The main uncertainties are the risks and operating costs of the public sector option

2.38 As regards allowance for risk in the public sector comparator, the FCO assumed that the most significant risks would be FCO changes to the design before and during construction (which would add to the construction cost), claims for normal insurance risks, changes in the Embassy staff complement and therefore space requirements, and changes to security and service requirements in the operating period (which would add to the operating costs).

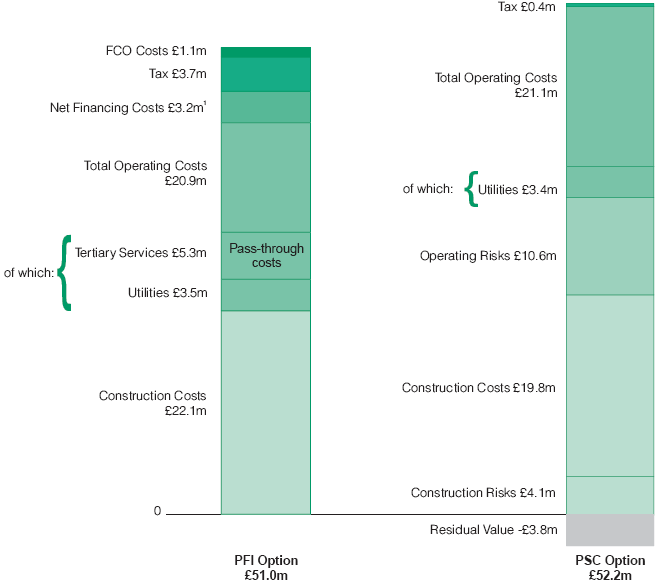

2.39 The quantification of risks inevitably involves a degree of judgement. For the risks associated with the construction of the Embassy, the FCO was able to draw on data on cost overruns on FCO conventionally procured construction projects. But in valuing operational risks, a number of judgements had been made. The initial valuation of risk, at £25 million net present cost, appeared too high, and was reduced in later versions of the comparator. The final valuations which the FCO placed on construction risk (£4.1 million) and operating risk (£10.6 million) are shown in Figure 13.

2.40 Finally, as regards the sensitivity to changing assumptions of the conclusion that the PFI deal and the public sector comparator offered very similar costs, the FCO examined in detail a number of exchange rate scenarios. These scenarios were based on assuming a variety of stable exchange rates from various dates. This analysis showed that the cost of the preferred bid could vary between £45.7 million and £53.6 million, depending on exchange rates in the short term. Similar analysis was applied to the public sector comparator, resulting in a range from £49.3 to £56.6 million. Since the contract was let, sterling has appreciated against the German mark, making the PFI option relatively better value for money.

2.41 In the light of information about Arteos's forecast costs which was made available to us during this examination, we examined further sensitivity tests, as shown in Figure 13. This analysis led to the following conclusions:

■ some of the costs which would fall to Arteos in the first instance could be passed on to the FCO, but there would need to be very unfavourable movements in these costs to render the PFI deal significantly worse value than the public sector comparator; and

■ the public sector operating costs are not fully comparable with the operating costs in Arteos's model.

Figure 13 |

| |

Comparison of the PFI Option and the Public Sector Comparator | ||

| ||

These columns show the overall net present cost of the PFI deal and the Public Sector Comparator are similar. There are three main areas where elements of these totals could vary. 1. PFI Operating Costs capable of being passed-through to the FCO.

2. PSC Operating Costs of £31.7 million.

| ||

Note: 1. | The financing costs under the PFI option are net of the residual value to Arteos of the building lease, estimated at £4.6 million. | |

Source: National Audit Office | ||

Tertiary services and utilities currently account for £8.8 million. The outturn of these costs could be higher or lower.

Tertiary services and utilities currently account for £8.8 million. The outturn of these costs could be higher or lower.