Before signing the contract the Department confirmed that the PFI offered best value for money

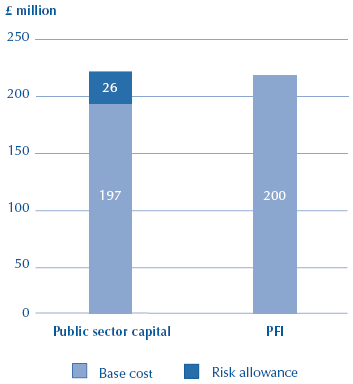

2.10 The Department chose to sign the PFI contract in June 1998 as it had concluded in its financial appraisal that the proposed deal at £200 million5 was £23 million (10 per cent) cheaper than the option based on the use of public sector capital (Figure 10). We found no significant errors in these calculations.

9 |

| Summary of risk allocation | ||

|

| The allocation of risk agreed in the final contract is, in our opinion, broadly in line with other PFI contracts signed at that time. | ||

|

| Risk | Party bearing risk | Detail of allocation |

|

| Design and construction | Defence Management did not start to receive any payment due under the contract until the start of service delivery in the newly completed facilities | |

|

| Availability | Payments to Defence Management are reduced if it fails to make areas of the new facilities available for use by the Department | |

|

| Performance | Payments to Defence Management are reduced if it fails to provide support services at the new facilities to the required standards | |

|

| Inflation | Shared | Defence Management's fee is subject to annual indexation by a pre-agreed formula. Defence Management will bear the extra costs if its underlying costs increase by more than this indexation, although certain costs will be benchmarked against market rates after ten years of service delivery |

|

| Demand | Shared | The Department has guaranteed to buy a certain level of usage at the new facilities but the level of this guarantee decreases in later years |

|

| Residual value | Shared | The College facilities will revert to the Department at the end of the contract or the Department can choose to leave them with Defence Management |

|

| NOTE For details on the allocation of risk, see Appendix 3. | ||

10 |

| Comparison of costs of PFI and public sector capital options (June 1998) |

|

| Defence Management Limited's bid was 10 per cent cheaper than the public sector capital option. |

|

| NOTE All costs discounted over 30 years to 1997 prices. Source: The Department |

2.11 In line with good practice, after analysis by the Department and its financial advisers, Price Waterhouse, of the risks involved, the Department added £26 million to the public sector capital option's base cost in respect of the risks transferred to the private sector under the PFI but retained by the Department under the public sector capital option. This addition was necessary in order to put the costings of the PFI and publicly financed options on an equal footing as the PFI bidder included its own allowance for these risks in its bid price. At 13 per cent of the public sector capital option's base cost, the risk allowance on this project is at the low end of the range of between 10 per cent and 40 per cent of such allowances on other PFI accommodation projects we have examined.

2.12 The Department considered that the proposed deal brought non-financial benefits. The public sector capital option would not meet its requirements as well as the PFI because of the limitations of the Camberley site which would entail the need for two separate buildings and thus make for an environment that was less joint than required. Camberley would involve the retention of more risk by the Department. The alternative option of remaining at Bracknell and upgrading the facilities there was likely to be more expensive and difficult to implement due to problems in obtaining planning permission, and would bring fewer operational benefits.

2.13 The proposed PFI deal was affordable. In April 1998 the Department identified that the payments due under the PFI would exceed its available funding by £2.5 million in the first four years. However, it considered that it would manage the shortfall within its overall budget. In contrast, it would have difficulty funding the public sector capital option with its requirement for up-front capital expenditure.

__________________________________________________________________

5. Costs are discounted to 1997 prices using a 6 per cent discount rate.