract would have incurred substantial additional costs. The closest comparison was with EDS rates because their long-term contract with the Inland Revenue includes staff charges below the industry average - although it must be recognised that the EDS rate resulted from an outsourcing type contract which is very different from the PFI contract for NIRS 2. The model costed Accenture's proposals at £100 million for a contract volume of 8,000 function points. Using EDS rates, the cost would have been £105 million, but when the £44 million cost of breaking the contract was taken into account the total outlay would have been £149 million. Figure 6 shows the break costs, which were validated by PA Consulting.

|

6 |

|

The additional costs of breaking the contract with Accenture |

|

|

|

|

|

|

£m |

|

|

|

|

Cost of mounting new procurement |

2 |

|

|

|

|

Early termination and ongoing licences to use the system |

19 |

|

|

|

|

Handover payments (overlap of key staff, new supplier's transitional costs) |

16 |

|

|

|

|

Buying out previous enhancements not yet paid for, fixing known faults |

7 |

|

|

|

|

|

44 |

|

|

|

|

Source: Inland Revenue NIRS 2 financial evaluation model |

|

|

|

7 |

|

Accenture's proposal offered better value for money than breaking the contract |

|

|

|

Comparing the costs of delivering development work, Accenture's proposal compared closely with the benchmarks used by the Inland Revenue - industry rates and outsourcing rates. But when the £44 million cost of breaking the Accenture contract is added to the comparators they become much more expensive than the Accenture proposal. |

|

|

|

|

|

|

|

Source: Inland Revenue, NIRS 2 financial evaluation model |

3.7 Accenture's proposal included higher staff charges than the comparators. The Inland Revenue considered, however, that, if they used an alternative supplier, they would have to accept rates above the industry average because another supplier would be likely to require a premium to take over the system, given its record.

3.8 Although Accenture's staff charges were higher, the model assumed that the firm would be able achieve higher productivity than the comparators. Accenture agreed to accept a productivity target of 7.5 staff days a function point for NIRS 2 development work under the contract extension compared with a rate of 8 to 10 staff days achieved on the base system. The Inland Revenue's operational researchers estimated that a new supplier, lacking knowledge of the system, would achieve a rate of 11.5 staff days a function point. The model used this rate to estimate the costs of using an outsourcing contract or another industry comparator.

3.9 We noted that the target productivity rates on new work carried out under the Inland Revenue's outsourcing contract, which reflect six years of experience with the relevant systems, would produce much lower unit costs than those used in the model. But even using this more optimistic assumption, the model showed that the outsourcing costs would have been higher than the Accenture proposal, although their lower unit costs would come close to outweighing the costs of breaking the contract at very high volumes of work (Figure 8).