Question 176 (Mr Ian Davidson): Details of risks for private companies involved in PFI projects

There are a number of PFI projects where significant risks have occurred for the private sector counterparties. Whilst there is no collated information, the following was collected from publicly recorded sources for the purposes of informing the Committee.

The National Physical Laboratory-A PFI contract awarded by the DTI in January 1998 was terminated in December 2004 following difficulties experienced by the private sector consortium in completing the construction to specification. The National Audit Office is currently studying how the DTI approached the project, negotiated the termination and evaluated the contractor's interest.

Press reports, including the Building magazine article of 17 June 2005 "No regrets" recorded that problems with the temperature in the facility "was the major factor in the £70 million hit that Laing took on the scheme in 2001".

The Dudley Hospital-A PFI contract was awarded to a consortium including the construction company Sir Robert McAlpine in 2000.

The National Audit Office noted in its Report Darent Valley Hospital: The PFI Contract in Action- HC 209 Session 2004-05 10 February 2005, that "Sir Robert McAlpine reported losses of £27 million in the two years to 31 October 2003". Higher figures (up to £71 million) have appeared subsequently in newspapers.

A contract to build and run an Energy Centre at the Mayday Healthcare NHS Trust in Croydon, was terminated in 2000, as the private sector consortium, which included Miller Construction failed to complete successfully the facility.

The financial problems at Jarvis plc have been widely reported. The group won up to 25 PFI contracts in the schools, local authority and smaller health facility sectors. Jarvis encountered problems with the construction on a number of those projects. In its consolidated balance sheet as at 30 September 2005, the group recorded accumulated losses of £710.8 million.

In September 2005 Mowlem announced a £70 million cut in profit and the contracts were all related to building, infrastructure and engineering, and that some of were PFI jobs.

Earlier this year it was Reported that Kajima, a Japanese construction firm was set to make a loss of £80 million because of problems on its PFI schools contracts.

In late 2003 the contractor Ballast was put into administration, after the company has lost £14.3 million in eight months to 31 August. Ballast was involved a number of PFI projects, including Tower Hamlets Schools.

Financial and accounting problems at Amey, a PFI and outsourcing company, led to a £55 million pretax profit in 2001 being restated as an £18 million loss.

The Internal Rate of Return (IRR) is the rate that when used to calculate the net present value of future cash flows gives an answer of zero.

The shareholder's IRR of 18.7% was the return that the shareholders expected to generate as a result of the competitive process for the entire PFI contract. The Octagon consortium was selected because their bid overall was the best for the Trust.

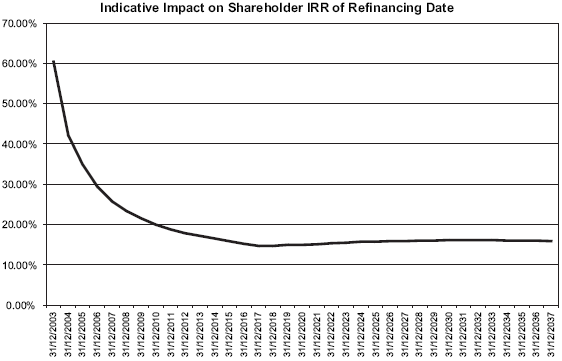

The calculation of the shareholder's IRR is sensitive to the timing of the receipts. The graph shown on the attached sheet shows what the shareholder IRR would be if the refinancing was delayed.

The IRR is a product of the timing of the refinancing and as a result of the refinancing being completed in December 2003 the IRR for the shareholders is 60%. The graph attached shows that the IRR changes dramatically dependent on the timing of the refinancing.