The supplier bears several key business risks

2.27 We examined the financial model produced by Arteos and found that the business appears to be able to survive significant reductions in income or increases in cost without requiring additional financing according to key cover ratios. These ratios, which are used in the financial appraisal of projects, measure the extent to which current and future liabilities to lenders are covered by available cash flows. Arteos expects to obtain an internal rate of return on equity of close to 15.5 per cent, which is comparable with the return sought on similar projects in the United Kingdom, although the more mature PFI market in the United Kingdom tends to produce lower cover ratios. It is difficult to compare with other projects in Germany given the lack of PFI projects.

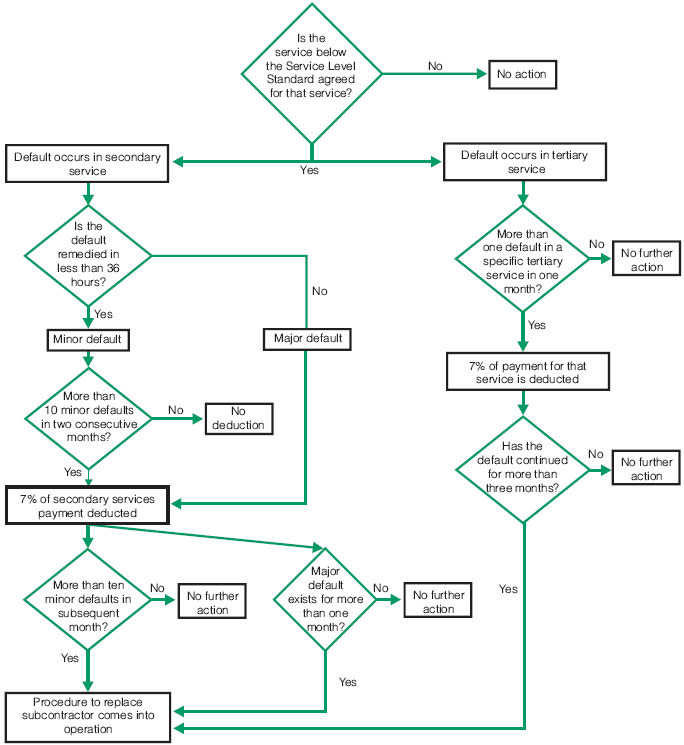

Figure 12 |

|

Service deduction regime | |

If service defaults are not remedied within a specified period, the contractor responsible can be replaced | |

| |

Note: 7% is the percentage profit of the consortium on service provision. | |

Source: The FCO | |

2.28 The FCO has retained the risk that the cost of tertiary services will change over the course of the contract. These services are subject to competitive tendering every three years with the result that the cost of these services will be passed through to the FCO so this risk will not be borne by the supplier.

2.29 The FCO also retained the risk that German value added tax may change. During negotiation it was agreed that if the rate of value added tax changed during the period of the contract, the FCO would reimburse any value added tax which is not recoverable from the German authorities, whilst any reduction in the rate of value added tax would benefit the FCO.

2.30 The FCO should obtain the Embassy even if Arteos goes into liquidation because the banks financing the project will wish to ensure their loan is repaid and the best way to ensure that happens is by finding another operator to complete the project. A structure is provided for this in the Direct Agreement between the FCO and the banks, giving the banks rights to propose a substitute operator. In the event that the banks did not wish to exercise their step-in rights for any reason, the FCO would have to arrange completion of the project, although the FCO would benefit from the expenditure incurred by Bilfinger + Berger up to their withdrawal from the project. In these circumstances it is uncertain whether the target handover date would be achieved because of the need to find a new supplier.

2.31 If Arteos was to go into liquidation the banks' claims for repayment of their loans would be better secured than any possible FCO claims for damages in case of a breach by the supplier of the project agreement. This is a common provision in a PFI agreement, but the provisions on Arteos's financial standing are also satisfactory in providing the FCO with some security, as Arteos is obliged to hold certain levels of cash reserves and equity holdings. In addition, the agreement with the banks provides for bank security to fall away on termination of the agreement, which means that it is in the interest of the banks to ensure that Arteos performs or if necessary to replace Arteos.