The Inland Revenue concluded that a contract extension provided the best option for delivering the additional requirements in the timescale required

3.10 The Inland Revenue carried out an evaluation of whether the Accenture proposal offered value for money. In addition to the financial evaluation, they assessed Accenture's ability to deliver software of the required quality, their commercial stability, security issues, legal and commercial issues, the legislative timetable, and the scope to improve their management of development work.

3.11 The Inland Revenue concluded that the technical review by PA Consulting (paragraph 2.10) and the progress made in stabilising NIRS 2 gave assurance on the quality of NIRS 2 software. They also examined Accenture's performance in delivering a system to another customer using the Design Build and Run approach to software development and obtained external advice which gave assurance on Accenture's commercial stability. They had some concerns – which have since been resolved - about Accenture's disaster recovery arrangements but did not consider that there were other security issues.

8 |

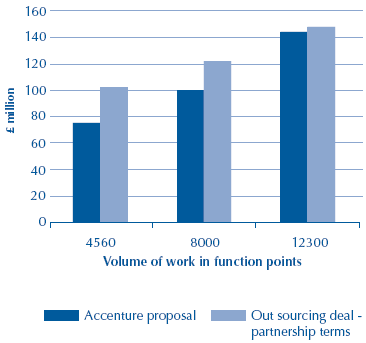

| Using different productivity assumptions, one comparator would have been almost as competitive as Accenture |

| ||

|

|

|

|

| Source: National Audit Office recalculation of financial evaluation model |

3.12 In addition, the Inland Revenue considered the feasibility of making changes to the arrangements for commissioning enhancements. The first major software release after the acceptance of the system was in April 1999 and improvements to procedures for enhancements were in the process of being developed with Accenture. But at that point they had given rise to operating difficulties because the original contract, drawn up within the PFI framework then in operation:

■ included procedures for proposing, evaluating and approving development work, but did not clearly define how enhancements were to be accepted or tested;

■ did not define clearly which types of smaller and regular enhancements were included in the basic contract price, which led to contractual disputes; and

■ did not provide a mechanism to distinguish changes required to meet legislative requirements from routine change requests.

When the Department of Social Security sought compensation for the delayed implementation of the system, there were also disagreements between the Contributions Agency and Accenture over the contractual requirements relating to system developments.

3.13 Since the original contract was signed, the Government have produced substantial additional guidance, in the light of experience with this and other contracts.10 In particular, the McCartney report emphasised modular and incremental development of projects, mechanisms to ensure open communication between client and supplier, and jointly agreed and documented change control processes. The Inland Revenue concluded that the proposed extension to the contract could be designed to reflect current guidance to achieve improved working methods and reduce risk. They obtained legal advice to confirm that these new requirements could be reflected in the contract.

3.14 In carrying out their evaluation, the Inland Revenue also took into account the need to deliver changes arising out of the legislative timetable. Using a supplier other than Accenture would have delayed implementation of the changes because of the time it would have taken for them to mobilise and become familiar with the system. It would also have required the Inland Revenue to break the existing contract, resulting in delay while they held a new competition. This could have led to additional costs for the government - for example, claims for compensation from pensions providers if systems were not implemented, or the costs of providing alternative clerical solutions. The Inland Revenue did not quantify these costs, but they would have made alternatives more expensive and risky.

3.15 The Inland Revenue needed to be in a position to place orders for development work in 2000-01. They also wished to manage development work in a way that would overcome the operating difficulties discussed in paragraphs 3.12 above. They considered that the Design Build & Run option proposed by Accenture offered:

■ a suitable structure to resolve issues with NIRS 2 and to take developments forward;

■ a vehicle for improving working methods on the contract; and

■ reduced risk compared with the previous arrangements.

3.16 In the light of all these factors, the Inland Revenue concluded that a contract extension provided the best option for meeting the legislative requirements in the timescale set and reached agreement with Accenture on these terms.

_______________________________________________________________________________

10 The standardisation of PFI contracts, Treasury Private Finance Taskforce 1999 Successful IT: Modernising Government in Action, Cabinet Office Central IT Unit 2000.