SUMMARY

1 Over the ten years to 2007, Northern Rock (the company) had become a stock market listed bank and grown rapidly to become the fifth largest provider of mortgages in the UK, with assets in excess of £100 billion. The company's growth was based on making competitively priced mortgages easily available. To maintain its competitiveness, Northern Rock required access to relatively low cost sources of funds, beyond what could be raised through retail deposits alone.

2 To raise the funds it needed, Northern Rock became reliant on wholesale lenders such as other banks and on selling, rather than retaining, the mortgages it had already issued. In August 2007, credit concerns stemming from bad debts in the US mortgage market caused banks to curb their lending to each other. As a result, Northern Rock began to experience problems in raising short term funds and rolling over existing loans from wholesale lenders. As the market worsened, the company became increasingly concerned that it would not be able to repay its wholesale borrowings as they became due, and asked the Bank of England (the Bank) for financial support in its role of lender of last resort.

3 The failure of a major bank would leave individuals and businesses unable to access savings or meet ongoing payment obligations. A single bank failure has the potential to destabilise other parts of the financial system and the economy generally, through its wider impact on consumer confidence. As banks are pivotal to the financial stability of the UK economy, successive governments have sought to regulate their activities.

4 The Financial Services and Markets Act 2000 created a single regulator for UK financial services, the Financial Services Authority (FSA). Alongside this, the Government also introduced a framework for the protection of financial stability, which set out the roles of the Treasury, the FSA, and the Bank of England (the Tripartite Authorities). In exceptional circumstances such as a major bank in severe financial difficulty, responsibility for the authorisation of a support operation and the use of public funds rests with the Treasury.

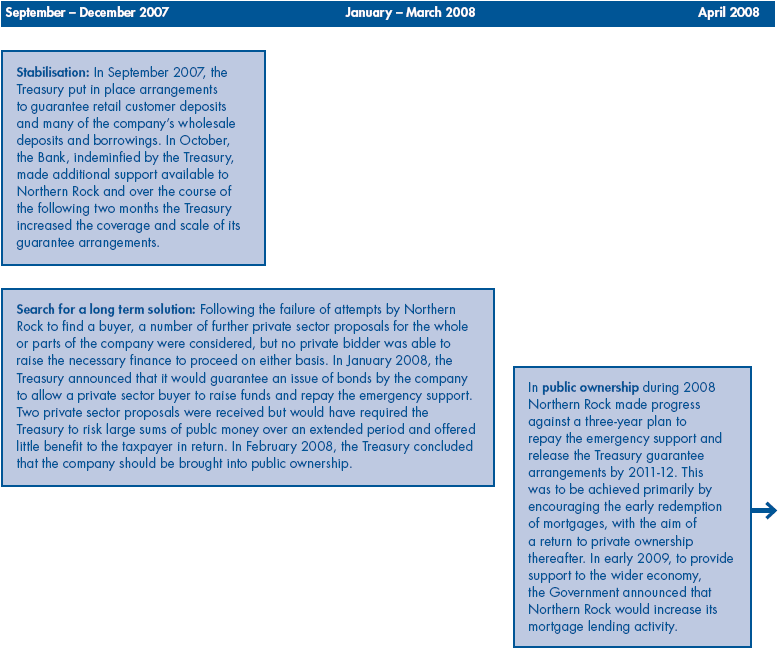

5 On 14 September 2007, Northern Rock announced that the Treasury had authorised the Bank to provide emergency support to Northern Rock, in the form of a loan secured against the company's highest quality assets. When Northern Rock's customers became aware of the existence of the support, queues formed outside the company's branches and, over a few days, just over £4.6 billion was withdrawn from depositors' accounts. The Treasury considered that the run on deposits could have an adverse effect on other banks. In response, the Treasury announced on 17 September 2007 that it would put in place arrangements to guarantee retail deposits. These arrangements were subsequently extended to certain wholesale funding and to further emergency support provided by the Bank. The guarantee arrangements covered up to £51 billion of the company's liabilities and allowed Northern Rock time to seek a longer term solution to its difficulties. The search culminated in the company being taken into public ownership in February 2008 (Figure 1). A more detailed chronology of events is at Appendix 1.

1 | Summary of key phases in the search for a solution |

| |

6 The actions taken by the Treasury, working with the other members of the Tripartite, were aimed at:

■ reducing the risk of a serious loss of confidence in the UK banking system, which would have caused wider economic disruption. The Treasury needed to ensure that Northern Rock's depositors remained confident that their savings would be safe, and that customers of other banks were not prompted to withdraw their savings;

■ minimising the financial risk to the taxpayer that substantial, taxpayer-backed support to a bank in difficulty would be called or not be repaid.