The Department selected its preferred bidder after a competition but the original timetable was unrealistic and negotiations were protracted

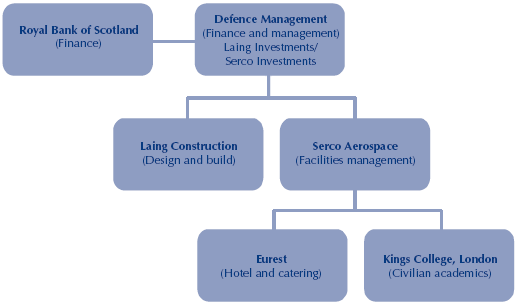

2.5 In June 1998 the Department awarded the PFI contract to Defence Management, a special purpose company wholly owned by Laing Investments and Serco Investments (Figure 7). Under the 30 year contract Defence Management had to design, build and finance the permanent facilities for the college. It then has to provide a range of support services (Figure 1). In return for making the facilities available and providing the support services to the required standards Defence Management is paid £26 million a year (at 2000 prices) (Figure 8).

2.6 In February 1997 the Department chose Defence Management as its preferred bidder after a competition during which it received bids from only two companies. It preferred Defence Management as its bid offered the best value for money. At a cost of £193 million3 Defence Management's bid was half the cost of the other bid. The Department also considered that Defence Management's design and operational proposals, with its proposed construction of new facilities on surplus land at an existing Department site at Shrivenham, were of a higher quality.

7 |

| Defence Management and its contractors |

|

| Defence Management's shareholders are Laing and Serco Investments. Associate companies of these were awarded the contracts for˜ construction and the provision of support services. Serco Aerospace in turn sub-contracted the provision of certain of these services. |

|

| Source: National Audit Office |

8 |

| The structure of thr PFI fee1 |

Defence Management will receive £26 million a year (at 2000 prices) if it makes the facilities available and provides the support services to the required standards. |

|

| Guaranteed Usage |

| Non-guaranteed usage fee rate |

| Number | Fee rate £ | Total Payable £ million | £ |

Student place days | 128,860 | 97 | 12.5 | 2 |

Residential place days | 138,894 | 45 | 6.3 | 5 |

Married quarters weeks | 15,080 | 489 | 7.4 | 62 |

|

|

| 26.2 |

|

NOTE 1 All figures are at July 2000 prices and exclude VAT. Source: PFI Contract | ||||

2.7 After Defence Management's selection as preferred bidder there was a long period of negotiations until the contract's eventual signature 16 months later in June 1998. These negotiations took 12 months more than expected for a number of reasons. These included the need to gain planning permission for the new facilities at Shrivenham and to agree a number of outstanding contractual and risk transfer issues which the Department had not resolved prior to its selection of the preferred bidder. In our experience, such lengthy negotiations with the preferred bidder were a common problem on other PFI projects at that time. The subsequent issue by the Treasury of guidance on the selection of preferred bidders and of standard terms and conditions for PFI contracts4 should, if followed by departments, contribute to reductions in the time taken to complete such negotiations on future deals.

2.8 During these lengthy negotiations, there was an increase in the cost of Defence Management's bid from £193 million to £200 million. This increase largely occurred because of changes to the Department's requirements, such as increases in the estimates of the number of academic support staff required, as the design of the main Advanced course was finalised, and improvements in the IT requirements, as well as inflationary increases to construction and other costs arising from the delay in finalising the deal. The total increase was, however, limited to under 4 per cent as a fall in interest rates during the period offset, in part, the cost increases. Without these savings the cost of the bid would have increased by almost 10 per cent. The Department told us that, if there had been no interest rate savings and it had been faced with a 10 per cent increase in the bid price, it would have reduced its requirements to minimise any such cost increase.

2.9 There were a number of changes to the allocation of risk sought by the Department during the negotiations. The final allocation of risk agreed (Figure 9) is, in our opinion, broadly in line with other PFI contracts signed at that time. The Department also has some rights under the contract should Defence Management seek to refinance the deal. In our experience these rights are stronger than those contained in other PFI contracts dating from this time. For example, Defence Management cannot make a material amendment to its financing arrangements without the Department's prior consent if this will increase the Department's liabilities under the contract.

__________________________________________________________________

3. Costs are discounted to 1997 prices using a 6 per cent discount rate.

4. Treasury Taskforce Technical Note 4 "How to appoint and work with a preferred bidder" (July 1999); Standardisation of PFI Contracts (July 1999).