1 The risks and rewards from refinancing

1. The Trust let a PFI hospital contract to Octagon in January 1998 to build a new hospital, to then maintain it and provide facilities management services for a minimum period of 30 years. Octagon subsequently refinanced the contract in December 2003, two years after the new hospital opened. Octagon was able to secure improved financing terms because the construction phase of the project had been completed; the PFI market had become established; and commercial interest rates generally had fallen.2

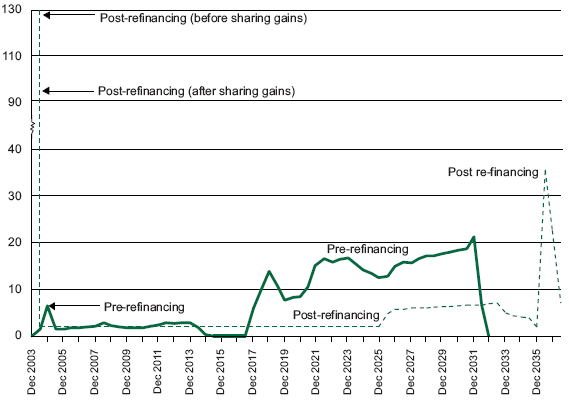

2. On refinancing, Octagon was able to extend the period of its borrowings, replacing bank finance repayable by 2018 with bond finance repayable by 2035. The longer borrowing period and lower interest rates available enabled it to increase its borrowings by 53% from £200 million to £306 million. It then used the additional funds to accelerate the benefits which its investors would receive from the project (Figure 1).3

Figure 1: Octagon's assessment of projected benefits to its shareholders following the refinancing

Note: Based on information provided by Octagon at the time of the refinancing the maximum potential immediate cash benefit to Octagon's investors following the refinancing was £129 million. After agreeing to share the refinancing gains with the Trust, the available immediate cash benefit to Octagon's investors was £95 million.

3. The net present value of the total refinancing gain was £116 million of which the Trust secured the right to receive £34 million (29%) under the voluntary code for early PFI deals which the Treasury had agreed with the private sector. The refinancing gain was calculated, in accordance with Treasury guidance, by discounting the expected cash flows to Octagon's investors at a rate of just under 19%, the expected cost of Octagon's equity capital when bidding for the contract. The use of a higher, rather than a lower, discount rate in these calculations increases the value of the refinancing gains because the value of accelerating benefits is enhanced by a higher discount rate.4

4. The acceleration of benefits to the investors, permitted by Octagon increasing its debt on refinancing, more than trebled the internal rate of return (IRR) which investors expected to receive from the project. The IRR is the discount rate at which the present value of the investors' receipts from a project equals that of their payments, including their initial investment. IRRs are often used to compare the investor cash flows in different bids for a project. This measure is very sensitive to increases to investor benefits in the early years of a project. In this project, the expected IRR, which had been disclosed as 19% when Octagon bid for the contract, rose to 60% following the refinancing and the sharing of the gains with the Trust.5

5. The Trust and the Department did not seek to defend the very high investor returns. They noted, however, that these high returns had arisen on what had been an early PFI deal; that the Trust had secured a share of around 30% of the refinancing gains it had not been entitled to contractually; and that Octagon's service had been very good. Whilst this was an early PFI hospital deal and investors will seek higher returns for the risks of investing in a new market, the involvement of the bank ABN Amro, which had financed the Fazakerley Prison PFI deal three years earlier, would have contributed relevant general PFI experience. That experience should have limited the investors' exposure to risks and their need for very high returns.6

6. At current prices, the Trust expects to pay £1.3 billion to Octagon over the life of the contract. The total cash Octagon's investors expect to receive over the life of the contract was projected to fall following the refinancing from £464 million to £335 million. The investors have, however, significantly increased their benefits from the project in the early years, in exchange for reduced benefits in the later years of the contract. The increase in the return to the investors reflected the value of receiving accelerated benefits from the project. The advantage of these accelerated benefits is similarly reflected in an increase in the net present value of the aggregate projected cash flows to the investors over the life of the contract (Figure 2).7

Figure 2: Changes in Octagon's investors' projected financial benefits

| At contract award | Just before the refinancing | Just after the refinancing | Post-refinancing benefits as multiple of pre-refinancing benefits |

Total projected cash flows to the investors over the life of the contract | £501m | £464m | £335m | 0.72 (or -28%) |

Net present value of the projected cash £47m flows to the investors over the life of the contract (note 1) |

| £35m | £117m | 3.34 (or +234%) |

Internal rate of return to the investors (note 2) | 19% | 16% | 60% | 3.75 (or +275%) |

Notes:

1 The net present values of the benefits to Octagon's investors are calculated, in accordance with Treasury guidance, by discounting the projected cash flows at 18.94%, the anticipated IRR to Octagon's investors reported by Octagon when the contract was let.

2 The internal rate of return is the discount rate at which the present value of the investors' receipts from a project equals that of their payments, including their initial investment. The increase following the refinancing reflects the high value of receiving large returns early in the project.

Source: Derived from Octagon's financial records relating to the refinancing held by the Trust's financial advisers, Royal Bank of Canada

7. The high rate of return to Octagon's investors following the refinancing is in line with the Darent Valley Hospital refinancing where the private sector also substantially increased its borrowings at the time of the refinancing in order to provide additional funds to pay accelerated benefits to the investors (Figure 3).8

Figure 3: Comparison of the returns to Octagon's investors following the refinancing with other PFI refinancings of comparable building projects

Project | Projected internal rate of return (IRR) to investors at contract letting | Projected IRR to investors just before the refinancing | Projected IRR to investors just after the refinancing (note) | Substantial increase in borrowings at time of refinancing | Projected IRR to investors following the refinancing as a multiple of the pre-refinancing IRR |

Norfolk & Norwich hospital | 19% | 16% | 60% | Yes | 3.75 (or +275%) |

Darent Valley Hospital | 21% | 23% | 56% | Yes | 2.44 (or +144%) |

Fazakerley Prison | 13% | 16% | 39% | No | 2.44 (or +144%) |

Ministry of Defence: Joint Services Command and Staff College | 18% | Not available | 31% | Yes | 1.72 (or +72%) |

Note: These rates of return are after the sharing of refinancing gains with the public sector. The comparator projects are other early PFI building projects on which the NAO has previously reported which have been refinanced.

Source: National Audit Office, from private sector financial models held by departments

8. The outcome of this refinancing has been that Octagon's investors have both increased their returns and reduced their risks as financial benefits from the project that were previously uncertain have now been realised. But the Trust, whilst sharing in the refinancing gains, has significantly increased its risks. In particular, the Trust could face significantly higher costs to break the contract as a result of Octagon increasing its borrowings.9

9. The additional risks to the Trust from the refinancing were as follows.

____________________________________________________________________________________________

2 C&AG's Report, paras 1-2, 1.2-1.3

3 ibid, Figures 6 and 7a, p8 and Figure 8, p9

4 C&AG's Report, Figure 2, p2, para 1.3; Qq 2-3, 123-126; Ev 20

5 C&AG's Report, Figure 2, p2 and para 1.3

7 C&AG's Report, Figure 8, p9 and Figure 24, p22; Ev 20, 24; Qq 60-71