They compared the costs of the two final bids with those of continuing with the existing systems

2.23 The Department supplied bidders with a spreadsheet model of their estimates of the costs of continuing to operate fixed telecommunications under the existing arrangements over a ten year period. They asked bidders to provide their own estimates of the costs to the Department on that model, to ensure that bids were received in a consistent format to assist fair comparison.

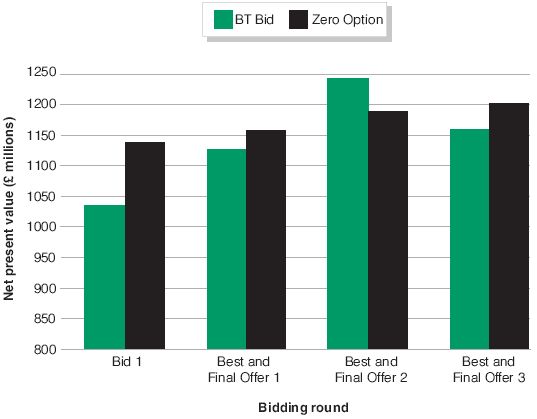

2.24 During the procurement process the Department's calculations showed many changes in the savings that the bids would deliver, compared with continuing the existing systems. The changes arose from the Department changing their estimates of the costs of continuing the existing systems, amending the scope of the project, and other pricing changes by the bidders. The effect of these changes on the Department's evaluation of BT's bid is shown in Figure 9. These various changes made it difficult for the Department to monitor the comparative value of the bids they received at different stages of the procurement.

2.25 The Department did not prepare a public sector comparator to compare the privately financed bids against the costs of a similar publicly funded project. Instead, they compared the bids, together with other costs of delivering the service which would be borne directly by the Department, with the costs of maintaining the existing network provision (the Zero Option). They concluded that the BT bid was better value for money than the Zero Option (Figure 9). The Department told us that a full public sector comparator would have been unrealistic, as there was little prospect of financing a reliable non-privately financed option. This was in line with Treasury guidance at the time10. The Department also stated that the preparation of a full public sector comparator would also have required a great deal of the Department's resources.

How the costs of the BT bid and the Zero Option changed over the competition process

|

|

|

Figure 9 |

| |

|

| |

| The figure shows how BT's bids and the Department's Zero Option changed during the bidding process. In addition, changes to the project scope and planned cost savings resulted in the cost of the Zero Option reducing from the earlier estimate in the Project Definition Study (Figure 6, page 18). The various changes in the Zero Option made it difficult for the Department to compare the expected savings at different stages of the procurement. | |

|

| |

Source: Ministry of Defence/National Audit Office |

| |

2.26 Neither difficulties in financing a publicly funded alternative nor the extra resources needed to prepare a public sector comparator are reasons for not comparing the cost of privately financed solutions with traditional procurement. The comparison provides evidence of the extent to which privately financed solutions represent value for money. The Treasury guidance which the Department were following was subsequently withdrawn in March 1998 and the Treasury's current guidance stresses the importance of a public sector comparator in the financial assessment of a Private Finance Initiative project. The Department were not in a position to demonstrate that the BT bid was better value for money than might have been obtained under traditional procurement, as they did not know the cost of a fully compliant publicly funded alternative. They had, however, received two bids based on publicly financed capital expenditure from GPT and Nortel, and concluded from these that traditional procurement was unlikely to deliver value for money.

2.27 The GPT and Nortel bids assuming public finance had both initially appeared to offer greater savings than the privately financed bids from BT and Racal. But, as explained in paragraphs 2.12 to 2.15 above, the Department considered that the GPT bid was not technically feasible and was, therefore, not a credible comparator. They considered that Nortel's bid, after adjustments, did offer a reasonable guide to the cost of a largely compliant publicly funded project. But, as explained in 2.13 to 2.15, the Department chose to invite BT and Racal to submit further bids based on private finance, as they were keen to pursue a privately financed solution even though Nortel's bid had offered more savings than Racal over ten years.

2.28 After deciding not to pursue Nortel's publicly financed bid, the Department did not subsequently update their comparisons with the expected cost of a publicly financed alternative to take account of the final bidding round and the late changes in the specification. As BT's bid improved in the final round of bidding, after taking account of the specification changes, the Department consider BT's final price was likely to have been better value for money than traditional procurement.

________________________________________________________________________________________________________

10 The Treasury guidance "Private Opportunity, Public Benefit" issued in November 1995 (but now withdrawn) said that a comparator was not needed if a project could not have gone ahead as a publicly financed project at the time a department were seeking privately financed bids. The Treasury's subsequent guidance issued in 1998 expects a comparator to be produced to demonstrate whether value for money has been achieved.