Intrinsic project risk

2.3 These are risks faced by any major capital investment. The only NHS-specific risks relate to the clinical content. All capital investments must manage these risks. Many struggle unsuccessfully to balance time, cost and quality. None will succeed without good risk, project and programme management.

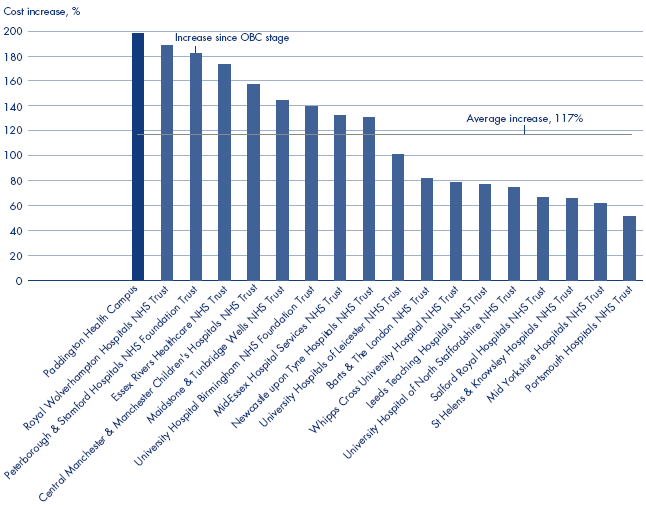

2.4 A major project risk affecting affordability is that of the history of cost escalation for large NHS schemes. All large NHS capital investments (schemes above £75 million) cost significantly more than their initial OBCs. For major schemes either in planning or build stage, the average cost increase above the original OBC is 117 per cent (Figure 3 overleaf). In the case of the Campus scheme it was late 2002 before the Campus partners realised, for the first time, that, because of the inadequate 2000 OBC, the likely full costs of delivering the scheme had more than doubled to £786 million (excluding optimism bias).

2.5 In the case of the Campus scheme, the 2000 OBC omitted any material cost relating to how St Mary's hospital would be kept operational while the new hospitals were built on the St Mary's site - the decant strategy. The original OBC allowed £1 million for this. The Campus partners' 2003 estimate was for £80 million for what was, by then, a completely different scheme because the Campus's space requirements grew during its development.

2.6 Securing planning permission is a standard risk that needs to be managed. The NHS Capital Investment Manual states that Trusts are expected to obtain outline planning permission for the site to be developed prior to advertising the scheme in the Official Journal of the European Union (OJEU). In the case of the Campus scheme the partners did not expect planning permission to pose a threat to the viability of the scheme. After a tendering exercise in 1999, the Kensington, Chelsea and Westminster Health Authority appointed Skidmore, Owings & Merrill (SOM) as consultant architects, at a cost of £35,000, to undertake a seven week study to identify a Master Plan and Urban Design Strategy. The work was later extended to cover an Outline Planning Application for the selected Master Plan.

3 | Increases in estimated capital cost since original OBC for NHS capital schemes over £.75 million |

Source: Draft memorandum received from the Department of Health containing replies to a Written Questionnaire from the Health Select Committee, HC 736 (iii)1, Session 2005-06, December 2005. Figure for Paddington Health Campus calculated by National Audit Office. | |

2.7 After spending £1,040,000 in total with SOM on design fees for a planning application prepared in accordance with an agreed development brief, the scheme failed to secure outline planning permission adequate for the development.7 Outline Planning Permission was agreed in principle by Westminster City Council in August 2002, subject to the completion of a legal agreement. In the event the planning permission was not issued as the scheme had moved on.

2.8 In the negotiations with the Campus partners on the August 2002 scheme, Westminster City Council's planning department had stressed the maximum bulk and scale that could be recommended for the site and therefore believed the partners to be aware of its planning concerns before November 2002. In November 2002 the Council's planners advised that the scheme, which was by then significantly different from the August 2002 scheme, was too large for the existing site (by one floor for St Mary's and two floors for the Royal Brompton and Harefield's proposed buildings). This required the partners to acquire additional land to address the building design issues.

2.9 Procurement of a major capital investment of the scale of the Campus scheme is a one-off event and few if any NHS Trusts or Boards have the necessary skills for such a scheme. In November 2002, the Campus partners appointed Partnerships UK (PUK) as a procurement co-sponsor for the scheme (backdated to 1 July 2002). St Mary's NHS Trust told us that Campus partners assumed that with the degree of expertise that PUK brought, they had the best available advice on the management of complex PFI projects in the NHS. This included the procurement of advisers and property advice.

2.10 PUK's role was to work with the Campus partners to achieve the successful procurement of a contract for the scheme in a timely and efficient manner. PUK also agreed to fund 50 per cent of internal and third party project development costs up to a maximum of £6 million and share any value for money savings from a signed contract.

2.11 If the scheme was cancelled by the Campus partners PUK would recover its direct costs and project funding. Once the scheme was cancelled, when the Royal Brompton and Harefield NHS Trust did not recommend the May 2005 Addendum to the OBC for approval, PUK was therefore entitled to recover its investment. In October 2005 the Trusts agreed to settle the amount due to PUK which represented £1.1 million in direct costs, £4.8 million for third party and internal project development costs funded by PUK and £0.1 million in interest charges for deferred payment. The NHS Trusts agreed to pay these amounts, in broadly equal proportions in April 2006, because of cash-flow problems in the NHS in the North West London Strategic Health Authority. The Strategic Health Authority has agreed to reimburse the two Trusts £1 million each towards the settlement of the sums due to PUK.

________________________________________________________________________________

7 Initial payments were made by Kensington, Chelsea and Westminster Health Authority on behalf of the West London Partnership Forum until October 2000, after which St Mary's NHS Trust hosted payments in accordance with its Standing Financial Instructions. Kensington, Chelsea and Westminster Health Authority waived its Standing Financial Instructions to take account of the increased cost as the Paddington Basin Steering Group judged the time required to tender the work would have delayed the planning application unacceptably. The only other material breach of procurement guidelines was the contract with Mike Flaxman Associates, let in 2000 on the basis of a cost estimated by the Campus partners at £75,000 for consultancy on NHS financial matters. The work was not tendered until 2002 by which time Mike Flaxman Associates had been paid £173,000. In total they were paid £460,000 between March 2000 and June 2005.